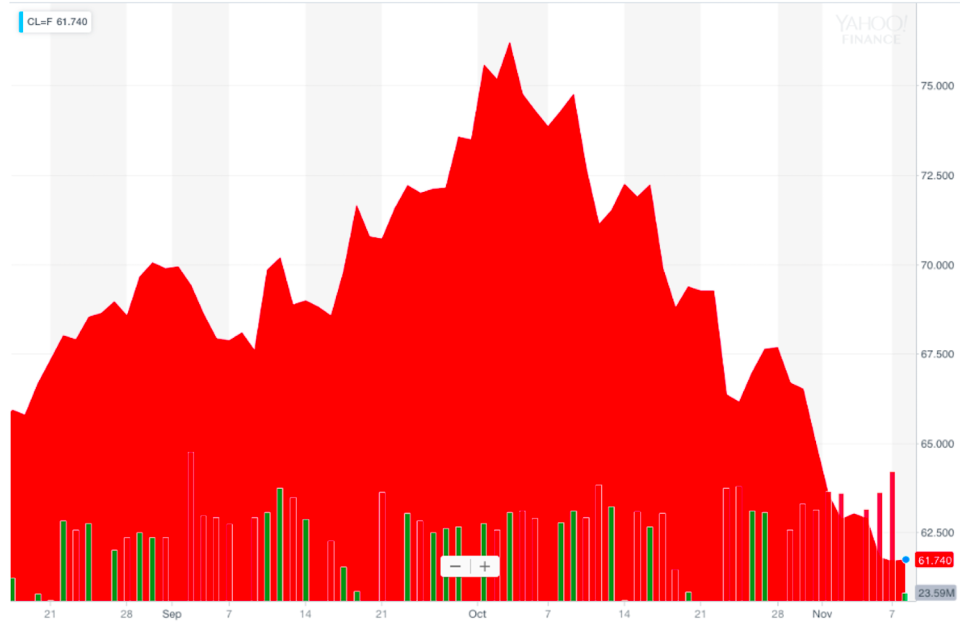

US crude oil enters bear market, prices fall for ninth straight session

Oil prices are on the decline.

US West Texas Intermediate crude (CL=F) fell for the ninth straight session Thursday, the longest sequential decline since July 2014. Prices for the WTI December 18 futures contract fell 1.62% to $60.67 Thursday, or the lowest closing price since March. Domestic crude closed in bear market territory, down more than 20% from an October 3 closing high of about $76 per barrel.

A supply glut has suppressed prices for the domestic benchmark. Oil production spiked up to a record 11.6 million barrels per week, and crude inventories rose by 5.8 million barrels in the week ending November 2, the US Energy Information Administration’s reported in preliminary results Wednesday. That’s double the level analysts had been expecting, and marks the seventh consecutive week of increases for US crude stockpiles. The EIA also upwardly revised its forecast to predict that US oil production will average 12.1 million barrels per day in 2019.

The recent slump in prices is a major downturn from sharp rises that began in late August, on the heels of a strong demand seasons for gasoline and crude oil over the summer. Prices continued to rise through the beginning of October, in part due to speculation of forthcoming sanctions on Iran.

“The last three weeks of October going into November, the market has corrected, that bubble has popped, and now we’re more focused on the reality” of heightened production, Stephen Schork of The Schork Report told Yahoo Finance. “We’re at a point now where we’ve come down a long way in a short amount of time, and that’s what happens when bubbles pop.”

The US on Monday re-imposed sanctions on Iran’s shipping, banking and energy industries, hitting the OPEC nation’s key oil industry. However, the Trump administration decided to extend waivers to eight countries to allow them to continue importing Iranian oil. Prices for US crude have declined about 3% since Trump administration officials announced the waivers Friday.

“It’s occurring to the market with these waivers that were granted to eight Iranian buying markets that the impact of the sanctions are going to be much smaller than the market was betting on just two months ago,” Schork said.

President Donald Trump claimed credit for the price declines in a press conference Wednesday, saying he gave “some countries a break on oil” because he didn’t “want to drive oil prices up to $100 a barrel or $150 a barrel.”

“If you look at oil prices, they’ve come down very substantially over the last couple of months,” Trump said. “That’s because of me. Because you have a monopoly called OPEC, and I don’t like that monopoly.”

Supply and demand

Basic economic supply and demand dynamics are also to blame. Oil is facing a major global demand shortage in part due to improved technology allowing energy to be used more efficiently, said Peter Borish, chief strategist of Quad Group. Expectations of weak economic growth in China – the world’s largest crude oil importer – has also been a continued concern for future demand. But these worries were somewhat assuaged Thursday after customs data showed that crude imports increased in China in October, surging to 9.61 million bpd from 9.05 million bpd in September.

On the supply side, an evolving regulatory landscape and improved production techniques have also contributed to the glut, Borish added. Voters in Colorado on Tuesday, for instance, sided with the energy sector by rejecting a measure that sought to to limit energy companies’ ability to explore for oil and natural gas in the state.

“On the regulatory side, we’re having the ability to produce more, less regulations, opening up more lands to drill,” Borish said. “The other side of supply is technology’s been getting better, so we’ve produced at any given level, more efficiently.”

Projections for oil demand have declined along with prices. “If you ask me what’s more likely, $55 or $75 from here, I would say $55,” Borish said.

Morgan Stanley analysts similarly pealed back their price forecasts for ICE Brent, the international benchmark, for the year-end and the first half of 2019. They now foresee $77.5 per barrel versus their previous forecast of $85.

“Oil market fundamentals have softened,” the analysts wrote in a note. “Supply continues to come in higher-than-expected, particularly from the US, Middle East OPEC, Russia and Libya. The market is well supplied, and we see a balanced rather than tight market ahead.”

Members of the OPEC nations plan to meet on Sunday in Abu Dhabi to discuss the outlook for 2019. Russia and Saudi Arabia reportedly began discussing a return to production cuts next year, according to a Russian news report earlier this week citing an unnamed source. Russia and other OPEC nations began boosting output over the summer to offset the then-impending sanctions on Iran.

Brent crude (BZ=F) fell 1.86% to $70.73 per barrel as of 2:25 p.m. ET for a third consecutive day of declines.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Read more from Emily:

Netflix user growth beats expectations, shares spike

Now is a ‘once-in-a-lifetime chance’ to invest in US pot companies, investor says

There are ‘4 headwinds’ facing markets rights now

Yahoo Finance

Yahoo Finance