UK Exchange Highlights Three Growth Companies With High Insider Ownership

As the UK economy shows signs of robustness with positive GDP figures and a buoyant FTSE 100, investors are keenly observing market dynamics and opportunities. In this context, growth companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those who know the company best amidst evolving economic conditions.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Plant Health Care (AIM:PHC) | 34.7% | 121.3% |

Petrofac (LSE:PFC) | 16.6% | 124.5% |

Gulf Keystone Petroleum (LSE:GKP) | 12% | 44.4% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

Helios Underwriting (AIM:HUW) | 23.1% | 14.7% |

Belluscura (AIM:BELL) | 38.6% | 121.7% |

Velocity Composites (AIM:VEL) | 27.8% | 173.3% |

Mothercare (AIM:MTC) | 15.1% | 41.2% |

Judges Scientific (AIM:JDG) | 11.5% | 25.3% |

Hochschild Mining (LSE:HOC) | 38.4% | 42.6% |

Let's dive into some prime choices out of from the screener.

Energean

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energean plc is an oil and gas company focused on the exploration, production, and development of hydrocarbon resources, with a market capitalization of approximately £1.93 billion.

Operations: The company generates its revenue primarily from the exploration and production of oil and gas, totaling $1.42 billion.

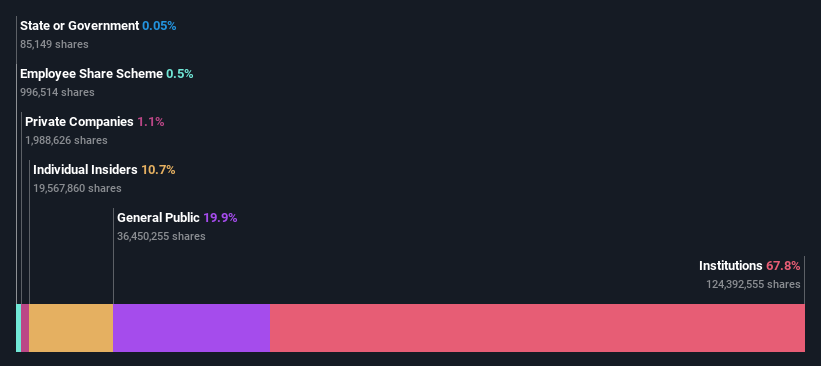

Insider Ownership: 10.6%

Energean plc, a UK-based growth company with high insider ownership, is trading at 62.1% below its estimated fair value and analysts expect its stock price to rise by 33.1%. Despite high levels of debt, Energean's earnings have grown by a very large margin over the past year and are projected to increase by 15.6% annually, outpacing the UK market's forecasted growth. However, its dividend coverage is weak, with dividends not well supported by earnings or free cash flows. Recent production increases and positive corporate guidance underscore its operational momentum despite financial leverage concerns.

Click to explore a detailed breakdown of our findings in Energean's earnings growth report.

Our expertly prepared valuation report Energean implies its share price may be lower than expected.

Playtech

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Playtech plc is a global technology company specializing in gambling software, services, content, and platform technologies with a market capitalization of approximately £1.57 billion.

Operations: Playtech's revenue is primarily derived from its Gaming B2B and B2C segments, generating €684.10 million and €946.60 million respectively, with additional contributions from HAPPYBET and Sun Bingo totaling €91.60 million.

Insider Ownership: 13.5%

Playtech, a UK growth company with substantial insider ownership, is currently undervalued, trading 52.9% below its fair value with expectations of a 37.2% price increase per analysts' consensus. While its revenue growth is modest at 4% annually, earnings are set to expand significantly by 20.62% each year. Recent strategic partnerships like the one with MGM Resorts to deliver live casino content from Las Vegas enhance its market position despite some concerns over low forecasted Return on Equity of 8.9%.

TBC Bank Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates primarily in Georgia, Azerbaijan, and Uzbekistan, offering a range of financial services including banking, leasing, insurance, brokerage, and card processing with a market capitalization of approximately £1.59 billion.

Operations: The company generates revenue from a variety of financial services such as banking, leasing, insurance, brokerage, and card processing across Georgia, Azerbaijan, and Uzbekistan.

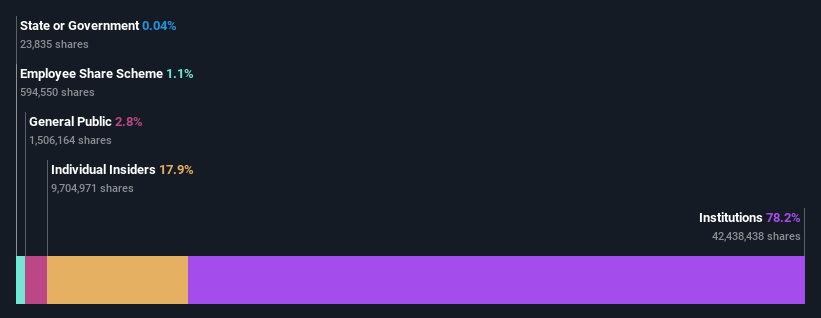

Insider Ownership: 18%

TBC Bank Group, a UK-based growth company with high insider ownership, is trading at a good value relative to its peers. Despite some volatility in its share price recently, the bank has demonstrated robust financial performance with significant earnings growth over the past five years and continued strong revenue and earnings forecasts. However, concerns about its high level of bad loans and unstable dividend track record temper the positive outlook. Recent strategic moves include a GEL 75 million share buyback program aimed at reducing share capital and supporting employee benefits.

Dive into the specifics of TBC Bank Group here with our thorough growth forecast report.

Upon reviewing our latest valuation report, TBC Bank Group's share price might be too pessimistic.

Seize The Opportunity

Get an in-depth perspective on all 62 Fast Growing UK Companies With High Insider Ownership by using our screener here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include LSE:ENOGLSE:PTEC LSE:TBCG and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com