USD/CAD Continues to Pare May Advance as BoC Endorses Wait-and-See

DailyFX.com -

Talking Points:

- USD/CAD Continues to Pare May Advance as BoC Endorses Wait-and-See Approach.

- USDOLLAR Struggles as Mixed Data Continues; Durable Goods Orders on Tap.

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

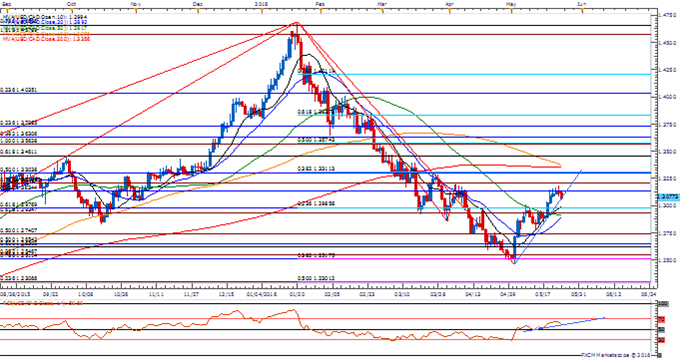

USD/CAD

Chart - Created Using FXCM Marketscope 2.0

USD/CAD may continue to pare the advance from the May low (1.2460) as the pair struggles to retain the bullish trend from the start of the month, with the Relative Strength Index (RSI) highlighting a similar dynamic as it comes up against trendline support.

Even though the Bank of Canada (BoC) sees real GDP contracting in the second-quarter, it seems as though Governor Stephen Poloz and Co. will continue to endorse a wait-and-see approach in 2016 as the central bank argues that the current policy is ‘appropriate’ with the inflation outlook ‘roughly balanced.’

The failed attempts to a break/close above 1.3210 (78.6% expansion) may spur a near-term pullback in the exchange rate, with the first area of interest coming in around 1.2930 (61.8% expansion) to 1.2990 (23.6% retracement) followed by 1.2740 (50% expansion).

The DailyFX Speculative Sentiment Index (SSI) shows increased volatility in retail positioning, with the FX crowd flipping net-long going into the BoC interest-rate decision.

The ratio currently sits at +1.00 as 50% of traders are long, while open interest stands 5.4% below the monthly average during the last full-week of May.

Why and how do we use the SSI in trading? View our video and download the free indicator here

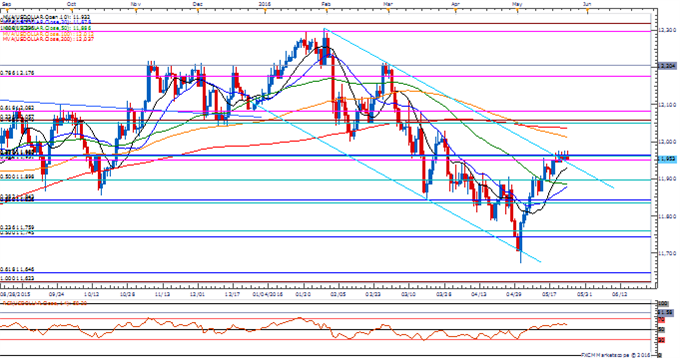

USDOLLAR(Ticker: USDollar):

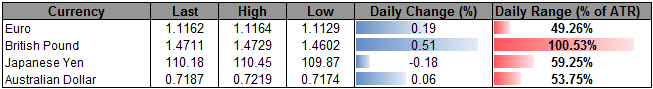

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 11953.67 | 11977.74 | 11951.12 | -0.12 | 60.59% |

Chart - Created Using FXCM Marketscope 2.0

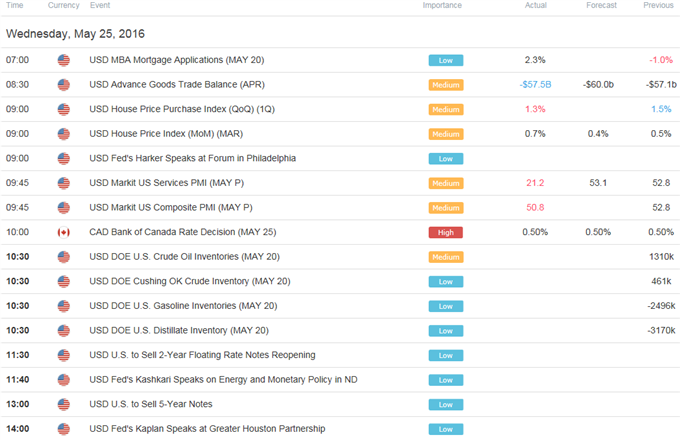

Even though the USDOLLAR appears to be making a broader attempt to break out of the downward trend from earlier this year, the rebound appears to be losing steam amid the slew of mixed data prints coming out of the U.S. economy; will keep a close eye on the U.S. Durable Goods Orders report as forecasts are calling for another 0.5% expansion in demand for large-ticket items.

The Federal Open Market Committee (FOMC) appears to be on course to implement higher borrowing-costs in 2016 as the central bank remains upbeat on the economy, but the majority may retain the highly accommodative policy stance throughout the summer months as Fed officials look for a ‘consumer-led’ recovery.

The USDOLLAR may face a near-term pullback as it largely struggles to make a more convincing attempt to break/close above the Fibonacci overlap around 11,951 (38.2% expansion) to 11,965 (23.6% retracement), with the first downside region of interest coming in around 11,898 (50% retracement).

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Check out FXCM’s Forex Trading Contest

Read More:

Gold Bulls Look to CPI, Fed Minutes for Solace

DailyFX Technical Focus: Short Term S&P and Gold Analysis

USD/CAD Technical Analysis: Time For Bulls To Prove Their Worth

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance