Vale (VALE) Gears Up for Q3 Earnings: What's in the Cards?

Vale S.A VALE is scheduled to report third-quarter 2021 results on Oct 28, after the market close.

Q3 Estimates

The Zacks Consensus Estimate for third-quarter total sales is pegged at $14.1 billion, indicating growth of 30.8% from the year-ago quarter. The consensus mark for earnings currently stands at $1.08, suggesting an improvement of 28.6% from the prior-year quarter. The estimate has gone down 29% over the past 30 days.

Q2 Results

Vale’s second-quarter earnings and revenues were higher than the year-ago quarter driven by strong performance of the Ferrous Minerals business, on account of higher volumes and iron ore prices. While the bottom line beat the Zacks Consensus Estimate, the top line missed the same. The company has beat earnings estimates in each of the trailing four quarters, the average surprise being 14.3%.

VALE S.A. Price and EPS Surprise

VALE S.A. price-eps-surprise | VALE S.A. Quote

Factors to Note

Vale recently provided third-quarter-2021 production update, which offers a sneak peek as to how the company is likely to fare in the to-be-reported quarter. Iron ore production for third-quarter 2021 was 89.4 million tons (Mt), up 1% from the year-ago quarter. It marked an 18% sequential increase, driven by improvement of weather-related conditions in the Northern System that boosted Serra Norte and S11D performance. Increase in output in Itabira operations, higher output at Vargem Grande due to dry processing, and a rise in purchases of ore from third parties contributed to the improvement as well. The company’s pellet production was down 2.6% year over year to 8.3 Mt in the quarter. Sales volume of iron ore fines and pellets was up 2% to 75.9 Mt in the quarter under review.

Even though iron ore prices have lost steam in the third quarter due to a stronger dollar and growing concerns about the health of the Chinese real estate market, it still remains above the year-ago quarter’s levels. Iron generates around 80% of Vale’s revenues. Thus, higher iron production and prices are likely to have contributed to Vale’s top-line performance in the quarter to be reported.

With regard to base metals, which collectively contribute around 16% to the company’s revenues, production of nickel plunged 22% year over year owing to labor disruption at Sudbury and extended maintenance at Onca Puma. Copper production was down 21% year over year to 69.2 kt due to labor disruption in Sudbury. Copper and nickel prices were up year on year in the third quarter. Higher year-over-year metal prices might have somewhat offset the impact of lower production for these metals.

Vale has been committed to maintaining its ‘”value over volume” approach for the iron ore business. The company remains committed to delivering the highest possible margins by managing an extensive supply chain and flexible product portfolio. It has been focusing on controlling costs. These efforts might have favored the third-quarter performance.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Vale this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Vale is 0.00%.

Zacks Rank: The company currently carries a Zacks Rank of 5 (Strong Sell).

Price Performance

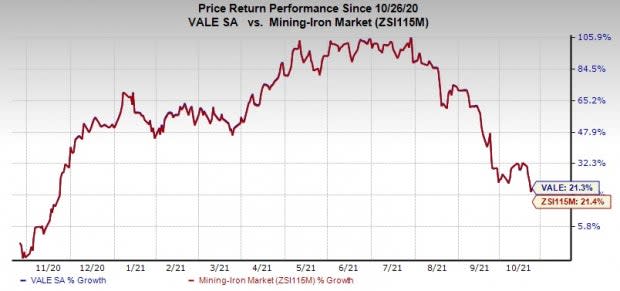

Image Source: Zacks Investment Research

In a year’s time, shares of Vale have gained 21.3%, compared with the industry’s rally of 21.4%.

Stocks to Consider

Here are some Basic Materials stocks, which you may consider as our model shows that these have the right combination of elements to post an earnings beat in their upcoming releases.

Teck Resources Ltd TECK has an Earnings ESP of +9.68% and a Zacks Rank of 1, currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Olin Corporation OLN, a Zacks #1 Ranked stock, has an Earnings ESP of +5.79%.

Celanese Corporation CE has a Zacks Rank #2 and an Earnings ESP of +3.14%, at present.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

VALE S.A. (VALE) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

Olin Corporation (OLN) : Free Stock Analysis Report

Teck Resources Ltd (TECK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance