Veeva Systems (VEEV) Q4 Earnings Beat, Margins Decline

Veeva Systems, Inc. VEEV reported adjusted earnings per share (EPS) of $1.15 in the fourth quarter of fiscal 2023, reflecting an improvement of 27.8% from the year-ago EPS of 90 cents. Adjusted EPS surpassed the Zacks Consensus Estimate by 10.6%.

We had projected the fiscal fourth-quarter adjusted EPS to be $1.04, in line with the Zacks Consensus Estimate.

GAAP EPS in the fiscal fourth quarter was $1.16, up 93.3% from the year-ago period’s 60 cents.

Full-year adjusted EPS was $4.28, up 14.7% from fiscal 2022. The figure surpassed the Zacks Consensus Estimate by 2.1%.

Our projection of full-year adjusted EPS was $4.19, in line with the Zacks Consensus Estimate.

Revenues

For the quarter, the company’s revenues totaled $563.4 million, outpacing the Zacks Consensus Estimate by 2%. On a year-over-year basis, the top line improved 16%.

The fiscal fourth-quarter revenues compared with our estimate of $551.6 million.

The fiscal fourth-quarter top line was driven by Veeva Systems’ robust segmental performances.

Full-year revenues were $2.16 billion, reflecting a 16.4% uptick from fiscal 2022. The figure surpassed the Zacks Consensus Estimate by 0.9%.

Our projection of full-year revenues was $2.14 billion, in line with the Zacks Consensus Estimate.

Segmental Details

Veeva Systems derives revenues from two operating segments — Subscription services, and Professional services and other.

In the fiscal fourth quarter, Subscription services revenues improved 16.3% from the year-ago quarter to $460.2 million. This was driven by Veeva Systems’ most established products.

This compares to our projection of $452.1 million of revenues in the fiscal fourth quarter.

Professional services and other revenues were up 14.9% year over year to $103.2 million, primarily resulting from continued strength in Research and Development (R&D) Solutions services and Veeva Business Consulting.

This compares to our projection of $99.5 million of revenues in the fiscal fourth quarter.

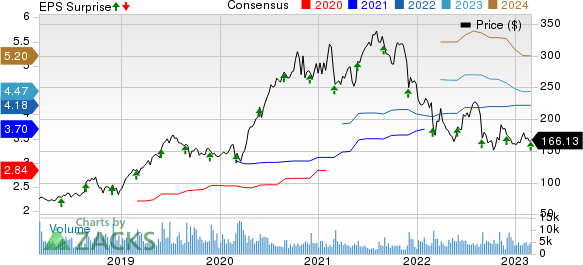

Veeva Systems Inc. Price, Consensus and EPS Surprise

Veeva Systems Inc. price-consensus-eps-surprise-chart | Veeva Systems Inc. Quote

Margin Details

In the quarter under review, Veeva Systems’ gross profit rose 14.1% year over year to $399.1 million. However, the gross margin contracted 118 basis points (bps) to 70.8%.

We had projected 71.8% of gross margin for the fiscal fourth quarter.

Meanwhile, sales and marketing expenses rose 12.4% year over year to $89 million. R&D expenses went up 35.4% year over year to $142.5 million, while general and administrative expenses climbed 29% to $58.6 million. Total operating expenses of $290.2 million increased 26.2% year over year.

Operating profit totaled $108.9 million, which declined 9% from the prior-year quarter. The operating margin in the fiscal fourth quarter contracted a huge 533 bps to 19.3%.

We had projected 19.8% of operating margin for the fiscal fourth quarter.

Financial Position

The company exited fiscal 2023 with cash and cash equivalents, and short-term investments of $3.10 billion compared with $2.38 billion at the end of fiscal 2022.

Cumulative net cash provided by operating activities at the end of fiscal 2023 was $780.5 million compared with $764.5 million in the year-ago period.

Guidance

Veeva Systems initiated its financial outlook for the fiscal 2024 and provided its estimates for first-quarter fiscal 2024.

For the first quarter of fiscal 2024, the company expects total revenues of $514-$516 million. The Zacks Consensus Estimate for the same is pegged at $546.1 million.

Subscription revenues are estimated to be $405 million in the fiscal first quarter.

Adjusted EPS is projected between 79 cents and 80 cents. The Zacks Consensus Estimate for the metric is pegged at 98 cents.

Veeva Systems expects revenues of $2.35-$2.36 billion for fiscal 2024. The Zacks Consensus Estimate for the same is pegged at $2.40 billion.

Subscription revenues are expected to be $1.88 billion. This consists of Commercial Solutions’ subscription revenues of $972 million and R&D Solutions’ subscription revenues of $908 million.

Adjusted EPS for the year is expected to be $4.33. The Zacks Consensus Estimate for the metric is pegged at $4.47.

Our Take

Veeva Systems exited the fourth quarter of fiscal 2023 with better-than-expected results. The uptick in the overall top and bottom lines, and robust performances by both segments during the quarter are impressive. The company continues to benefit from its flagship Vault platform, which is encouraging. Veeva Systems’ continued strength in its Commercial Solutions, with new SMB customer additions, looks promising.

Veeva Systems registered great traction in newer areas, including Veeva Vault Safety, Veeva Link and Veeva Compass, which augurs well. The strength in Clinical operations, which grew to more than 470 Vault eTMF and 180 CTMS customers, is also driving the momentum in new areas, including Veeva Site Connect and Study Training, raising our optimism.

On the flip side, rising operating costs putting pressure on the margins during the quarter is a headwind. Per management, the advertising environment remains tough, causing slowing down of growth in the near term, which raises apprehension.

Zacks Rank and Key Picks

Veeva Systems currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Becton, Dickinson and Company BDX, popularly known as BD, McKesson Corporation MCK and Hologic, Inc. HOLX.

BD, currently carrying a Zacks Rank #2 (Buy), reported first-quarter fiscal 2023 adjusted EPS of $2.98, beating the Zacks Consensus Estimate by 11.6%. Revenues of $4.59 billion outpaced the consensus mark by 0.9%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

BD has a long-term estimated growth rate of 7.8%. BDX’s earnings surpassed estimates in all the trailing four quarters, the average being 6.5%.

McKesson, having a Zacks Rank #2, reported a third-quarter fiscal 2023 adjusted EPS of $6.90, which beat the Zacks Consensus Estimate by 8.8%. Revenues of $70.49 billion outpaced the consensus mark by 0.02%.

McKesson has a long-term estimated growth rate of 10.4%. MCK’s earnings surpassed estimates in two of the trailing four quarters and missed the same in the other two, the average being 3.4%.

Hologic reported first-quarter fiscal 2023 adjusted earnings of $1.07 per share, beating the Zacks Consensus Estimate by 18.9%. Revenues of $1.07 billion surpassed the Zacks Consensus Estimate by 9.5%. It currently sports a Zacks Rank #1.

Hologic has a long-term estimated growth rate of 15.2%. HOLX’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 30.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance