Varian (VAR) Earnings and Revenues Surpass Estimates in Q2

Varian Medical Systems, Inc. VAR reported second-quarter fiscal 2020 adjusted earnings per share (EPS) of 85 cents, beating the Zacks Consensus Estimate of 84 cents by 1.2%. The figure however fell 19% year over year.

The company reported revenues of $794.5 million, which beat the consensus mark of $780.3 million by 1.8%. Revenues rose 1.9% year over year and 3% at constant currency (cc). Organically, revenues fell 1%.

Segment Details

Oncology Systems: Revenues totaled $761 million, up 2% year over year .Operating earnings at the segment were $111 million, down 16% year over year.

As a whole, gross orders grew 1% from the year-ago quarter to $773 million.

Orders in the United States fell 3% year over year owing to a 1% decline in North America. In EMEA, orders rose 11% year over year on two large orders, one in Russia and another one in the U.K. In APAC, orders fell 5% year over year.

Proton Solutions: Revenues at the segment dropped 32% to $22 million. Per management, operating earnings gained from higher service revenues, partially offset by unfavorable project mix.

Other: Revenues at this segment grossed $12 million. For investors’ notice, the segment comprises interventional oncology business, including cryoablation, embolic microspheres, and microwave ablation, as well as the company’s cardiac radioablation assets.

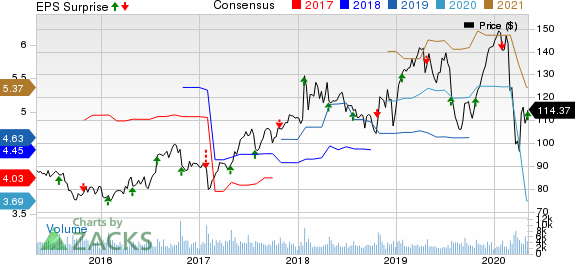

Varian Medical Systems, Inc. Price, Consensus and EPS Surprise

Varian Medical Systems, Inc. price-consensus-eps-surprise-chart | Varian Medical Systems, Inc. Quote

Margins

Total gross profit in the reported quarter was $337.2 million, up 5.9% year over year. Gross margin in the reported quarter was 42.4% of net revenues, up 162 basis points (bps).

Research and development expenses rose 19.5% year over year to $71 million. Selling, general and administrative expenses increased 19.4% year over year to $175.3 million.

As a percentage of revenues, adjusted operating margin was 11.4%, down 293 bps.

Guidance

The company is withdrawing its fiscal 2020 guidance due to uncertainty surrounding the magnitude and duration of the COVID-19 pandemic.

Our Take

Varian exited the fiscal second quarter on a strong note. The company continues to gain from its core Oncology Systems segment, which saw solid overseas growth, especially in EMEA. Gross orders rose in the quarter. Expansion in gross margin is an added positive.

Management is optimistic about the completed acquisitions of CyberHeart, Cancer Treatment Services International, Endocare and Alicon. The receipt of five Ethos orders in the United States and Europe and two Proton orders in the AsiaPacific buoys optimism.

On the flip side, the Proton Solutions unit was weak in the quarter. Contraction in adjusted operating margin is also worrying.

Zacks Rank and Key Picks

Varian currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Pacific Biosciences of California, Inc. PACB, Aphria APHA and Exact Sciences EXAS, each carrying a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Pacific Biosciences’ first-quarter 2020 revenues is pegged at $20.1 million, suggesting a year-over-year rise of 22.3%. The same for loss stands at 15 cents, indicating year-over-year improvement of 25%.

The Zacks Consensus Estimate for Aphria’s fourth-quarter fiscal 2020 revenues is $100.3 million, implying a 4.4% increase from the year-earlier figure.

The Zacks Consensus Estimate for Exact Sciences’ first-quarter fiscal 2020 revenues is pegged at $349.2 million, suggesting year-over-year improvement of 115.5%. The same for loss stands at 60 cents, indicating 9.1% improvement from the year-ago figure.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Varian Medical Systems, Inc. (VAR) : Free Stock Analysis Report

Exact Sciences Corporation (EXAS) : Free Stock Analysis Report

Pacific Biosciences of California, Inc. (PACB) : Free Stock Analysis Report

Aphria Inc. (APHA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance