US June CPI data sets the stage for a September Fed rate cut: OCBC

Following the latest CPI data, markets are now expecting two Fed rate cuts this year, with the first possibly in September.

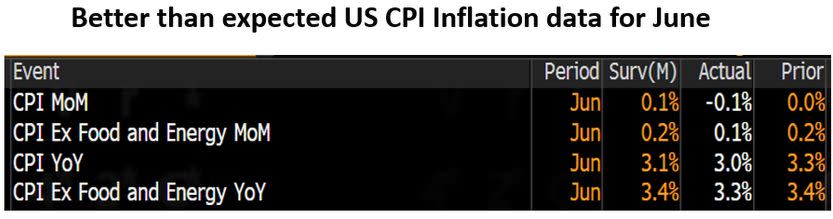

The latest US monthly inflation rate for June, which was released in the evening of July 11 Singapore time, dipped for the first time in more than four years, setting the stage for the US Federal Reserve (Fed) to start lowering interest rates in 2H2024, says Vasu Menon, managing director, investment strategy, OCBC.

Following the latest CPI data, markets are now expecting two Fed rate cuts this year, with the first possibly in September, adds Menon in a July 12 note. The Fed fund futures market is also looking at sharper rate cuts over the next three years, compared to three months ago.

The headline and core inflation rate for June came in below expectations and was also lower than the prior month. Despite the good news on the inflation front, the S&P 500 Index fell 0.88% last night because of rotation out of mega-cap tech stocks, which caused Nasdaq to pull back by 1.95%, notes Menon.

In turn, investors flocked to areas of the market that will benefit from Fed rate cuts, including small caps, as the Russell 2000 jumped about 3.6%.

Lag effect

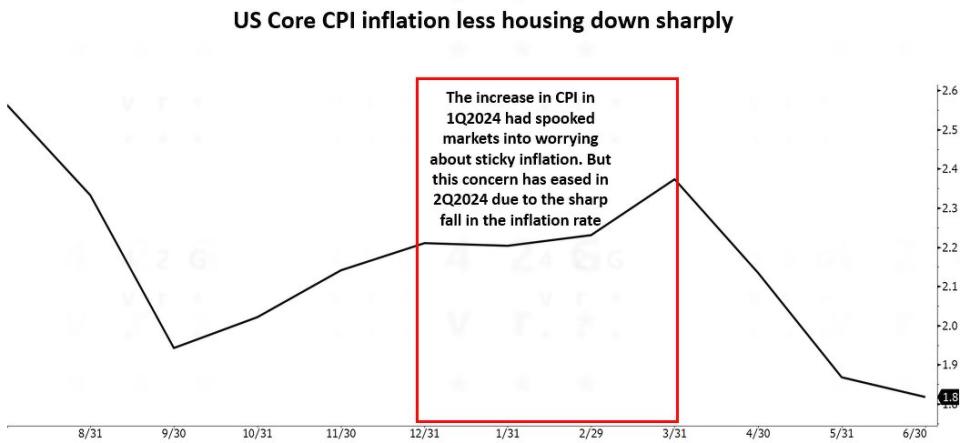

The CPI for housing has historically lagged actual price changes by four quarters, notes Menon.

“The lag effect is largely due to how long it takes for leases to roll over into a new contract,” he explains. “Landlords typically renew leases every 12 months, which means current price dynamics won’t be reflected in new contracts for a year. In this sense, housing is somewhat of an outlier among other CPI categories.”

As such, excluding housing, core inflation would have been 1.8% (below the Fed’s 2% target), a decline from 1.9% in May and a sharp fall from 2.4% at the end of 1Q2024, notes Menon.

Powell turns more dovish

Fed chairman Jerome Powell turned more dovish in recent days when he testified before the US Congress to present the central bank’s semi-annual Monetary Policy Report, says Menon.

He warned that reducing policy restraint too little or too late could unduly weaken economic activity and employment. According to Menon, Powell seemed to be setting the stage for rate cuts soon.

Powell noted that “the labour market appears to be fully back in balance”, which contrasts with prior comments, in which he had said that the labour market is coming back into balance.

The US economy has been cooling for a few months now, says Menon. “It's been a gentle slowdown. Fed policymakers had wrongly assumed the economy and inflation were reaccelerating earlier this year based on 1Q2024 data.”

According to Menon, Powell is “clearly concerned” that high interest rates will hurt the economy and he is keeping a close eye on the labour market, not just inflation. “He has effectively pivoted in recent days and signalled that jobs are the big focus now.”

Powell warned Congress that “elevated inflation is not the only risk we face”. He noted the higher 4.1% unemployment rate in June, and he acknowledged that recent labour market readings sent a clear signal that employment conditions were cooling. With the labour market no longer overheated, Powell judged that it was no longer “a source of broad inflationary pressures for the economy”.

Menon notes that the three-month moving average of payroll growth has slowed to 177,000 jobs, while wage growth has moderated to 3.9% June compared to the year before. Both are post-pandemic lows.

Powell, in his testimony before lawmakers this week, avoided signalling the timing of likely rate cuts and insisted policy moves would be guided by incoming data. “Nevertheless, we are of the view that the Fed could start cutting rates in September,” says Menon.

The Fed chairman is set to speak again next Monday in a moderated discussion hosted by the Economic Club of Washington, DC. Markets will be waiting with bated breath to glean fresh insights, adds Menon.

Risk appetite

“If we have a soft landing in the US economy and earnings continue to deliver, global markets should have more upside in the medium term, supported by lots of liquidity on the sidelines looking for bargain-hunting opportunities on pullbacks,” says Menon.

There is a “massive” US$6 trillion ($8.06 trillion) sitting idle in US money market funds currently,” he adds. “However, once the Fed starts cutting rates, money market funds will start losing some shine and investors should become more receptive to moving money out and taking on more investment risk in equity and corporate bond markets for better returns.”

So, the firepower from liquidity should not be underestimated, says Menon, and it offers a reason for investors to remain positive on the medium-term market outlook.

“Investors should not let short-term market volatility spook them into inaction as there are good reasons to remain hopeful about the prospects over the next two to three years. In other words, don’t lose sight of the forest by focusing on the trees,” says Menon.

Charts: OCBC

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

As Great Eastern's free float falls below 10%, it may need to restore free float

Get in-depth insights from our expert contributors, and dive into financial and economic trends