Unlocking the Home Loan Hack: A Comprehensive Guide for Singapore Mortgage Seekers

Is there a way to discover the ultimate “home loan hack” to make your dream of owning a home in Singapore a reality?

In Singapore’s competitive real estate market, finding the right home loan can be a daunting task. However, with the right knowledge and strategy, you can discover the ultimate “home loan hack” to make your dream of owning a home a reality. This comprehensive guide aims to empower Singapore mortgage seekers with valuable insights and practical tips to navigate the mortgage landscape and secure the best home loan deals.

Understanding the Singapore Mortgage Market

Before diving into the home loan hack, it is essential to have a solid understanding of the Singapore mortgage market. The market is primarily dominated by local banks, such as DBS, OCBC, and UOB, along with several international banks and financial institutions. The key factors influencing mortgage rates in Singapore include the Singapore Overnight Rate Average (SORA), Singapore Interbank Offered Rate (SIBOR), Swap Offer Rate (SOR), and fixed deposit rates.

Home Loan Hack #1: Improve Your Credit Score

One of the most crucial steps in securing a favorable home loan is to improve your credit score. Lenders rely on credit scores to assess an individual’s creditworthiness. Start by paying off any outstanding debts, ensuring timely bill payments, and maintaining a healthy credit utilization ratio. Regularly review your credit report and rectify any errors or discrepancies. A higher credit score can help you negotiate better interest rates and loan terms.

Home Loan Hack #2: Compare and Negotiate

To find the best home loan deal, it is essential to compare rates and terms offered by different lenders. Utilize online platforms and consult with mortgage brokers to assess multiple options. Armed with this knowledge, negotiate with lenders to secure a lower interest rate or favorable loan conditions. Remember, even a small reduction in interest rates can result in significant savings over the life of the loan.

Home Loan Hack #3: Leverage Loan-to-Value Ratio (LTV)

Understanding the Loan-to-Value (LTV) ratio can be a game-changer for mortgage seekers. The LTV ratio determines the amount of financing you can obtain relative to the property’s value. Aim for a lower LTV ratio, as this reduces the risk for lenders and often results in better loan terms. Save for a higher down payment to lower the LTV ratio and increase your chances of securing a favorable home loan.

Home Loan Hack #4: Optimize Loan Tenure

The loan tenure significantly impacts the overall cost of your home loan. While longer tenures may result in lower monthly payments, they also incur higher interest costs over time. Opting for a shorter loan tenure can save you a substantial amount of money in the long run. Analyze your financial capabilities and select a loan tenure that strikes a balance between manageable monthly payments and minimizing interest expenses.

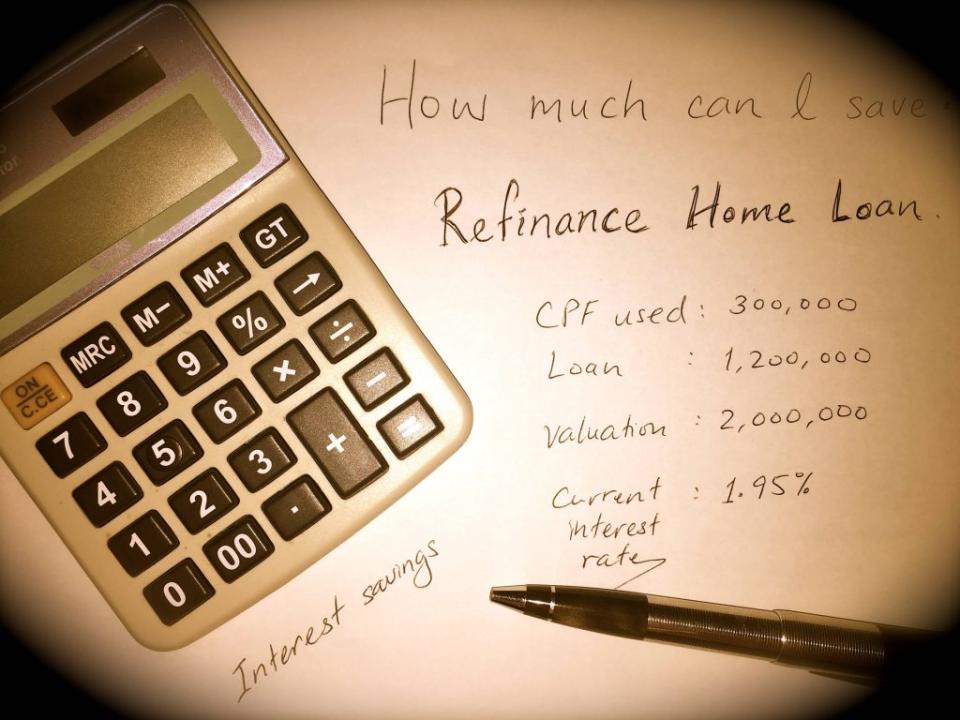

Home Loan Hack #5: Consider Refinancing Opportunities

Once you have secured a home loan, don’t forget to explore refinancing opportunities down the line. As market conditions change, refinancing can provide a chance to obtain better interest rates and loan terms. Keep an eye on interest rate movements and consult with mortgage professionals to assess if refinancing can help you save money over the remaining tenure of your loan.

The quest for the perfect home loan in Singapore may seem challenging, but with the right strategies, you can unlock the ultimate “home loan hack.” By improving your credit score, comparing and negotiating with lenders, leveraging the loan-to-value ratio, optimizing loan tenure, and considering refinancing opportunities, you can secure a home loan that aligns with your financial goals.

Remember to stay informed and up-to-date with the latest developments in the mortgage market. Be proactive in researching and understanding the terms and conditions of different loan offerings. Seek advice from financial experts or mortgage professionals to gain valuable insights and guidance throughout the process. Additionally, maintain a disciplined approach to managing your finances, ensuring that you make timely repayments and avoid unnecessary debts. By following these practices, you can maximize your chances of success in securing a favorable home loan that fits your needs and budget.

Home Loan Hack #6: Engage a Mortgage Broker for Expert Guidance

When it comes to navigating the complex world of home loans, enlisting the services of a professional mortgage broker can be a game-changer. A mortgage broker acts as an intermediary between you and the lenders, offering expert guidance and personalized assistance throughout the home loan process. Here’s why engaging a mortgage broker can be a valuable addition to your arsenal of home loan hacks:

Access to a Wide Range of Lenders: Mortgage brokers have established relationships with various lenders, including both local and international banks. This means they can provide you with a comprehensive range of loan options that suit your unique financial situation and requirements. Brokers can save you time and effort by doing the legwork of researching and comparing loan products on your behalf.

Expert Advice and Market Insights: Mortgage brokers possess in-depth knowledge of the mortgage market, including current interest rates, loan terms, and eligibility criteria. They stay abreast of market trends and can provide valuable insights into which lenders are offering the most competitive rates and favorable conditions. With their expertise, brokers can help you make informed decisions and choose the right loan option for your specific needs.

Tailored Loan Recommendations: By assessing your financial situation and goals, mortgage brokers can tailor their recommendations to match your unique circumstances. They take into account factors such as your income, credit history, and future plans to present you with loan options that best align with your objectives. This personalized approach ensures that you secure a loan that is not only affordable but also suits your long-term financial aspirations.

Negotiation Power: Mortgage brokers have the experience and negotiation skills to advocate on your behalf. They can present your application to lenders in a favorable light, highlighting your strengths as a borrower and potentially securing better interest rates or loan terms. Brokers understand the intricacies of the mortgage industry and can navigate the negotiation process more effectively than an individual borrower.

Streamlined Application Process: Applying for a home loan can be a time-consuming and paperwork-intensive endeavor. Mortgage brokers simplify this process by managing the paperwork, liaising with lenders, and ensuring that all necessary documentation is in order. They can guide you through each step, from the initial application to the final settlement, saving you from the hassle and stress of handling the process alone.

Engaging a mortgage broker can be a powerful home loan hack for Singapore mortgage seekers. Their access to multiple lenders, expert advice, tailored recommendations, negotiation power, and streamlined application process can significantly enhance your chances of securing a favorable home loan. So, consider partnering with a reputable mortgage broker who can provide you with the guidance and support you need to navigate the mortgage market with confidence. With their assistance, you can unlock the best home loan options available and turn your homeownership dreams into reality.

The home loan hack for Singapore mortgage seekers lies in a combination of knowledge, strategy, and diligent financial management. By improving your credit score, comparing loan options, leveraging the loan-to-value ratio, optimizing loan tenure, and considering refinancing opportunities, you can navigate the mortgage landscape with confidence.

Remember, owning a home is a significant milestone, and finding the right home loan can make all the difference. So, empower yourself with the necessary information and take the necessary steps to unlock the door to your dream home.

The post Unlocking the Home Loan Hack: A Comprehensive Guide for Singapore Mortgage Seekers appeared first on iCompareLoan.

Yahoo Finance

Yahoo Finance