Valneva (VALN) Up on 6-Month Lyme Disease Jab Persistence Data

Shares of Valneva VALN were up 9.3% on Dec 1 after management reported six-month antibody persistence data after completing a three-dose or a two-dose vaccination scheduleof its Lyme disease vaccine VLA15, in adults and children aged five through 65 years.

Data from the phase II VLA15-221 study showed that the antibody levels generated by VLA15 in both vaccination schedules remained above baseline. Per management, this confirms the persistence level of the Lyme disease vaccine candidate 6 months after completing a three-dose or a two-dose vaccination schedule.

Management also confirmed that the antibody levels were higher in participants who received the three-dose vaccination schedule compared to those who received the two-dose vaccination schedule.

These results further validate Valneva incorporating a three-dose vaccination schedule in its ongoing phase III study initiated this August.

The VLA15-221 study evaluated VLA15 at two different immunization schedules against a placebo. While a few participants received a two-dose series with shots at the beginning of the study and at six months (Month 0-6), some study participants received a three-dose series with shots at the beginning of the study, another after two months and the last one at six months (Month 0-2-6).

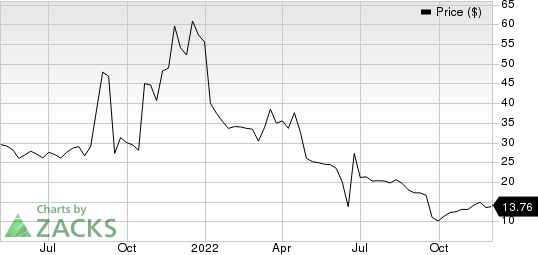

Shares of Valnevahave slumped 75.2% this year compared with the industry’s 44.4% decline.

Image Source: Zacks Investment Research

Valneva is developing VLA15 in collaboration with Pfizer PFE. The company entered into a collaboration with Pfizer in 2020 to co-develop VLA15 for Lyme disease. Earlier this June, Pfizer bought an 8.1% stake in Valneva for $95 million. Valneva plans to use this money to support its contribution toward developing the vaccine. Alongside the equity stake, the companies also updated the terms of their collaboration and license agreement.

Following the initiation of the phase III study for VLA15 in Lyme disease this year, Pfizer also made a $25 million payment to Valneva as a milestone payment.

Currently, there are no vaccines available for Lyme disease and VLA15 is the only Lyme disease vaccine candidate currently in clinical development. The vaccine was granted Fast Track designation by the FDA in 2017.

Apart from VLA15, Valneva is also developing a vaccine for chikungunya. In August 2022, Valneva announced that it had started a rolling BLA submission with the FDA, which seeks approval to use its single-shot chikungunya vaccine, VLA1553, in adults. Management expects to complete this submission by 2022-end.

If approved, VLA1553 will also be the first vaccine for chikungunya and will be eligible for a priority review voucher. VLA1553 has already been granted Breakthrough Designation therapy and Fast Track designations by the FDA.

Valneva SE Sponsored ADR Price

Valneva SE Sponsored ADR price | Valneva SE Sponsored ADR Quote

Zacks Rank & Stock to Consider

Valneva currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include Kamada KMDA and Repare Therapeutics RPTX, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, estimates for Kamada’s 2022 loss per share have narrowed from 14 cents to 7 cents. During the same period, the earnings estimates per share for 2023 have risen from 26 cents to 42 cents. Shares of Kamada have declined 28.6% in the year-to-date period.

Earnings of Kamada beat estimates in two of the last four quarters and missed the mark twice, witnessing a negative earnings surprise of 62.50%, on average. In the last reported quarter, Kamada’s earnings beat estimates by 433.33%.

Repare Therapeutics’ stock has declined 23.1% this year so far. While Repare Therapeutics’ loss estimates for 2022 have narrowed from $2.89 to $0.69 per share in the past 30 days, estimates for 2023 have narrowed from $3.22 to $3.21 per share during the same period.

Repare Therapeutics beat earnings estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 240.65%. In the last reported quarter, RPTX reported an earnings surprise of 955.00%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Kamada Ltd. (KMDA) : Free Stock Analysis Report

Repare Therapeutics Inc. (RPTX) : Free Stock Analysis Report

Valneva SE Sponsored ADR (VALN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance