Understanding A Retirement Product – AXA Retire Happy

Most insurance companies have financial products that are meant for retirement planning. These are products that typically provide a regular payout (also known as an annuity) to policyholders during retirement age.

One of our financial advisor friends recently did for us a benefit illustration of the AXA’s Retire Happy policy. The benefit illustration looks reasonable and the policy is easy to understand. We thought it would be worth highlighting on.

Retire Happy Illustration For A 28 Year Old Male (Non-Smoker)

Premiums & Payout

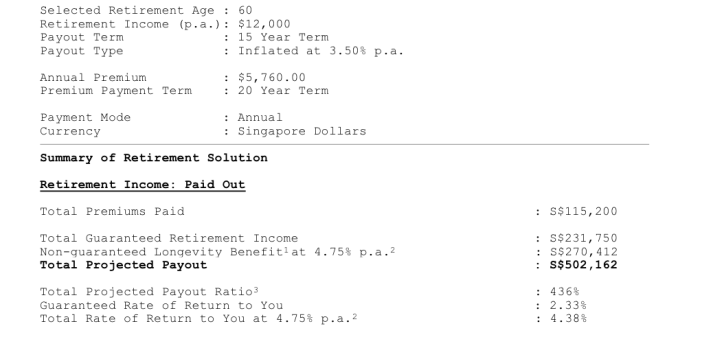

Here is a look at the premiums to be paid based on this illustration that was done.

The policyholder pays $5,760 per year for a period of 20 years. Thereafter, payment cease and the portfolio is allowed to continue growing.

At the age of 60, the policyholder would be given a payout of $1,000 per month (or $12,000 per year as indicated in the illustration) for a total of 15 years. This payout is guaranteed and increases each year by 3.5% to cope with inflation. In total, the guaranteed amount to be paid out is $231,750, or about $2.01 for every $1 put in.

There is a non-guaranteed component as well for the policy that would be paid out upon maturity of the policy (age 75). In this illustration, the policyholder would receive an additional $270,412 when the policy matures should the portfolio achieve a growth of 4.75% per annum. Do note this is not guaranteed

In total, policyholder would get $502,162, or about $4.35 for every $1 put in, should the policy achieve a return of 4.75% per annum. Pretty attractive isn’t it?

You Wouldn’t Want To Surrender The Policy

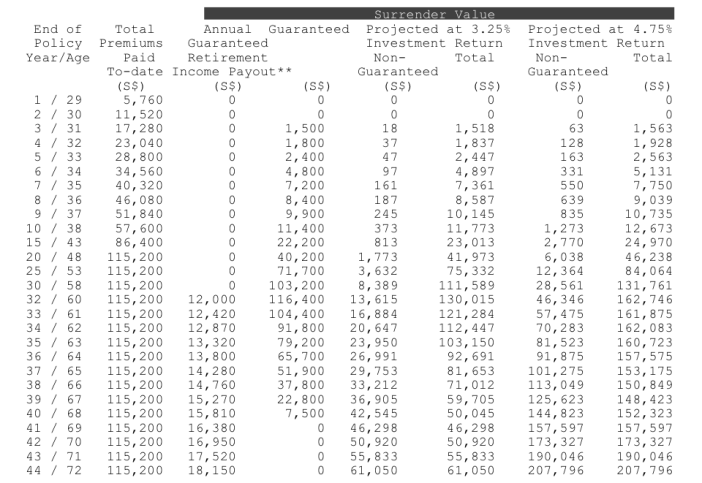

Most insurance policies give a pretty raw deal if you surrender your policy early. Retire Happy is no exception.

For example, assuming you pay the premiums faithfully till the age of 48 but then decide to terminate the policy at age 53, you are only guaranteed to get back $71,700. If you terminate it at an earlier age, say 38, you only guaranteed to get back $11,400 of the $57,600 of premiums you have paid.

In other words, surrendering this policy is an absolute no no.

The payout works differently if the policyholder passes on.

By comparing the guaranteed portion to the premiums paid, we can tell that the death benefit paid out is pretty much equal to the premiums paid by the policyholder. In other words, your premiums are returned to you if anything happens.

There may be some non-guaranteed payout as well, depending on how well the portfolio fares.

Effects Of Deduction & Distribution Cost

Before we go into the details, let us first stress that your decision on whether to buy this policy, or any other policies for the matter, should be based on understanding the product, and analysing for yourself whether it is suitable for you and whether you can afford it in the long run.

You should not let high distribution cost or effect of deduction turn you away from a product that is suitable for you.

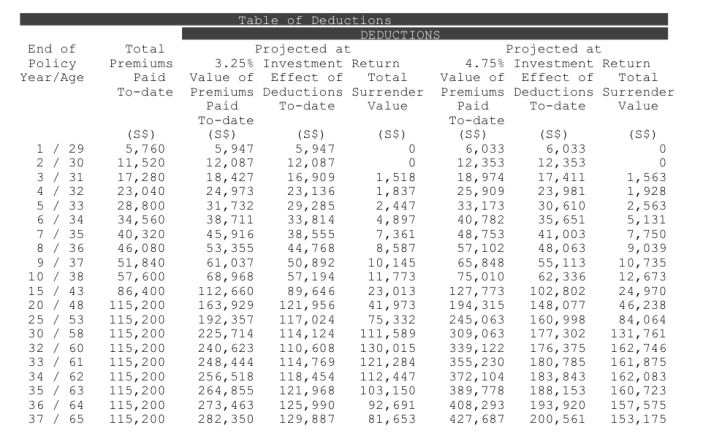

That being said, all insurance illustration would show the distribution cost and the effects of deduction. It is worth understanding what these things mean.

Let us explain how this works. We will look at the row where the person is at age 60.

At age 60, the value of the premium at the 3.25% projection level can be seen to be $240,623. This is the amount the person would have had he or she invested the money themselves.

The effect of deduction is shown to be $110,608. What this number refers to is the cost that the company charges for providing the policy and all other related costs such as cost of insurance, distribution cost and surrender charges. In case you are wondering, the profits made by the insurance company are included as part of this figure.

Our Opinion

One of the reasons why the benefit illustration appears attractive is due to the age (28) assumed for the policyholder. Because of that, the compounding interest accumulated is very high and the company is able to provide a decent guaranteed amount. Policyholders who are older may not be able to get such an attractive deal.

The other area we like to highlight is the high effect of deduction. It shows that if you decide to invest the money yourself, you would be able to enjoy a much higher payout for yourself for the same return compared to buying a policy from an insurance company.

Nonetheless, regardless of whether you choose Retire Happy, or decide to invest directly yourself, the same principal still applies; it is better to start planning for retirement in your younger days.

We will be sharing our personal finance journey with you exclusively on our once-a-month DollarsAndSense.sg newsletter. Sign up today. It is free.

The post Understanding A Retirement Product – AXA Retire Happy appeared first on DollarsAndSense.sg.

Yahoo Finance

Yahoo Finance