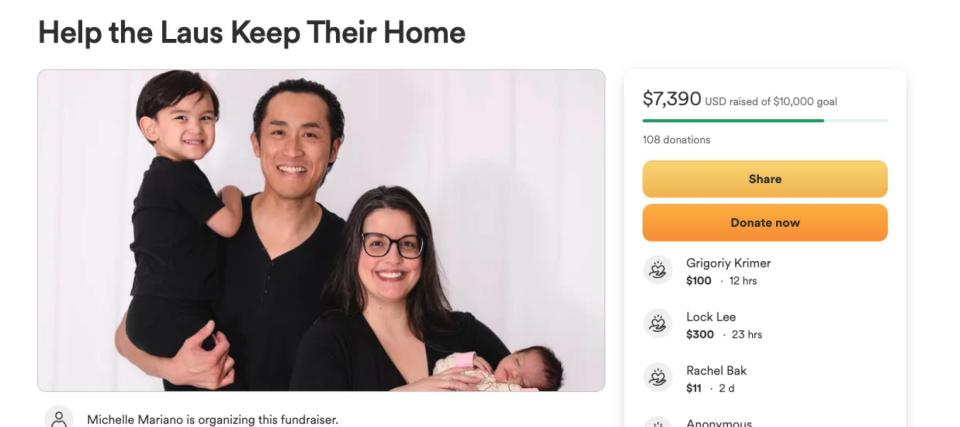

‘We’ve achieved a miracle’: This Nevada family managed to stave off eviction by raising thousands of dollars

When Michelle and Ken Lau were both hospitalized with COVID-19 in 2021, they faced mounting medical bills — and couldn’t meet rent on their Las Vegas home.

“It was several months of being sick, and then Ken couldn't go back to work. That's when we started falling behind with rent.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

“But [the debt] just kept building, we weren't able to catch up,” Michelle told Newsweek, noting that their landlord was very understanding and empathetic toward their situation.

Michelle’s chronic health issues meant Ken has been the main breadwinner for the family for years, however he ended up getting laid off from his job in commercial HVAC in February. The family’s landlord asked them to either pay off their back rent balance of $10,000 by June 30 or face eviction on July 1.

The Laus turned to an unconventional option to help them raise money — GoFundMe, a popular crowdfunding platform that has reportedly seen a 40% spike in eviction fundraisers this year compared to pre-pandemic levels.

Sunbelt cities are seeing eviction rates soar

Eviction filings over the past year in some Sunbelt cities are up 35% or more compared with pre-COVID levels, according to the most recent data from the Eviction Lab.

In Las Vegas, where the Laus live, eviction filings have soared by 43%.

Part of the issue is increasing rental rates — a recent report from Zillow reveals the typical renter would now need to make nearly $80,000 a year to spend no more than 30% of their income on rent at the average asking price these days. That’s 36% more than they would have required back in 2019 ($58,692).

The other problem occurs when a household experiences a major financial setback, like a loss in income or a medical emergency, that leads them to fall behind on rent.

The Laus say they’ve experienced a string of financial setbacks, including their daughter needing oral surgery, which cost them around $500, and their car getting repossessed.

Read more: Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here's how you can save yourself as much as $820 annually in minutes (it's 100% free)

Eviction-related fundraisers are gaining steam

Between March and April alone, GoFundMe saw a 20% surge in eviction fundraisers, with some involving entire mobile home parks that were facing evictions, Newsweek reports.

The Laus have raised nearly $7,400 so far and have paid back nearly $8,000 toward their rent, according to The Wall Street Journal.

They say any additional funds they receive will go toward paying off other bills they’ve fallen behind on, and other necessities like diapers or transportation.

"We are also open to leads on jobs and housing, as well as assistance programs we may not have heard of or tried," they write on their GoFundMe page. "If you know anybody looking for energy work or side/cash jobs please keep us in mind."

What to read next

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2024

Stop crushing your retirement dreams with wealth-killing costs and headaches — here are 10 'must-haves' when choosing a trading platform (and 1 option that has them all)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.