Tyson Foods (TSN) Q2 Earnings Lag, View Reflects Coronavirus Woes

Tyson Foods, Inc. TSN posted dismal second-quarter fiscal 2020 results, wherein earnings and sales fell short of the Zacks Consensus Estimate and the bottom line also plunged year over year. Results in the quarter were affected by coronavirus-related concerns. A shift in demand from foodservice to retail, decline in team member attendance, volatile supply chain and temporary plant shutdowns were hurdles. Nonetheless, the company managed to adjust its product mix efficiently.

Q2 in Detail

Adjusted earnings for the reported quarter were 77 cents per share, missing the Zacks Consensus Estimate of $1.21. Additionally, the bottom line declined 36% year over year.

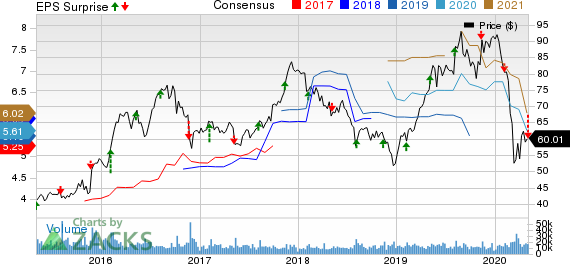

Tyson Foods, Inc. Price, Consensus and EPS Surprise

Tyson Foods, Inc. price-consensus-eps-surprise-chart | Tyson Foods, Inc. Quote

Net sales advanced 4.3% to $10,888 million. However, the top line fell short of the Zacks Consensus Estimate of $11,641 million.

Gross profit for the fiscal second quarter came in at $1,021 million, down 14.3% from the prior-year quarter. Gross margin contracted 200 basis points (bps) to 9.4%.

Tyson Foods' adjusted operating income decreased 23.4% to $501 million. Also, adjusted operating margin for the period was 4.6%, down 150 bps year over year.

Market Edge From Zacks · 5 Stocks to Navigate the Coronavirus Earnings Season

Segment Details

Beef: Sales in the segment dropped 2.4% to $3,979 million. Sales volume rose 2.7% year over year owing to robust demand for beef products. Average sales price remained flat.

Pork: Sales in the segment grew 8% year over year to $1,266 million. Sales volume increased 2% year over year, owing to higher domestic availability of hogs and solid demand for pork products, especially in the consumer products and export sales networks. Average sales price rose due to higher livestock costs as well as stronger export markets.

Chicken: Sales in the segment dipped 0.3% to $3,397 million on account of reduced volumes from the rendering and blending business. Sales volume declined 1.5%. Average sales price in the quarter rose owing to reduced rendering and blending sales, partly offset by weak chicken prices due to tough market conditions.

Prepared Foods: Sales in the segment rose 2.6% to $2,080 million. Prepared Foods’ sales volume remained flat as volume growth in the consumer products business was countered by softness in the foodservice channel and other intersegment sales channel shifts. Average sales price increased on account of favorable product mix and higher raw-material costs.

International/Other: Sales in the segment were $465 million, down from $277 million reported in the prior-year quarter. Sales volume improved remarkably, whereas average sales price tumbled.

Other Financial Updates

The company exited the quarter with cash and cash equivalents of $437 million, long-term debt of $10,978 million and total shareholders’ equity (including noncontrolling interests) of $14,594 million. In the first six months of fiscal 2020, cash provided by operating activities was $1,260 million. Management projects capital expenditure to be approximately $1.2 billion for fiscal 2020.

Guidance

For fiscal 2020, USDA still expects overall domestic protein production (chicken, beef, pork and turkey) to rise 3-4% year over year. A large portion of the upside is likely to be absorbed by export markets. However, the company expects certain disruptions from coronavirus. Management expects food and protein demand to shift among different sales networks and witness short-term hiccups amid the pandemic. Nonetheless, worldwide demand is expected to increase over time.

The company is battling several hurdles related to the pandemic, which are expected to elevate the company’s operating cost burden and weigh on its volumes in the remainder of fiscal 2020. Tyson Foods expects to continue facing a slowdown and temporary idleness at its production facilities due to member shortages. Moreover, though every segment is seeing a demand shift from foodservice to retail, retail volume increases have not been enough to compensate for soft foodservice volumes. Management expects volumes to decline in the second half of fiscal 2020.

While the company is unable to forecast the impacts of COVID-19 on its short and long-term demand, management said that it is well placed in terms of liquidity to run its business and meet obligations. In fiscal 2020, it expects total liquidity to stay above its minimum target of $1 billion.

Segment-Wise Guidance

Moving on, management anticipates industry-fed cattle supplies in the beef unit to rise roughly 2% in fiscal 2020 compared with 1% growth projected earlier. For pork, the company envisions increased industry hog supplies to the tune of nearly 5% year over year compared with the prior view of 4% growth. Also, livestock costs are projected to decline in the remainder of fiscal 2020 with more available export markets.

Additionally, chicken production is now estimated to rise 3-4% in fiscal 2020, per USDA. Earlier, it was anticipated to rise 4%. For the remainder of fiscal 2020, management doesn’t expect pricing to improve. Also, it doesn’t expect elevated consumer products demand to completely make up for the expected declines in foodservice.

The company anticipates disruptions from coronavirus to impact raw material availability in the Prepared Foods segment. Overall raw-material costs are anticipated to fall in the remainder of fiscal 2020 from the same period in fiscal 2019. Management expects higher retail sales to dent foodservice demand in the remaining part of fiscal 2020. Moreover, its international segment is anticipated to be troubled in the back half of the fiscal due to coronavirus-related market hurdles.

This Zacks Rank #4 (Sell) company has seen its shares plunge 22.2% in a year compared with the industry’s decline of 6.2%.

Looking for Promising Food Stocks? Check These

The Hain Celestial Group, Inc. HAIN, with a Zacks Rank #1 (Strong Buy), has a trailing four-quarter positive earnings surprise of around 7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Smucker SJM, with a Zacks Rank #1, has a trailing four-quarter positive earnings surprise of around 2%, on average.

Campbell Soup Company CPB has a long-term earnings growth rate of 7.2% and a Zacks Rank #2 (Buy).

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hain Celestial Group, Inc. (HAIN) : Free Stock Analysis Report

Campbell Soup Company (CPB) : Free Stock Analysis Report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Tyson Foods, Inc. (TSN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance