United Continental or Delta: Which is Better Positioned?

The airline industry is looking up, thanks to the increased demand for air travel. The bullish forecast by Airlines for America (‘A4A’) — a premier trade organization — for U.S. carriers in the current spring season further highlights this trend. According to the forecast, these companies are expected to profit considerably this spring (Mar 1-Apr 30) as travel demand is projected to increase 4% year over year to 151 million.

With the U.S. economy improving and consumer confidence remaining strong, more Americans are taking vacations, resulting in the increased demand referred above. Moreover, ticket prices are still low and this has been an added incentive for passengers who are benefiting from a much-improved job market and rising disposable income.

Buoyed the improving travel demand, many carriers including the likes of Delta Air Lines, Inc. DAL, Hawaiian Airlines — the wholly owned subsidiary of Hawaiian Holdings, Inc. HA, JetBlue Airways Corporation JBLU and United Continental Holdings, Inc. UAL – have recently issued improved views for current-quarter unit revenues. All the above-mentioned stocks carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other key carriers like American Airlines Group AAL and Southwest Airlines Co. LUV are also expected to perform well with respect to unit revenues in the first quarter of 2018.

Given this backdrop, it is not a bad idea to indulge in a comparative analysis of airline heavyweights — Delta and United Continental — based on certain parameters.

Price Performance

When considering price performance in a year’s time, Delta clearly scores over United Continental. Delta has gained 22.9%, higher than its industry’s 20.8% rally. Meanwhile, the Chicago-based United Continental gained only 7.4% in the same time frame.

Valuation

Delta as well as United Continental are attractively valued. Going by the EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) ratio, which is often used to value airline stocks, given their significant debt levels and high depreciation and amortization expenses, the stock doesn’t look expensive at this point.

Delta currently has a trailing 12-month EV/EBITDA ratio of 5.6, which is favorable compared to the figure of 8.1 carried by its industry. United Continental is even more favorably placed in this respect as its reading is 5.5.

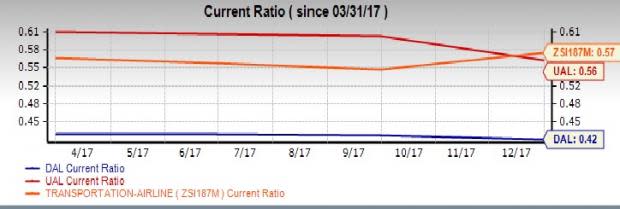

Current Ratio

This metric measures the ability of a company to service both short-term and long-term debt. In other words, it is the ratio of the current level of total assets and expresses to that of the current level of liabilities. Here, United Continental is the winner with a current ratio of 0.56, which is a tad lower than the industry average of 0.57 but much higher than Delta’s 0.42.

Debt-to-Equity Ratio

The debt-to-equity ratio is a good indicator of the financial well-being of a company and is a good proxy for its debt-servicing capacity. Delta scores over United Continental in this respect. The reading for this Atlanta GA- based carrier is 47.39 compared with 144.21 for United Continental and 161.03 for the industry.

Earnings Surprise History

United Continental has outpaced the Zacks Consensus Estimate in each of the trailing four quarters, with an average beat of 4.6%. Meanwhile, Delta has delivered a positive earnings surprise in three of the trailing four quarters while missing once, generating an average positive earnings surprise of 3.8%.

Conclusion

Our comparative analysis shows that Delta holds and edge over United Continental when considering price performance over an extended period and Debt-to-Equity Ratio. Another favorable factor for Delta is that it is a regular payor of dividends. Its dividend yield is an impressive 2.2%. However, United Continental does not pay dividends. Moreover, Delta’s larger business size (market capitalization of $39.39 B) compared to United Continental ($18.7 B) gives it the gargantuan scale to cope with industry headwinds in a better way.

Despite being outperformed, with respect to the above parameters, United Continental holds the edge over Delta in terms of valuation, current ratio and earnings surprise history.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Continental Holdings, Inc. (UAL) : Free Stock Analysis Report

Hawaiian Holdings, Inc. (HA) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance