The Ugly Truths Behind Investment-Linked Policies

If you have spoken to an insurance agent before, chances are you would have heard of the product, Investment-Linked Policies (ILPs). ILPs are frequently marketed by insurance companies and pushed to consumers by enterprising agents.

Last week, the Life Insurance Association (LIA) reported that ILPs accounted for 20% of all new insurance premiums paid for the first half of 2015. At the same time, new health insurances premium fell by about 34%.

So why are sales of ILPs performing well at a time where demand for new health insurances are falling? Is this a true reflection of the preferred choice of the Singapore consumers? Or simply the result of insurance companies pushing hard for the sales of these products?

What Are Investment-Linked Policies?

ILPs are policies offered by insurance companies that provide policyholders with both insurance and investment components. Overly enthusiastic agents will call it the “best-of-both worlds”. A more accurate phrase to describe it, in our opinion, would be “worst-of-both-worlds”.

For a regular premium ILPs (policyholders pay a monthly fee), premiums received would be used (after sales charges) to acquire units in a Mutual Fund (or more commonly known in Singapore as Unit Trust) of the policyholder’s choice. Some of these units are then sold off to purchase the insurance component that the policyholder requests for.

Flexibility Of Investment-Linked Policies

We will start with what is “good” about ILPs before going into what is wrong with them, since the latter has a much longer list than the former.

One thing your agent was right about is the flexibility offered by ILPs.

1. ILPs allow you to adjust your coverage.

Units in your mutual funds are sold to purchase insurance coverage. You can adjust your insurance coverage needed as per your discretion. If you want less coverage, you can reduce it and pay less cost for the insurance fee.

2. Premium Holiday

Most ILPs would offer policyholders the option of a “Premium Holiday”. That means you can stop paying the premium of your ILPs for a period of time (e.g. one year). During this time, the units in your mutual funds would still be sold off to pay for insurance coverage.

3. Flexibility of Funds Choice

Unlike a traditional whole life policy, policyholders can decide which mutual funds they would like to be vested into for an ILP.

So what is wrong with an Investment-Linked Product?

Almost everything else. Let us explain.

1. Sales Charges

In our opinion, the sales charges that an individual will incur when buying an ILP is simply too expensive. Here is a breakdown.

Agent Commission:

Buying an ILP is one of the few sure ways of helping an agent friend. An agent has A LOT of incentive to be selling you an ILP. Commission payable to the agent is usually worth at least one-year premium.

So if you were to buy an ILP for about $500 per month, your agent will be enjoying a nice commission of about $6,000 from selling you the policy.

Low Allocation Rates For Buying Units In Early Years:

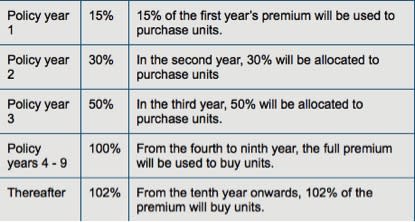

If you were thinking of getting an ILP, your agent would have given you a document indicating the allocation rate. Here is an example.

Source: MoneySense

Simply put, what this means is that the following premiums are being used to pay for the distribution (i.e. commission payable to agent and profit for insurance company) of the policy.

Year | Premiums Paid Annually ($500 per month) | Amount Payable To Insurance Company | Amount Used To Buy Units In Mutual Fund |

1 | $6,000 | $5,100 | $900 |

2 | $6,000 | $4,200 | $1,800 |

3 | $6,000 | $3,000 | $3,000 |

4 | $6,000 | – | $6,000 |

5 | $6,000 | – | $6,000 |

Total | $30,000 | $12,300 | $17,200 |

Based on our illustration, $12,300 will be used to pay for the distribution cost for the policy while only $17,200 would be used to buy actual units in the mutual funds. Is this good for you, or your agent? Go figure.

“Hidden” Ongoing Charges:

When you invest into a mutual fund, you incur management fees as well. This is the fee charged by the fund manager to investors of the fund. A typical annual fee charge would be about 1-1.5%.

We won’t go into the merits of requiring a fund manager when there are other lower cost options such as ETFs available. What you need to remember is that there will always be a fund manager charge involved when using a mutual fund.

Read Also: Why Passive Investing Without A Fund Manager Could Be Better

On top of that, the ILPs could also charge an account maintenance fee. This could easily be another 1% of the total fund value.

Let’s add more. How about the $10 monthly administrative charges? This translates into another 2%, based on the annual premium of $6,000 that we are using.

In total, you are easily looking at about 4% annual fee charges on an ongoing basis. We won’t be surprised if we are missing out on more hidden charges. You need to check your policies throughly to find out what fees are involved as each policy varies from one to another, even if they are from the same company.

Investment Linked Policies As An Investment

Using an ILP for investment purposes is a pretty bad idea. For an average year, you are already starting at about – 4%. For comparison purposes, the 10 year historical return of the STI ETF is about 9% while the risk-free return offered by CPF Special Account is up to 5%.

In other words, the fund manager that you select would need to earn an average of about 13% annually for a period of 10 years, just to generate the same results that an individual may otherwise get investing directly into ETF. Likewise, to breakeven with the risk-free returns offered by CPF, a fund manager would need to earn about 9% annually over the long run.

If this sounds like a really tall order to you, it’s because it is. And we have not even begun to touch the opportunity costs lost due to the fact that premiums in the earlier years are being used to pay for distribution cost of an ILP instead of being used for investment purposes.

Investment Linked Policies As Insurance

ILPs would fund the insurance coverage required by policyholders by selling units in the mutual fund. This means that when the market is not doing well, the fund is likely to perform poorly as well. With the prices of the fund low, the ILP would need to sell more units to fund the fee of the insurance coverage.

Remember that when you grow older, the cost of your insurance will also be higher which means you will need to sell more units from your mutual funds to fund the same insurance coverage.

In addition, a little known fact is that there is a bid-offer spread when you are buying or selling units in the mutual fund of your choice. You pay more for units when you buy but receive less when you sell.

For example, with all things being equal, the ILP might be paying $500 to purchase 500 units at an offer price of $1 in a mutual fund. Assuming insurance coverage is $50, with the bid price being $0.95, the ILPs would then need to sell 53 units at $0.95 each to pay for the insurance coverage.

Being well informed is your friend

We think it is important for consumers to be well educated before making financial decisions, especially ones that would have long-term impacts such as purchasing an ILP. We know many friends who have bought into ILPs during the early years of their careers and who have since terminated or are contemplating the termination of these policies at significant losses. Some of them have even bought from agents that are no longer in the industry.

Over the past 2 months, we have spoken to at least 5 insurance agents who we know well and who we consider as friends. All of them are in agreement with us that in general, people who are discipline and informed could easily get much better insurance and investment deals out there through other instruments.

We will be expecting for a sizeable group of agents out there who will viciously disagree with us. When someone threatens your livehood, you react.

Ultimately though, it is your own decision whether or not you should buy a new policy or cancel an existing one. So do what is best for yourself. Ask and probe your agent on some of these hard questions about ILPs. If you are not satisfied with the answers you are getting, don’t be afraid to walk away. It is your money at the end of the day.

DollarsAndSense.sg is a website that aims to help people make better financial decisions.

The post The Ugly Truths Behind Investment-Linked Policies appeared first on DollarsAndSense.sg.

Yahoo Finance

Yahoo Finance