Vanguard Group Inc's Strategic Acquisition of Palantir Technologies Shares

Overview of the Recent Transaction

On September 30, 2024, Vanguard Group Inc made a significant addition to its portfolio by acquiring 42,466,906 shares of Palantir Technologies Inc (NYSE:PLTR). This transaction increased Vanguard's total holdings in Palantir to 244,058,850 shares, marking a substantial investment move. The trade was executed at a price of $37.20 per share, reflecting a strategic enhancement in Vanguard's portfolio with a modest impact of 0.03%.

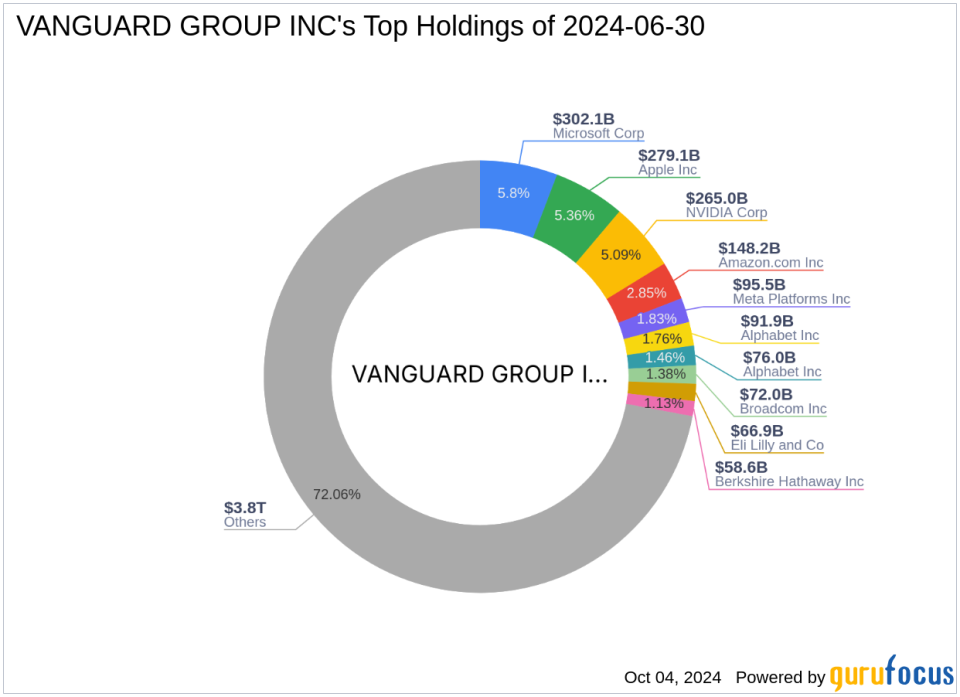

Profile of Vanguard Group Inc

Founded in 1975 by John C. Bogle, Vanguard Group Inc has grown into a global leader in low-cost mutual funds and ETFs, emphasizing a client-owned structure that benefits its investors. Vanguard's investment philosophy focuses on long-term success and cost efficiency, which is evident in its strategy of offering index mutual funds and reducing operating expenses. The firm's significant growth has been supported by international expansion and a broad range of product offerings tailored to diverse investor needs.

About Palantir Technologies Inc

Palantir Technologies, based in Denver, specializes in analytical software aimed at enhancing operational efficiencies for both commercial and government clients. Since its IPO on September 30, 2020, Palantir has focused on its two main platforms, Foundry and Gotham, to serve its diverse client base. With a current market capitalization of $89.33 billion, Palantir continues to play a pivotal role in data analytics.

Impact of the Trade on Vanguard's Portfolio

The recent acquisition of Palantir shares represents a 0.17% position in Vanguard's portfolio, aligning with its strategy of investing in high-growth technology companies. Holding 11.39% of Palantir's shares, Vanguard has positioned itself as a significant investor, reflecting confidence in Palantir's future growth and operational strategy.

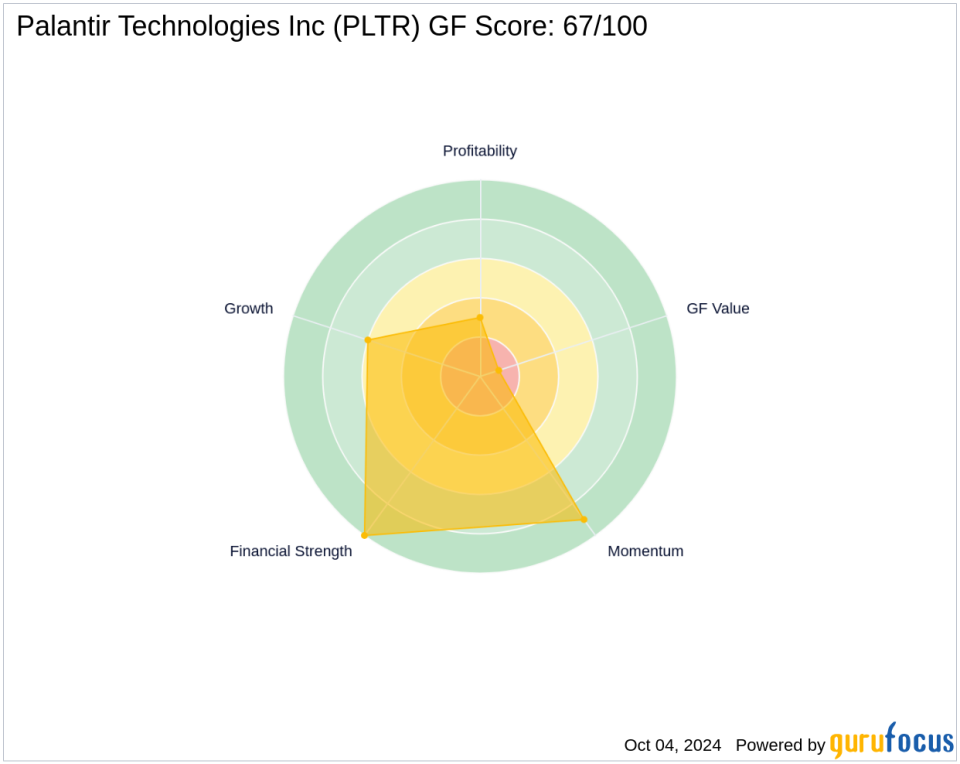

Palantir's Market Performance and Valuation

Currently, Palantir's stock is priced at $39.89, which is significantly overvalued according to the GF Value of $17.88. Despite this, the stock has shown impressive momentum, with a year-to-date increase of 140.59% and an overall gain of 298.9% since its IPO. This performance highlights the market's strong confidence in Palantir's growth trajectory and technological offerings.

Financial Health and Market Valuation

Palantir's financial health is robust, with a Financial Strength rank of 10/10. However, its Profitability Rank stands at 3/10, indicating areas for improvement. The company's growth and Growth Rank are also areas of focus, with a score of 6/10. Despite these challenges, Palantir's market valuation metrics and its strategic positioning in the technology sector suggest potential for future growth.

Comparative Analysis with Other Investors

Other notable investors in Palantir include Mario Gabelli (Trades, Portfolio) and Private Capital (Trades, Portfolio), with Gotham Asset Management, LLC holding the largest share. Vanguard's recent increase in its stake places it among the top investors, highlighting its strategic commitment to Palantir as part of its broader investment in the technology and financial services sectors.

Conclusion

Vanguard's recent acquisition of Palantir shares is a strategic move that aligns with its long-term investment philosophy and commitment to technology sector growth. This transaction not only enhances Vanguard's portfolio but also underscores its confidence in Palantir's future prospects. As the market continues to evolve, Vanguard's position in Palantir will be crucial in its overall investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.