UK consumers at gloomiest since Brexit vote aftermath as households fret about rate rise and slowing property market

UK consumer confidence at its lowest level since the aftermath of the Brexit vote, according to a survey from YouGov and the Centre for Economics and Business Research

Score for household finances over the past 30 days slipped to its lowest level since January 2014 as households fret over the recent rate rise at the Bank of England and the slowing housing market

Mortgage approvals slide to 13-month low but remortgaging soars as households rush to beat the rise in interest rates

FTSE 100 nudges down; PPB and William Hill both reported to be in talks with Aussie bookie CrownBet

Markets wrap: Consumer confidence falls to lowest since Brexit aftermath; remortgaging surges as households rush to beat BoE hike

Consumer confidence in the UK has slipped to its lowest level since the aftermath of the Brexit vote as households fret over the recent rise in interest rates and slowing housing market.

The survey by YouGov and the Centre for Economics and Business Research showed the score for household finances over the past 30 days has plunged to its lowest level since January 2014 while house values fell to their lowest since July 2013.

Elsewhere, mortgage approvals dipped to a 13-month low in October but remortgaging surged as households rushed to beat the rise in interest rates earlier this month.

Homeowners tried to lock in lower interest deals on fixed rate mortgages ahead of the hike but squeezed incomes and battered consumer confidence caused mortgage approvals for new properties to suffer their biggest fall in six months.

Meanwhile, the FTSE 100's fall has been softened by consumer goods giants rising on slashed import tariffs in China and reports that Paddy Power Betfair is in talks with CrownBet, just hours after William Hill confirmed it was speaking to the Aussie bookie over a deal

Bank of England policymaker says she believes wages will pick up

Research points to an imminent pay rise for UK workers, according to a leading Bank of England policymaker.

Silvana Tenreyro, who voted in favour of a interest rate hike on November 2, the UK's first in a decade, said she believed that data suggested a rise in earnings was on the way.

This comes as reports from both the Office for Budget Responsibility and the Institute for Fiscal Studies have suggested that low productivity will not only hamper overall growth in the UK economy until 2021-22, but also hit household incomes, with stagnant levels of wage growth.

In response to Wednesday's OBR report, the IFS labelled the fact that wages are unlikely to return to 2008 levels by 2022 as “truly astonishing”.

Read Anna Isaac's full report here

Pound pulled in different directions by the dollar and euro

The pound is largely a passenger on currency markets this afternoon, being pulled in different directions by the dollar and euro.

The dollar has been on the decline since Wednesday's Fed meeting minutes showed a divide at the central bank over sluggish inflation and a weaker-than-expected set of PMI figures in the US today hasn't lifted sentiment towards the greenback. Meanwhile, the euro has climbed to a two-month high against the dollar on the increasing probability that a grand coalition in Germany will be formed.

IG chief market analyst Chris Beauchamp gave his review of the action on stock markets this week:

"US traders, well, some of them, have dragged themselves back to their desks for a half-day’s trading, but so far the atmosphere is quiet across all markets. Early gains for the FTSE 100 have fizzled out, while on the continent stock markets are mostly higher, but the real action has been concentrated in the euro.

"Looking back over the past week we can see that risk appetite has recovered nicely, especially in European markets, which bodes well for the rally as we get into the traditionally strong pre-Christmas period. Data suggests that the ‘Santa rally’ tends to be particularly strong from mid-December, so we should not assume that we are due a one-way trip from here.

Sherry sales rocket thanks to popularity among 'hipsters’

Once seen as the tipple of choice for older generations at Christmas, sherry has enjoyed a revival over the past year thanks to its soaring popularity among "hipsters".

Alongside other popular alcoholic beverages such as gin, craft ales and Negroni, sherry is becoming the millennial drink du jour, with sales up 46pc since January.

While sales of sherry plummeted two years ago – with almost 10 million bottles sold in 2015 compared to 22 million bottles in 2005, according to figures from the Wine and Spirit Trade Association (WSTA) – Majestic Wine said that drier, premium styles are enticing new, hipper audiences to the world of fortified wine.

Sales of premium sherries in the £10 to £5 price range are up 71pc since the beginning of the year, and are set to increase more than 18pc in the coming years, according to the IWSR.

The renewed demand for the drink has been put down to the increasing popularity of Spanish food and drink, and the fact that discerning customers are willing to pay a bit more for their booze.

Read Sophie Christie's full report here

WTI crude surges on damaged pipeline; investors sit on hands

Brent and WTI crude, the two major benchmarks on the oil market, normally move in tandem but WTI has raced ahead today on news that the the damaged Keystone pipeline from Canada to the US has been partially shut down.

While the American benchmark has surged 1.2pc to a two-year high as the US market tightened, Brent crude remains flat at $63.60 per barrel.

Investors have been sitting on their hands on the markets today with a lingering holiday mood prompting subdued trading, according to FXTM analyst Lukman Otunuga.

He added on sentiment in the oil market:

"Optimism over OPEC members extending production cuts beyond March 2018 has also played a role in oil’s incredible resurgence. While further upside could be on the cards short term, it will be interesting to see how markets react to the rising output from US Shale in the longer term."

Fuller's calls for rates overhaul as it grows profits despite mounting costs

Fuller, Smith & Turner has managed to navigate the pub industry's mounting cost pressures but called for the “antiquated” business rates system to be overhauled.

Chief executive Simon Emeny said even though he “cannot remember a time when we have faced such an array of additional cost pressures” his business grew half-year sales and profits ahead of the wider industry.

He said in spite of the company suffering an extra £2m in business rates this financial year, the Chiswick-based brewer had managed to grow adjusted pre-tax profits in the six months to 30 September by 4pc to £23.8m, a figure which excludes proceeds from pub sales.

With this included, statutory pre-tax profits rose by 10pc, helped by an exceptional gain of £4.8m from the disposal of 11 pubs. The earnings performance came of the back of sales of £209m, up 6pc.

While the chief executive said he welcomed the decision in the Chancellor Philip Hammond's Budget to link business rates to the lower level of inflation - the consumer prices index - from next year, it still did not address the fundamental issue.

Read Bradley Gerrard's full report here

Banks promise City watchdog they'll keep Libor going until 2021

Twenty banking giants have agreed to support the scandal-hit benchmark the London interbank offered rate (Libor) until an alternative is found in 2021 so that the transition doesn't rattle markets.

The City watchdog warned earlier this year that markets would be disrupted if banks stopped submitting Libor before it is due to be phased out in four years time, the concern being that if some stopped others might follow.

"We could not – and cannot – countenance the market disruption that would be caused by an unexpected and unplanned disappearance of Libor," said the Financial Conduct Authority's chief executive Andrew Bailey.

Those fears were alleviated on Friday, however, when the FCA confirmed that all 20 banks which submit quotes for Libor have promised to support the rate until an alternative is bought in. These include HSBC, Credit Suisse, JP Morgan and Lloyds.

Read Lucy Burton's full report here

Lunchtime update: Consumer confidence slips to lowest level since Brexit aftermath; mortgage approvals dip to 13-month low

Consumer confidence in the UK has slipped to its lowest level since the aftermath of the Brexit vote as households fret over the recent rise in interest rates and slowing housing market.

The survey by YouGov and the Centre for Economics and Business Research showed the score for household finances over the past 30 days has plunged to its lowest level since January 2014 while house values fell to their lowest since July 2013.

Elsewhere, mortgage approvals dipped to a 13-month low in October but remortgaging surged as households rushed to beat the rise in interest rates earlier this month.

Homeowners tried to lock in lower interest deals on fixed rate mortgages ahead of the hike but squeezed incomes and battered consumer confidence caused mortgage approvals for new properties to suffer their biggest fall in six months.

The FTSE 100 is stuck in flat territory on a quiet session on the stock market. Paddy Power Betfair has jumped to the top of the index after Reuters reported that the bookie has held talks over a tie-up with CrownBet, just hours after rival William Hill confirmed that it is also in talks with the Australian firm.

Harrods begins £200m refurbishment - the biggest in the department store’s 170-year history

Harrods is to undergo a £200m revamp in what will be the biggest and "most ambitious" redevoplement in the luxury department store’s 170-year history.

All 330 departments inside the store, which span across one million square feet, will be given a makeover. The Fine Watch Room, home to timepieces that cost more than £60,000, will be expanded next Spring, while there will also be a large-scale extension of the beauty hall which will encompass space across two floors.

The three-year project has already begun, with the recent opening of the food halls, and will continue through to 2020 with the dedication of an entire floor to menswear and sports and an evolution of the home department. There will be no changes made to the exterior of the Grade II listed building.

Read Sophie Christie's full report here

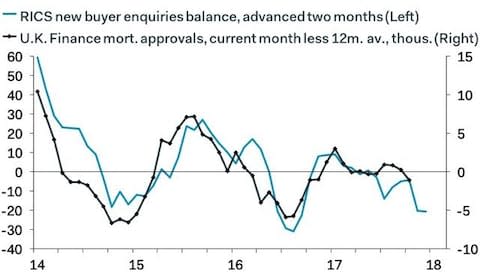

Mortgage approvals slide likely to get worse

Mortgage approvals suffered their biggest fall in six months last month, sliding to a 13-month low, and the figures confirm the fragility of consumer confidence shown in this morning's data from the Centre for Economics and Business Research.

The downturn in mortgages approvals has begun and not even the Chancellor's Stamp Duty cut for first-time buyers can reverse the trend, Pantheon Macro's chief UK economist Samuel Tombs commented.

And it will probably get worse.

He added:

"Finance data capture the period before the MPC hiked interest rates. Housing market activity likely has cooled further in recent weeks, given that mortgage rates have moved swiftly higher and consumer confidence has weakened since the MPC’s hike."

Remortgaging rockets ahead of November interest rate hike, as new mortgages reach new low

Remortgaging was pushed to an eight year high last month as borrowers looked to lock in deals ahead of November's interest rate rise, and as growth in other forms of credit cooled.

Figures have revealed that £23.1bn was lent for mortgages in October, a 14pc rise on the same time last year.

The remortgaging rush came ahead of the much-trailed rise in rates at the Bank of England on 2 November, to 0.5pc.

This rise is therefore likely driven by homeowners trying to lock in lower interest deals on fixed rate mortgages ahead of the hike, according to UK Finance, a trade association which combines 300 entities including the British Bankers Association and the Council of Mortgage Lenders.

But new mortgage approvals for house purchases reached 13-month low. They fell from by just over 1,000 to 40,488 in October, down from a six-month high of 41,787 in August.

Report by Anna Isaac

Bank of England rate rise compounds on inflation squeeze fears

The Bank of England's rate rise earlier this month has compounded on fears of the inflation-induced squeeze on household incomes, Christian Jaccarini, economist at the Centre for Economics and Business Research, said in reaction to those grim consumer confidence numbers.

The slowing housing market is one of the most striking measures in today's data with house values falling to their lowest level since July 2013.

It should be noted, however, that the survey was done before the Budget. Next month's consumer confidence figures will be a true litmus test for how Chancellor Philip Hammond's has been received by the public.

The increased cost of living caused by rising inflation and weak wage growth has put a "big squeeze on people's household finances", according to head of YouGov Stephen Harmston.

Mike Ashley asks Sports Direct shareholders to approve £11m payout for his brother

Mike Ashley has called a meeting of Sports Direct’s shareholders so they can vote on a proposed £11m payout for his brother.

The retailer commissioned a review of its financial dealings with John Ashley, its former IT director, after shareholders voiced concerns about an arrangement it had with his delivery company.

But the review by Sports Direct's legal advisors RPC and independent accountants Smith & Williamson found that, had he been paid in line with other executives, he would have received an additional £11m.

Sports Direct says he was denied the cash “because of concerns at the time about public relations".

Read Jack Torrance's full report here

Brexit will determine monetary policy, says Bank of England MPC member

One of the Bank of England's newest policymakers Silvana Tenreyro has said in her first interview since joining the MPC that two more interest rate increases will be needed to constrain inflation but Brexit will largely determine how monetary policy develops in the foreseeable future.

She explained:

"Brexit will likely affect the supply side of the economy.

"We don’t know how the demand side will respond. It depends on how households and companies react to the new normal, to the new potential. Shocks can hit the economy one way or the other and we will have to respond to that."

Ms Tenreyro said that Brexit could present challenges that mean that the central bank will have to remove the highly accommodative monetary policy currently in place.

Pound nudges higher despite grim consumer data; James Fisher & Sons dives on FTSE 250

Let's not sugarcoat it, the markets are having a quiet one this morning.

James Fisher & Sons' 4.5pc drop on the FTSE 250 is the only semblance of any volatility in London this morning. The shipping firm has suffered its sharpest drop in a year after admitting that the pick-up in its offshore oil unit has stuttered.

The pound has made some small gains against the dollar, moving 0.2pc higher to $1.3328, despite that grim consumer confidence data but that's your lot in terms of excitement.

Spreadex analyst Connor Campbell said this on sterling's climb on currency markets and the dull session over in Europe:

"Sterling’s (admittedly slim) gains came despite the continued gloomy outlook for Britain’s wages – backed by yesterday’s IFS report that workers face ‘lost two decades of wage growth’ – and the no doubt related drop in consumer confidence to lows not seen since the Brexit vote, as shown in a YouGov/CEBR survey.

"Over in the Eurozone things were hardly more exciting. The DAX strained to keep its head above 13000 with a 0.1% rise, while the IBEX climbed 0.3% and the CAC sat flat around 5370. The region’s focus this morning will be the German Ifo business climate reading, with analysts expecting the figure to come in at 116.6 for November against the 116.7 seen in October."

Mitsubishi Materials shares plunge after it admits quality assurance failures

Shares in Mitsubishi Materials Corporation (MMC) slumped more than 11pc after the industrial conglomerate became the latest Japanese company to admit to falsifying quality assurance data.

MMC, part of the broader Mitsubishi “keiretsu”, or group of companies, said up to 70 of its aerospace clients and seven of its auto industry customers may have received the improperly tested products produced by two of its subsidiaries, Mitsubishi Cable Industries and Mitsubishi Shindoh.

The parts affected include rubber gaskets and packings that prevent the leakage of oil, water and air, and metal strips used in cars’ electrical systems.

MMC said: “We sincerely apologise for any problems and difficulties that this matter has caused to all concerned parties.”

The company said it halted shipments of the affected products last month and created a taskforce to look into the problems. It now plans to strengthen and expand its quality control team.

Report by Jack Torrance

Agenda: Consumer confidence slumps on interest rate hike and housing concerns

UK consumers are their least confident since the aftermath of the Brexit vote as households fret over the recent interest rate hike at the Bank of England and the slowing housing market, a survey by YouGov and the Centre for Economics and Business Research has found.

The score for household finances over the past 30 days slipped to its lowest level since January 2014 with all of the index's eight measures falling.

#China rout abates as strong global flash November PMIs lift the mood. Dollar inches higher in thin trading as Treasury yields gain. pic.twitter.com/I4mCX11DAT

— Holger Zschaepitz (@Schuldensuehner) November 24, 2017

It’s a quiet end to the week for economics data with mortgage data the sole release to tempt traders this morning. PMI figures for November in the US will liven up a shorter-than-normal trading session across the Atlantic.

Corporate news is also a little on the light side this morning. Provident Financial has released a statement telling the market that its executive chairman has sadly died while William Hill has confirmed that it is in discussions over merging its Australian subsidiary with CrownBet.

And it is of course Black Friday, which marks the start of a crucial festive season for the UK’s battered retail sector.

AGM: Petra Diamonds

Economics: High street lending (UK), Revised UoM inflation expectations (US), Revised UoM consumer sentiment (US), Flash manufacturing PMI (US), Flash services PMI (US)

Yahoo Finance

Yahoo Finance