Are U.S. Treasury Yields Getting Attractive?

Here's a story the media is just catching on to: The yield on 10-year U.S. Treasuries (IEF - News) has been edging higher and is now close to matching the S&P 500's (IVV - News) dividend yield.

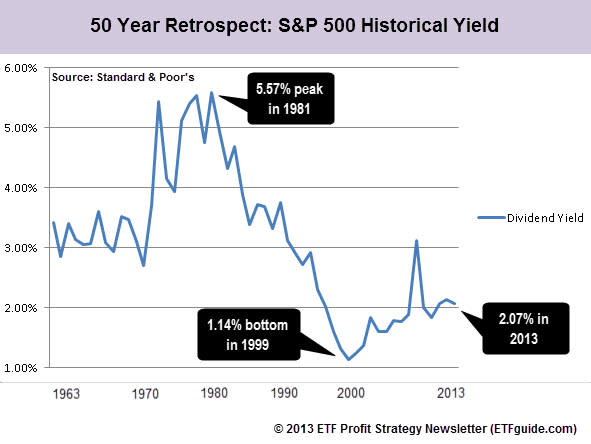

The 10-year U.S. Treasury bond currently yields 1.99% compared to the S&P's 2.07%. Last year, the S&P's dividend yield peaked at 2.29% in November.

As the S&P 500 and Dow Jones Industrial Average (DIA - News) approach all-time highs, U.S. Treasury prices have been pounded, pushing up yields. The price and yield of bonds is inverse correlated. As yields rise, bond prices fall and vice versa.

The DJIA's all-time high is 14,165, while the S&P 500's all-time high of 1,565. Both benchmarks reached those highs on Oct 9, 2007.

None of this is part of the Federal Reserve's plan, because the Fed wants to keep a lid on borrowing rates. Bloomberg pointed out:

"The Fed purchased $3.357 billion in Treasuries maturing from February 2020 to November 2022 as part of its plan to cap borrowing costs. The central bank is purchasing $85 billion of government and mortgage debt each month."

From a yield standpoint, U.S. Treasuries are still not attractive because they're not even keeping pace with inflation. In 2012, the Consumer Price Index (CPI), a benchmark of inflation averaged 2.1%. After factoring in inflation plus taxes, the yield on U.S. Treasuries is negative.

What about credit default risk? Are Treasury bondholders being adequately compensated for this risk? Of do we still have the fairyland view that Treasuries are "risk-free" investments?

If the yield on 10-year Treasuries matches or even exceeds the S&P's dividend yield (SPY - News) by a few basis points, it will still not make Treasuries an attractive investment for generating income.

On the other hand, the view that Treasuries (TLT - News) are a protection against a future stock market (SCHB - News) correction is the right interpretation.

In 2012, our $100,000 all ETF Income Mix Portfolio generated $10,400 by combining both dividend income and money from covered calls. The expense ratio average for this portfolio is 0.18%, which is five times less compared to U.S. stock mutual funds.

Follow us on Twitter @ ETFguide

More From ETFguide.com

Yahoo Finance

Yahoo Finance