Two of the biggest Trump trades are losing steam

Stocks are just below record highs.

But trades based on two of the most commonly-cited reasons to be bullish on Donald Trump’s agenda — tax reform and infrastructure spending — are already starting to lose steam.

In a note to clients on Friday, analysts at Goldman Sachs noted that the firm’s baskets of high tax rate stocks and infrastructure beneficiaries have seen their outperformance relative to the S&P 500 fade in recent days.

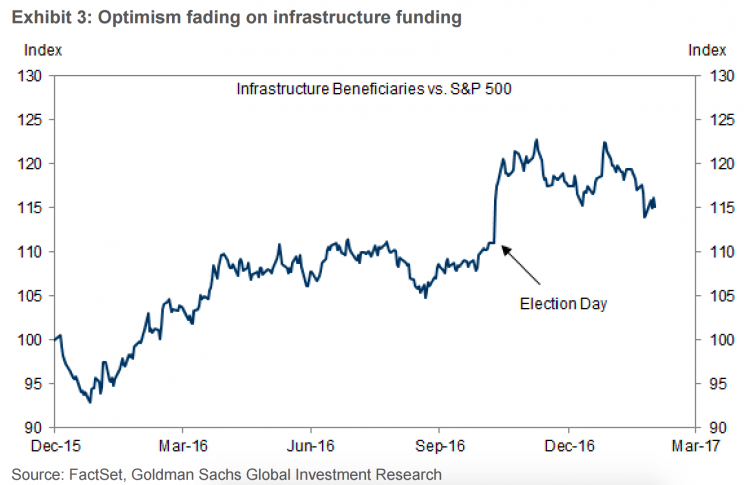

The infrastructure trade is fading

Last week, recall that Trump last week reiterated his pledge to spend $1 trillion on infrastructure. Market expectations, however, have already started to be pared back.

Starting at the beginning of 2016, infrastructure beneficiaries — think things like materials stocks and construction machinery makers — have been bid up as candidates from both the Democratic and Republican parties talked up the need for infrastructure investments during the campaign. Trump’s election caused these stocks to initially spike, but this enthusiasm has since been tempered by the market.

And as we noted back in January, industrial giant Caterpillar (CAT) was early on cautioning that any big infrastructure plans could be slower in being made reality than perhaps some had expected, saying in its earnings release that 2018 would likely be the earliest any effects from these changes would be felt.

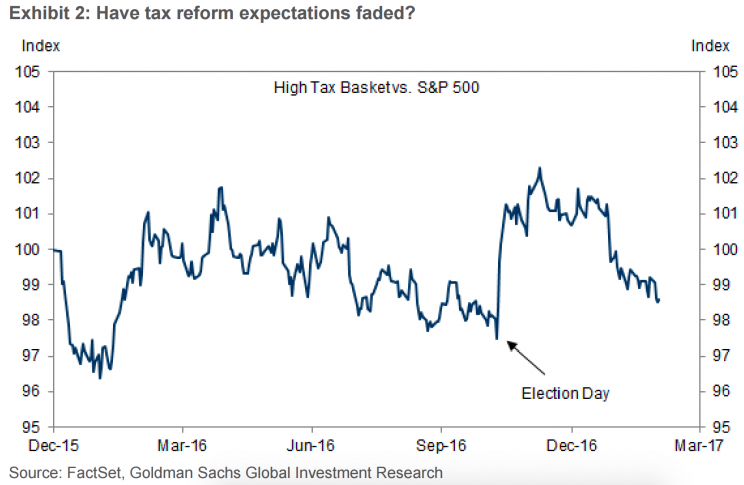

The tax reform trade is fading

Tax reform, which was seen as the biggest and clearest boon to stocks following Trump’s win, has been even more discounted markets in recent weeks.

Recall that shortly after the election, Goldman outlined the simple math on lower taxes for corporate bottom lines. The firm wrote that for every 1% the U.S. legal corporate tax rate is lowered, $1.50 would be added to S&P 500 earnings.

But now that Trump is in office and the haggling with House Republicans has begun, tax-specific issues like a border-adjustment tax — which Trump has called “too complicated” — as well as how tax cuts will be paid for have held up the process on producing a draft of this legislation.

Treasury Secretary Steven Mnuchin recently stated, however, that the administration still plans on having a tax package passed by July 28, ahead of the August recess. Tax reform has also gotten caught up in the administration’s promise to “repeal and replace” Obamacare, with Trump saying late last month a proposal on taxes would only come after Congress found a path forward on healthcare.

Companies in Goldman’s high-tax basket that appear poised to benefit from lower corporate rates include Under Armour (UA), Whole Foods (WFM), CVS (CVS), ConocoPhillips (COP), CME Group (CME), Charles Schwab (SCHW), Discover Financial (DFS), Visa (V), Quest Diagnostics (DGX), Arconic (ARNC), Parchex (PAYX), and Century Link (CTL).

Taking these lowered expectations together with the broad market hitting record highs last week, and we continue to see signs that investors are not pinning all of their hopes on the Trump administration passing its full legislative agenda.

Alternatively, last week’s push to new records following Trump’s speech before a joint session of Congress could be the blow-off top some have been expecting given the enthusiasm with which stocks rallied after the election.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance