U.S. unemployment rate hits a 16-year low

The unemployment rate in America is at a 16-year low.

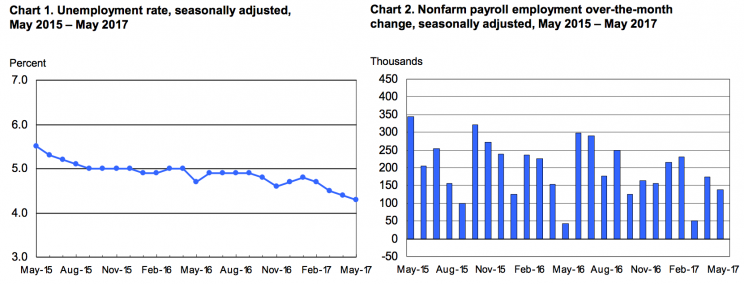

In May, the economy added 138,000 jobs and the unemployment rate fell to 4.3%, according to the latest data from the Bureau of Labor Statistics. This is a new post-crisis low for the unemployment rate — which is now at its lowest level since May 2001 — while headline job gains missed expectations.

Wage gains were tepid, rising 0.2% over the prior month and 2.5% over the prior year in May.

Each of the last two monthly job gains were revised down in Friday’s report, with March’s payroll growth coming down by 29,000 and April’s gains coming down by 37,000. Over the last three months, payroll gains have now averaged 121,000.

Investors were also keeping an eye on the underemployment rate, which takes not only the official unemployment rate but adds those who are working part-time but would prefer full-time work. In May this number stood at 8.4%, down from 8.6% in April. This is the lowest reading for this number since June 2007.

President Trump’s chief economic advisor Gary Cohn has said in recent months that the administration is focused on bringing the underemployment rate down.

Following the report, stock futures were higher, but below where they sat ahead of the number. Near 8:45 a.m. ET, Dow futures were up about 40 points, S&P 500 futures were up 3 points, and Nasdaq futures were up 14 points.

The drop in the unemployment rate comes as the labor force participation rate took a leg lower after having held steady — and slightly increased — over the last year or so. The labor force participation rate in May fell to 62.7%, down from 62.9% in April and 63% in March. The employment to population ratio also fell in May to 60% from 60.2% in April.

The number of Americans not in the labor force rose by 608,000.

By sector, the strongest job gains were in the professional and business and education and health services sectors, with these sectors of the economy adding 38,000 and 47,000 workers, respectively.

In the goods-producing sector, construction jobs were the leader with 11,000 jobs added during May. Manufacturing payrolls fell by 1,000.

Retail jobs, which have nose-dived in recent months, fell again in May, falling by 6,100 to mark the fourth-straight month of declines.

Expectations and calendar quirks

Via Bloomberg, here’s a quick look at the headline numbers markets were looking for this morning:

Nonfarm payrolls: +182,000

Unemployment rate: 4.4%

Average hourly earnings, month-on-month: +0.2%

Average hourly earnings, year-on-year: 2.6%

Average weekly hours worked: 34.4

It is also important to note that the wages number was likely to be impacted by a quirk in the calendar. Wage growth is tracked closely by economists for signs of inflation cropping up in the economy.

Each month, the Bureau of Labor Statistics collects its data for the jobs report during the week of the month containing the 12th. Oftentimes, this week also includes the 15th, a common pay date for those paid semi-monthly.

In May, however, the 15th fell outside of the survey week for the jobs report, which likely tamped down wage inflation. In a note on Thursday, Ian Shepherdson, an economist at Pantheon Macro, noted that this left open the chance for wage gains to miss consensus and perhaps fall to as low as 2.4% year-on-year. Given this quirk — and that Friday’s wage gains disappointed — expect a rebound in June.

Friday’s report follows a stronger-than-expected reading from ADP’s private payrolls number, which showed 253,000 jobs were added in the private sector in May. And while this number isn’t necessarily a great predictor of where the government’s number will fall, it indicates that overall hiring trends in the economy remains strong.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance