VeriSign (VRSN) Q1 Earnings Top Estimates, Revenues Rise Y/Y

VeriSign VRSN reported first-quarter 2020 adjusted earnings of $1.42 per share, which beat the Zacks Consensus Estimate by 11.8%.

Including income tax benefit worth $168, which increased earnings by $1.44, GAAP earnings were $2.86 per share. The figure jumped 111.9% from the year-ago quarter.

Revenues increased 2% year over year to $312.5 million and beat the Zacks Consensus Estimate by 1.1%.

Quarter Details

VeriSign ended the reported quarter with 160.7 million .com and .net domain name registrations, up 3.8% year over year.

The company processed 10 million new domain name registrations for .com and .net compared with 9.8 million in the year-ago quarter.

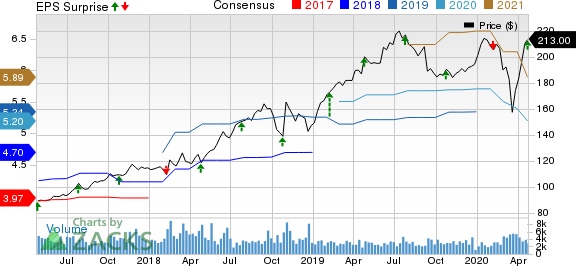

VeriSign, Inc. Price, Consensus and EPS Surprise

VeriSign, Inc. price-consensus-eps-surprise-chart | VeriSign, Inc. Quote

Notably, renewal rates are not fully measurable until 45 days after the end of the quarter. The final .com and .net renewal rate for the fourth quarter of 2019 was 73.8% compared with 74.3% in the year-ago quarter.

The company expects the renewal rate for first-quarter 2020 to be around 75.4%. The renewal rate in the first quarter of 2019 was 75%.

VeriSign’s research and development (R&D) expenses rose 7.6% from the year-ago quarter to $17.4 million. As a percentage of revenues, R&D expenses increased 30 basis points (bps) year over year to 5.6%.

General and administrative (G&A) expenses grew 8% year over year to $36.7 million. As a percentage of revenues, G&A expenses increased 70 bps year over year to 11.8%.

However, sales and marketing expenses (S&M) declined 37.2% year over year to $6.6 million. As a percentage of revenues, S&M expenses decreased 130 bps year over year to 2.1%.

Operating income was $206 million, up 3% from the year-ago quarter. Operating margin expanded 60 bps year over year to 66%.

Balance Sheet & Cash Flow

As of Mar 31, 2020, the company’s cash and cash equivalents (including marketable securities) were approximately $1.14 billion compared with $1.22 billion as of Dec 31.

Cash flow from operating activities was $180 million in the first quarter compared with $194 million in the previous quarter. Free cash flow was $169 million in the reported quarter.

In the first quarter, Verisign repurchased 1.3 million shares for an aggregate cost of $245 million, which brings the total amount available for buybacks to $826 million.

Key Developments in Q1

On Mar 27, Verisign entered into the Third Amendment to the .com Registry Agreement with ICANN, which, among other changes, permits Verisign to increase the price of .com domain name registrations by up to 7% over the previous year, in each of the final four years of each six-year period. The first such six-year period began on Oct 26, 2018.

Notably, in view of the coronavirus outbreak, the company announced that it will freeze registry prices for all of its Top-Level Domains (TLDs), including .com and .net, through the end of 2020.

2020 Guidance

Domain Name Base is expected to increase between 2% and 3.75% from 2019-end to 2020-end.

Moreover, VeriSign expects full-year revenues between $1.250 billion and $1.265 billion.

GAAP operating margin is expected in the 64.5-65.5% range.

Capital expenditure is anticipated in the range of $45-$55 million.

Zacks Rank & Stocks to Consider

VeriSign currently has a Zacks Rank #3 (Hold).

Advanced Micro Devices, Inc. AMD, Akamai Technologies, Inc. AKAM and Garmin Ltd. GRMN are some better-ranked stocks in the broader computer and technology sector. All three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Advanced Micro Devices and Akamai are set to report quarterly results on Apr 28 while Garmin will report on Apr 29.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Garmin Ltd. (GRMN) : Free Stock Analysis Report

VeriSign, Inc. (VRSN) : Free Stock Analysis Report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance