Uber prices IPO at $45, toward the low end of stated range

Uber (UBER) priced its initial public offering at $45 per share, raising over $8.1 billion, the company announced Thursday. Toward the low end of its stated range, the price reflects a volatile market and bad timing after ride-sharing rival Lyft tumbled in its initial debut.

The ride sharing company is officially transitioning from a privately-held Silicon Valley darling into a publicly-traded entity, in one of the most eagerly awaited market offerings of the year.

That price, which was first reported by The Wall Street Journal, values Uber at over $82 billion — a big figure but a substantial drop from what was originally estimated to be a $100 billion-plus company.

Uber said in an April 26 amended regulatory filing with the Securities and Exchange Commission that it planned to lower the range of its offering to between $44 and $50 per share, below a previously reported range of $48-$55 per share. Playing into the decision to scale back expectations is a market currently in turmoil amid U.S-China trade worries.

Uber is by far the leader in a market that analysts at Morningstar recently estimated has the potential to soar above $1 trillion within a decade. Yet the company — which will begin trading on Friday on the New York Stock Exchange — must now assuage skeptical investors and fend off increasingly tough competition.

The stock’s trade on Friday will be a key test of investor sentiment — and expectations are being tempered because of whipsaw conditions, and doubts about how long it will take for the company to turn a profit. One big wild card that’s emerged in recent days are drivers demanding higher pay and benefits, even though Uber operates in the red.

Separately, the underwhelming March debut by its chief rival, Lyft, may have forced Uber to recalibrate some of the hype surrounding its IPO. Lyft (LYFT) was sued by some investors after its IPO was marred by a stock price that tumbled sharply from its initial floatation levels.

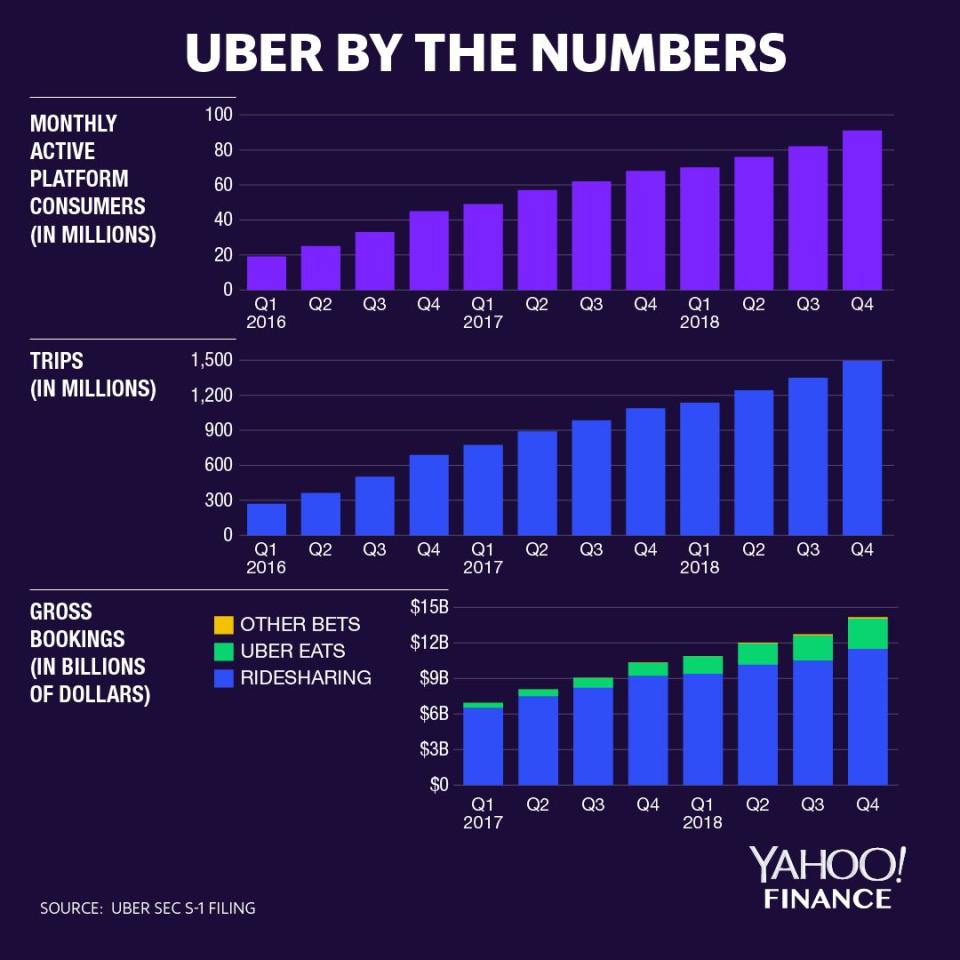

According to data from electronic commerce intelligence company Edison Trends, Uber commands 64% the U.S. ride-sharing market, compared to Lyft’s 36%. Within the last year, Uber has chipped away slightly at that lead, Edison’s data show.

Between its publicly traded shares and the billions in venture capital it has in its coffers, Uber is valued at over $80 billion. Until the IPO, that rich price tag placed the company in the rarefied air of being a “unicorn”— a private company worth over $1 billion.

In an updated picture of its financial health last month, Uber revealed that it lost an estimated $1 billion in the first quarter—a deficit that more than doubled compared to the comparable year-ago period.

The fact that both Uber and Lyft are still bleeding money will do little to assuage the market’s widening doubts about ride sharing companies’ ability to turn a profit in the immediate term.

Morningstar analyst Ali Mogharabi, who estimates Uber’s value at $110 billion, said this week that the company has a 30% market-share, and will continue to be the ride-sharing leader — even in the face of stiff competition from Lyft and Didi.

“We still value the company at $110 billion, or $58 per share, as Uber Eats is outperforming our expectations,” Mogharabi wrote in a comprehensive report, referencing the company’s popular food delivery system that’s helped insulate it from ride-sharing competition.

“Despite Uber's market leadership and high penetration in ride-sharing, it appears that its growth in that space is decelerating faster than we initially anticipated, and the same may be true for its peers, such as Lyft,” the analyst said.

“On the upside, while Uber has grabbed market share in food delivery much more quickly than we expected, we think strong growth potential for that service remains, Mogharabi added.

Uber’s IPO is backed in part by a $500 million investment from PayPal (PYPL). The payment service plans to purchase over 10 million Uber shares in a private placement at a price equal to the IPO pricing.

Read more:

WeWork amends confidential IPO filing, takes a step closer to going public

Lyft gets a sentiment boost as Wall Street gets bullish on its future

Follow Javier on Twitter: @TeflonGeek

Yahoo Finance

Yahoo Finance