U. S. Steel's (X) New Four-Year Labor Deals Ratified by USW

United States Steel Corporation X said that the United Steelworkers (“USW”) has ratified the new four-year collective bargaining agreements covering roughly 14,000 USW-represented employees at the company’s domestic facilities.

The new agreements cover workers across all of the company’s domestic flat-rolled and iron ore mining facilities as well as tubular operations in Fairfield, AL, Lorain, OH, and Lone Star, TX. The agreements are retroactive to Sep 1, 2018 and will remain in place through Sep 1, 2022.

U.S. Steel stated that the agreements are in the best long-term interests of its employees as well as its customers, shareholders and other stakeholders. It will also enable U.S. Steel to implement its long-term business strategy.

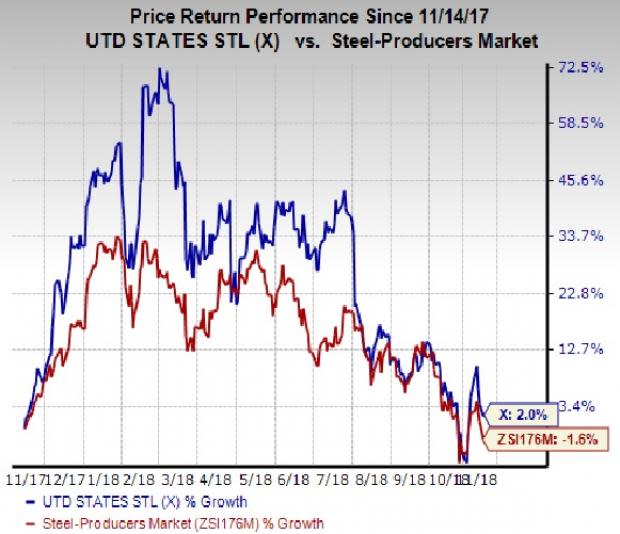

Shares of U.S. Steel have gained around 2% over a year, outperforming the industry’s 1.6% decline.

U.S. Steel saw higher profits in the third quarter of 2018, driven by a significant increase in earnings in its Flat-Rolled unit and higher steel prices. The company is seeing strong market conditions with stable end-user steel consumption. However, the company is witnessing lower customer order rates due to falling spot and index prices. It expects strong steel demand to support favorable market conditions going into 2019.

U.S. Steel expects adjusted EBITDA for the fourth quarter at roughly $575 million. The company now expects adjusted EBITDA for 2018 to be roughly $1.8 billion compared with its earlier view of around $1.85-$1.90 billion.

The company envisions results in the Flat-rolled unit to continue to improve on the back of higher shipments and reduced maintenance and outage costs, partly masked by lower average realized prices.

For the Tubular unit, U.S. Steel sees results to improve mainly due to higher shipments, partly offset by lower average realized prices. However, it expects results in the European segment to decline due to inventory revaluation adjustments associated with volatility in raw material prices.

U.S. Steel currently carries a Zacks Rank #3 (Hold).

United States Steel Corporation Price and Consensus

United States Steel Corporation Price and Consensus | United States Steel Corporation Quote

Stocks to Consider

Better-ranked stocks in the basic materials space include Methanex Corporation MEOH, CF Industries Holdings, Inc. CF and KMG Chemicals, Inc. KMG.

Methanex has expected long-term earnings growth rate of 15% and sports a Zacks Rank #1 (Strong Buy). Its shares have gained 22% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

CF Industries has expected long-term earnings growth rate of 6% and carries a Zacks Rank #1. Its shares have rallied 40% in a year.

KMG Chemicals has expected long-term earnings growth rate of 28.5% and carries a Zacks Rank #2 (Buy). Its shares have shot up 45% in the past year.

3 Medical Stocks to Buy Now

The greatest discovery in this century of biology is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating revenue, and cures for a variety of deadly diseases are in the pipeline.

So are big potential profits for early investors. Zacks has released an updated Special Report that explains this breakthrough and names the best 3 stocks to ride it.

See them today for free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Methanex Corporation (MEOH) : Free Stock Analysis Report

KMG Chemicals, Inc. (KMG) : Free Stock Analysis Report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

United States Steel Corporation (X) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance