Record decline in UK consumer borrowing but mortgage loans hit 13-year high

UK credit card and other consumer borrowing has fallen at its fastest pace on record just as mortgage borrowing has soared to a 13-year high.

New Bank of England (BoE) data on Monday illustrates a stark contrast in borrowing trends fuelled by the coronavirus pandemic.

Households have repaid £5.6bn ($7.5bn) in credit card, overdraft, car finance and other consumer debt since March. The crisis has heightened consumer worries over their finances, while the virus and lockdown restrictions have severely curtailed spending opportunities.

Average overdraft interest rates also leapt earlier this year, with the BoE reporting an effective 19.7% rate in October versus 10.3% in March.

Consumer debts have dropped 5.6% over the past year, the lowest since the central bank began recording the data in 1994. £400m was paid off in credit card debt in October alone.

Households are also putting away more money in banks. Deposits totalled £12.3bn in October, the highest since May.

“The strong flow of deposits in October can be accounted for by deposits into instant access accounts,” said the bank in its latest monthly analysis of household finances. It noted the deposits could reflect savers abandoning National Savings and Investment (NS&I) accounts, after it slashed market-leading interest rates.

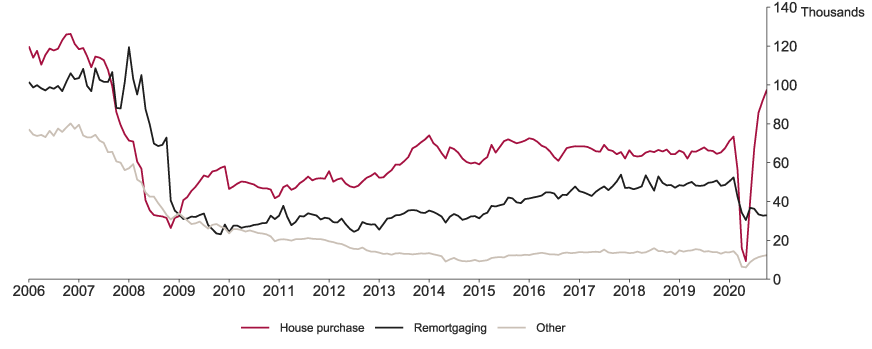

While households have reined in consumer borrowing, mortgage lending has soared in recent months after plummeting when the first UK lockdown paralysed the property market.

The pandemic and months of lockdown have triggered a rush to move home among those able to buy, fuelled further by stamp duty cuts in England and Northern Ireland.

The latest figures show 97,500 loans were approved for home purchases in October. It marks an increase on September’s record-breaking 92,100 approvals, which had also been the highest level since 2007.

READ MORE: COVID-19 ‘could knock £1,200 off average pay’ by 2025

It marks a 33% leap on pre-lockdown levels in February. Some estate agents report lender delays as banks struggle to cope with surging demand for their services.

Remortgages with different lenders were unchanged in October however, down 40% on February levels.

READ MORE: Zoopla predicts busiest December in a decade before house price growth slows in 2021

“October’s money and credit data showed that the mini-boom in the housing market continued but a fall in consumer credit suggests that consumer spending was already faltering before lockdown was imposed,” said Thomas Pugh, UK economist at Capital Economics.

Pugh noted: “Overall, households started to conserve cash again in Q4, which will weigh on spending.

“But as consumers and businesses are paying back credit now, the good news on vaccines means that businesses and consumers’ purses could be pretty full when regulations are loosened early next year, leading to a sharp rebound in consumption and GDP growth.”

WATCH: Why are house prices rising during a recession?

Yahoo Finance

Yahoo Finance