VALE Q1 Earnings & Revenues Miss Estimates, Dip Y/Y

Vale S.A. VALE reported first-quarter 2023 adjusted earnings per share of 41 cents, which missed the Zacks Consensus Estimate of earnings of 57 cents per share. The company had reported earnings per share of 78 cents in the year-ago quarter. Lower iron ore and pellet prices, and lower iron ore sales volumes mainly led to the drop in earnings.

Including one-time items, the company had reported earnings per share of 93 cents in the first quarter of 2022.

Revenues

Net operating revenues plunged 22% year over year to $8.4 billion. The top line also missed the Zacks Consensus Estimate of $8.8 billion.

Net operating revenues at the Iron Solutions segment declined 27% year over year to $6.4 billion due to lower realized prices and a decline in iron ore fine sales. The Energy Transition Metals segment’s net operating revenues gained 3% to around $2 billion on higher year-over-year sales volume for nickel. Also, elevated nickel prices from the last-year quarter helped offset the impacts of lower copper prices.

Operating Performance

In the first quarter of 2023, the cost of goods sold totaled $4.9 billion, up 7% year over year. The gross profit plunged 44% year over year to $3.5 billion. The gross margin was 41.3% compared with 57.3% in the prior-year quarter.

VALE S.A. Price, Consensus and EPS Surprise

VALE S.A. price-consensus-eps-surprise-chart | VALE S.A. Quote

Selling, general and administrative expenditure moved down 2% year over year to $118 million. Research and development expenses climbed 15% to $139 million from the year-ago quarter.

Adjusted operating income was $2.9 billion in the reported quarter. The figure declined 47% from the prior-year quarter. Adjusted EBITDA was $3.6 billion in the reported quarter compared with $6.2 billion in the prior-year quarter.

Pro-forma adjusted EBITDA (excluding expenses related to Brumadinho and COVID) plunged 42% year over year to $3.7 billion. The downfall was mainly attributed to lower realized prices of iron ore fines and pellets, lower sales of iron ore fines, and inflated costs.

The Iron Solutions segment’s adjusted EBITDA was $3.3 billion, reflecting a 43% downfall from the last-year quarter. The Energy Transition Metals segment’s EBITDA moved down to $573 million from $751 million in the prior-year quarter.

Balance Sheet & Cash Flow

Vale exited the first quarter of 2023 with cash and cash equivalents of $4.7 billion compared with $9.1 billion at the end of last year’s comparable quarter. Cash flow from operations was $3.6 billion in the first quarter of 2023 compared with $2.6 billion in the prior-year quarter.

Gross debt at the end of the quarter under review was $11.5 billion compared with $12.3 billion at the end of the first quarter of 2022. Vale paid out $1.8 billion as dividends in the quarter.

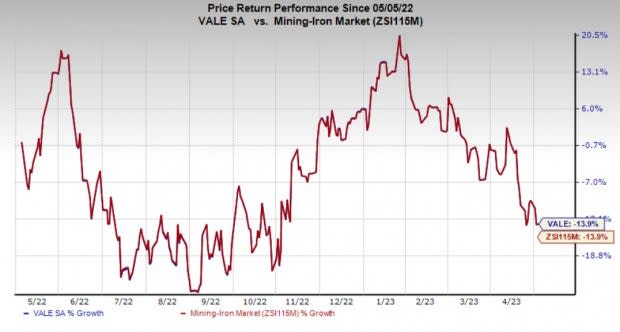

Price Performance

In the past year, shares of Vale have fallen 13.9%, in line with the industry.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Vale currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Steel Dynamics, Inc. STLD, PPG Industries, Inc. PPG and Linde plc LIN.

Steel Dynamics currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for STLD's current-year earnings has been revised 24% upward in the past 60 days. Steel Dynamics’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of 10.7%, on average. STLD has gained around 25% in a year.

PPG Industries currently carries a Zacks Rank of 2. The Zacks Consensus Estimate for PPG's current-year earnings has been revised 11.7% upward in the past 60 days.

PPG Industries’ earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of 6.8%, on average. PPG has gained around 5% in a year.

Linde currently carries a Zacks Rank of 2. The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 3.8% upward in the past 60 days.

Linde beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 5.9%, on average. LIN’s shares have gained roughly 16% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

VALE S.A. (VALE) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance