The UOB One Card Comes With Up To 15% Cashback—But Do You Know How It Works?

Other credit cards have come, gone or been rebranded, but the UOB One Card is still going strong. This entry level credit card has a reputation for being one of the best cashback cards in town, with an impressive maximum cashback rate of 15%.

The catch? The card is also notorious for its devilishly complicated mechanism and onerous minimum spending requirements.

Let’s see what the UOB One Card looks like in 2023 and if it’s still worth the effort.

UOB One Card Review—Is it MoneySmart? | ||

| ||

Category | Our rating | The deets |

Earn rates: Cashback | $$$$$ | – Up to 15% cashback at selected merchants for new-to-UOB cardmembers: McDonald’s, Grab, Shopee, SimplyGo, 7-Eleven, Guardian, UOB Travel, and more. |

Earn categories | $$$$ | |

Annual fees and charges | ★★★★☆ | S$194.40 annual fee (first year waived) |

Accessibility | ★★★★☆ | Minimum income requirement: $30,000 (Singaporeans and PRs, salaried workers) / $40,000 (Singaporeans and PRs who are self-employed or commission-based; non-Singaporeans) |

Extras/periphery rewards | ★★☆☆☆ | – At SPC Stations, up to 22.66% savings on fuel purchases |

Sign-up bonus | ★★☆☆☆ | Get S$350 Grab Vouchers when you successfully apply for an eligible UOB Credit Card and spend a min. of S$1,000 for 2 consecutive months from card approval date. Valid till 31 Oct 2023. |

See our credit card ranking rubric to find out how we rank credit cards.

Don’t miss our ultimate list of credit card reviews for the low-down on credit cards in Singapore.

UOB One Card—MoneySmart Review 2023

1. UOB One Card: Summary

The UOB One Credit Card is a cashback credit card that offers cashback on almost all types of daily spending.

In theory, this sounds great. No need to worry about spending categories because the card just gives you cashback on pretty much anything you buy. Right? Well, not exactly.

To qualify for the cashback, you need to watch out for the minimum spending requirements. You’ve gotta meet certain requirements for all three months in a quarter in order to snag that sweet, sweet cashback.

One other thing: The UOB One Card is not to be confused with the UOB One Account (a savings account) and the UOB One Debit Card (which offers less generous cashback). You don’t need to have either of those to use the UOB One Credit Card.

Online Promo

Get up to 15% Rebate

UOB One Card

Online Promo:

Get up to 15% Cashback and S$350 Grab Vouchers when you successfully apply for an eligible UOB Credit Card and spend a min. of S$1,000 for 2 consecutive months from card approval date. T&Cs apply!

Valid until 31 Oct 2023

More Details

Cash Back Features

Up to 10% cashback (up to 15% cashback for new UOB Credit Cardmembers) on McDonald's (including McDelivery®)

Up to 10% cashback (up to 15% cashback for new UOB Credit Cardmembers) on SimplyGo (bus and train rides)

Up to 10% cashback (up to 15% cashback for new UOB Credit Cardmembers) at DFI Retail Group (Cold Storage, CS Fresh, Giant, Guardian, 7-Eleven & more)

Up to 10% cashback (up to 15% cashback for new UOB Credit Cardmembers) at Grab (including GrabFood, excludes Grab mobile wallet top-ups)

Up to 10% cashback (up to 15% cashback for new UOB Credit Cardmembers) at Shopee Singapore (excludes ShopeePay)

Up to 10% cashback (up to 15% cashback for new UOB Credit Cardmembers) on UOB Travel

Up to 4.33% cashback on Singapore Power utilities bill

Up to 3.33% cashback on all retail spend (based on S$500, S$1,000 or S$2,000)

2. UOB One Card: Annual Fee, Minimum Income

UOB One is an entry level credit card, so you can sign up for it with a salary of $30,000 per year. Here are the card’s main terms and conditions.

UOB One Credit Card | |

Annual Fee | $194.40 |

Annual Fee Waiver | First year |

Supplementary Card Annual Fee | Free for first card, $97.20 for additional cards |

Interest Free Period | 21 days |

Annual Interest Rate | 26.9% |

Late Payment Fee | $100 |

Minimum Monthly Repayment | 3% or $50, whichever is higher |

Foreign Currency Transaction Fee | 3.25% |

Cash Advance Transaction Fee | 8% with minimum fee of $15 |

Overlimit Fee | $40 |

Minimum income | $30,000 |

Card Association | Visa |

Contactless Payment | Visa Contactless, Apple Pay, Samsung Pay |

3. UOB One Card Quarterly Cashback & Minimum Spend

Before we get into the juicy 15% cashback that everyone has their eyes on, let’s talk about the UOB One Card’s base/quarterly cashback rate. The card used to offer up to 5% cashback on all spending, but its glory days are over. These days, the maximum cashback rate you can earn on uncategorised spending is 3.33%.

Here’s how it works. In order to qualify for cashback, you need to meet a minimum spending requirement every month in a quarter. The first quarter of the year runs from January to March. So, you would need to meet the minimum spending requirement in January, February and March to qualify in that quarter.

If you manage to do that, you will get a lump sum of cashback for that entire quarter.

There are 3 tiers of cashback, depending on how much you spend, as follows:

Tier | Minimum spend for the quarter | Minimum card transactions for the quarter | Cashback for the quarter | Maximum cashback % |

1 | $500 | 5 | $50 | 3.33% |

2 | $1,000 | 5 | $100 | 3.33% |

3 | $2,000 | 5 | $200 | 3.33% |

Let’s say you spend exactly $2,000 in January, February and March. You will receive $200 cashback for that quarter, which translates to a cashback rate of 3.33%.

If you meet the minimum spending requirement of $2,000 only in January and February and then spend only $500 in March, your cashback for that quarter will fall to $50.

The only exception is the very first quarter you have your UOB One Card. According to their UOB One Card cashback T&Cs, clause 4.2, UOB will pro-rate your cashback only for this first quarter. For example, if you hit the minimum spend for the first 2 months but not the third month, UOB will be nice and give you two-thirds of the quarterly cashback. After the first quarter, no such niceties.

4. UOB One Card: Enhanced and Additional Cashback

The UOB One Card is probably feeling a bit self-conscious about the fact that its quarterly cashback has fallen from 5% to 3.33%. To continue making itself look attractive, it now offers additional cashback in several categories.

Basically, when you spend in one of these categories, your cashback gets bumped up. The actual amount of additional cashback depends on the spending tier you hit that quarter.

You’ve probably heard about the UOB One Card giving cardholders a fat 15% cashback rate. It’s true—but how you get there is pretty complicated. Stay with us now, we’ll take you through it.

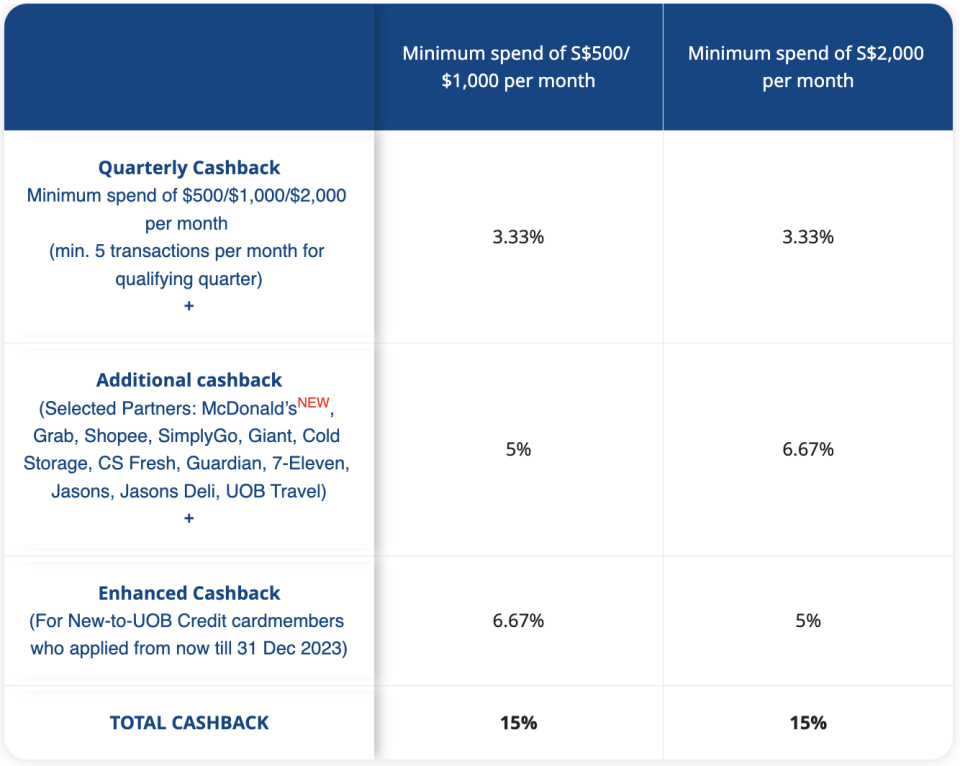

This is a table from UOB summarising how the UOB One Card’s cashback works:

Let’s take you through it.

Quarterly Cashback: This is what we talked about in the previous section. You get 3.33% when you spend $500, $1,000, or $2,000 in a month, for all the months in a quarter.

Additional Cashback: Extra cashback on top of the base/quarterly cashback when you spend at certain merchants, including Macs, Shopee, and Giant. You get 6.67% if you spend $2,000 per month, and 5% if you only hit $500 or $1,000 in spending.

Enhanced Cashback: Extra promotional cashback only for new-to-UOB folks who apply for the UOB Card and get approved by 31 Dec 2023. The cashback amounts here are flipped compared to the Additional Cashback amounts—5% if you spend $2,000 per month, and 6.67% if you only hit $500 or $1,000 in spending.

What the Enhanced Cashback does is even out the overall cashback you earn with the UOB Card for all spend tiers—only from now till the end of the promotion period though. From now till 31 Dec, you can get up to 15% cashback whether you spend $500, $1,000, or $2,000 a month.

5. UOB One Card: Spend exclusions

You can earn UOB One cashback on almost all spending, but there are a few exceptions. Here’s a selection of what you cannot earn cashback on:

Wire transfer/remittance

Insurance

Banking services and payments

Rent

Stored value card purchase or loading

Property management

Parking

Gambling

Hospitals

School fees and services

Religious organisations

Political organisations

Court costs

Fine

Bail and bond payments

Tax payments

Government postal services

Government purchases and services

These exclusions are pretty typical of credit card cashback programmes. Basically, don’t expect to earn cashback when you pay hospital bills, insurance bills, your kids’ school fees, NETS transactions, fines or your latest Singapore Pools bets.

6. What happens to the cashback I earn on the UOB One Card?

According to the UOB One Card cashback T&Cs, clauses 4.7 and 5.4, the cashback you earn can’t be redeemed for rewards or withdrawn as cash. Instead, it’ll be used to offset your UOB One Card credit card bill for the next month, after a qualifying quarter. This applies to the quarterly, additional, and enhanced cashback.

Also note that the cashback also only offset the principal cardmember’s transactions, and not any of the supplementary cardmembers’ bills, if any.

7. How do I maximise my UOB One Card?

The UOB One’s mechanism is different from that of most cashback cards which just give you back a percentage of your spending in cashback.

Instead, you get your cashback in a lump sum. Once you’ve hit the minimum spending requirement in your desired tier, you don’t get any extra cashback by spending more that much—doing so will just lower your cashback percentage.

So, if you’re aiming to spend $2,000 every month in the quarter to qualify for Tier 3 cashback, don’t go overboard and charge a $30,000 Rolex watch to your card.

You should also take pains to track your spending and be aware of how much you’ve spent in the quarter. Be careful when it comes to spending that takes place close to the end of the month, as it might be carried over to the next month. When in doubt, call the bank to enquire about your recorded spending for the present or past month.

Also, don’t forget that you need to make at least 5 transactions on the card each month in a quarter in order to qualify for the cashback!

8. Does UOB One Card earn UNI$ reward points?

The UOB One Card gives cashback, so apparently wanting to earn rewards points as well is too much to ask—your spending on the UOB One Card will not contribute to your store of UNI$.

If you want to earn UNI$, you can turn to these UOB rewards cards instead:

UOB Preferred Platinum Visa card

UOB Visa Signature Card

9. Should I get the UOB One Card?

The UOB One Card’s biggest drawback is its mechanism. Having to hit the minimum spending requirement for 3 months in a quarter is quite a burden, and in order to maximise your card you need to monitor your spending to ensure you don’t exceed the minimum spending requirement in your tier by too much.

If you’re the meticulous type and don’t cringe at the thought of having to monitor how much you’ve spent on the card each month, the maximum cashback rate of 3.33% is actually decent considering it’s doled out regardless of spending category. The first tier only requires you to spend $500 per month (every month in a quarter) and still entitles you to up to 3.33% base cashback.

The card is probably still the most generous cashback card for miscellaneous spending, and the bonus interest on things like Grab rides and our McDonald’s meals makes it even more attractive.

However, if you find that you tend to spend overwhelmingly on just a few types of things like dining or petrol, you might be better off with a card that gives you a higher cashback rate in these spending categories.

10. UOB One Card Sign-Up Promotion

If you’re thinking of signing up for the UOB One Card and happen to be one of the first 100 customers to sign-up in Oct 2023, you can get S$350 Grab Vouchers. To qualify, you’ll have to spend $1,000 for 2 consecutive months from your card approval date. Promotion valid till 31 Oct 2023.

Check the UOB One Card page for the latest promotions!

11. Alternatives to the UOB One Card

If the UOB One’s cashback mechanism makes your head spin, we don’t blame you. Check out these cards instead:

Citi Cashback+ Mastercard: Get 6% cashback on dining worldwide, 8% at supermarkets and grocery stores worldwide and up to 20.88% fuel savings at Esso and Shell. Minimum spending requirement is $800 per month.

Earn Unlimited 1.6% Cashback

Citi Cash Back+ Mastercard®

More Details

Key Features

1.6% cashback on your spend

No minimum spend required and no cap on cash back earned

Cash back earned does not expire

Redeem your cash back instantly on-the-go with Pay with Points or for cash rebate via SMS

With Citi PayAll, you can earn and accumulate Citi Miles, Citi ThankYou PointsSM or Cash Back quickly when you pay your big-ticket bills such as rent, insurance premiums, education expenses, taxes, utilities and more

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Standard Chartered Simply Cash Credit Card: 1.5% cashback on all spending with no minimum spending and no cashback cap.

Sponsored

MoneySmart Exclusive

Earn Unlimited 1.5% Cashback

Standard Chartered Simply Cash Credit Card

MoneySmart Exclusive:

Get an Apple iPad Wi-Fi 9th Gen, 64GB (worth S$503.65) OR an Apple Watch SE, 40mm GPS (worth S$382.50) OR a Nintendo Switch OLED (worth S$549) OR up to S$350 Cash via PayNow* when you apply and spend a min. of S$500 in Eligible Transactions. T&Cs apply

Valid until 31 Oct 2023

More Details

Key Features

Flat 1.5% cashback rate for all eligible purchases

No cashback cap and no minimum spend

Enjoy dining and shopping discount privileges at over 3,000 outlets in Asia with Standard Chartered’s The Good Life benefits program

1 year annual fee waiver, no minimum spend required

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

American Express True Cashback Card: 1.5% on all spending with no minimum spending and no cashback cap.

Unlimited Cashback

American Express True Cashback Card

More Details

Cash Back Features

3% Cashback for the first 6 months up to S$5,000 spend, 1.5% Cashback on any purchase you make thereafter

Unlimited Cashback - No min spend & no cap

P.S. Here’s our MoneySmart credit card ranking rubric

In case you’re wondering, here’s how we decide on our credit card rankings.

Is that credit card MoneySmart? Our MoneySmart credit card ranking rubric | |

Category | Our rating |

Overall | The average rating for the credit card on the whole, calculated from the ratings for the individual categories below. Plus, we’ll give you a one-liner on who we think the credit card is best suited for. |

Earn rates: Air miles / Cashback / Rewards points | Air miles / Cashback / Rewards points . This category looks at the depth rather than breadth of earn rates.

|

Earn categories | This category looks at the breadth rather than depth of your earnings.

|

Annual fees and charges |

|

Accessibility | Minimum income requirements:

Exclusivity: We dock 1-2 stars if there is/are another category/categories that make the card exclusive and very specific to a certain clientele. |

Extras/periphery rewards | These include:

We count the number of benefits and award between 0.5 to 2 stars for each, depending on how good the perk is. |

Sign-up bonus |

|

Finally understand the UOB One Card’s mind-boggling cashback mechanism? You’re welcome. Enlighten others by sharing this article with your friends and family!

The post The UOB One Card Comes With Up To 15% Cashback—But Do You Know How It Works? appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post The UOB One Card Comes With Up To 15% Cashback—But Do You Know How It Works? appeared first on MoneySmart Blog.

Original article: The UOB One Card Comes With Up To 15% Cashback—But Do You Know How It Works?.

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance