Trump's tariffs are a 'wonderful gift' to the Chinese: China Beige Book CEO

Rising debt loads in China have raised alarms about a dramatic slowdown in the domestic economy. But Beijing may be well positioned to withstand the pressure, thanks to the U.S.-China trade war.

Leland Miller, CEO of China Beige Book, says tariffs imposed by President Donald Trump have given Chinese leadership cover to shift the blame for any economic slowdown solely on the United States.

“This is the wonderful gift that Trump has given the Chinese,” Miller said, speaking to Yahoo Finance’s “The Ticker” this week. “They have this opportunity to say, okay, our growth is slowing, but it’s not us. We’re being ganged up on by Trump and the rest of the world.”

‘Beijing has an out’

Miller says he expects China to “slow dramatically over time” because of borrowing costs, which have now topped 300% of GDP, according to the Institute of International Finance. The estimated $34 trillion debt pile has ticked even higher as leaders have tried to steer an economy undergoing its slowest economic expansion since 2019, all but abandoning President Xi Jinping’s promise for financial deleveraging and “quality growth” laid out in 2017.

Miller says Beijing has injected a significant amount of liquidity in the face of that slowdown, to make up for decelerating growth. China’s economy posted GDP growth of 6.4% in the fourth quarter last year and the first quarter of this year, but that declined to 6.2% in the second quarter, a 27-year low.

“I think a decision was made in Beijing in fourth quarter 2018, that they were going to play for the long game, regardless of how the trade war went,” he said. “So, a cushion has gone out under the economy. And that’s why we saw better data first quarter and even the second quarter.”

New data suggests the third quarter could be even worse, Miller said, though he did not disclose those numbers publicly.

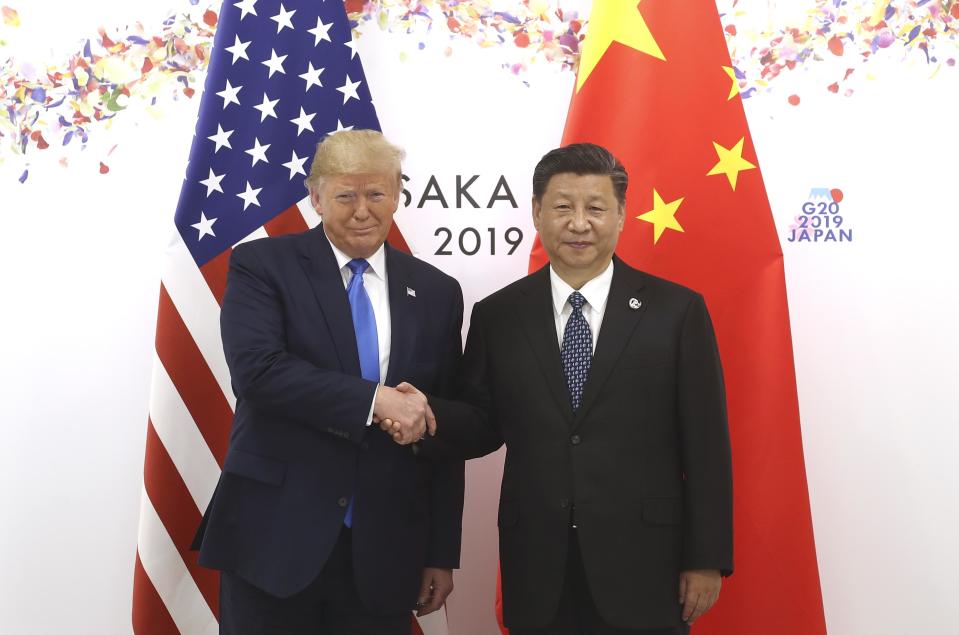

U.S. and Chinese officials have made little progress in trade talks, since Trump and Xi met at the G20 summit in Osaka in June. On Thursday, Washington and Beijing confirmed a plan for high-level talks in October, following deputy-level discussions later this month, in a welcome sign of a diplomatic thaw for the markets. That came after the Trump administration imposed a 15% tariff on roughly $112 billion in Chinese imports on Sept. 1.

Recent research published by the Federal Reserve suggests the trade war has already made a significant dent in global growth, with an estimated $850 billion loss globally through early next year, shaving roughly 1% off of GDP. Its analysis of corporate earnings calls and newspaper articles found trade policy uncertainty “shot up to levels not seen since the 1970s.”

Still, Miller says Beijing may not feel the need to drum up its domestic economy as aggressively as in the past, in part because it sees global tide shifting against the Trump administration.

“Beijing has an out, Xi Jinping has an out, and it’s very possible they’re going to take that out,” he said.

Akiko Fujita is an anchor and reporter for Yahoo Finance. Follow her on Twitter at @AkikoFujita

More from Akiko:

Former U.S. ambassador to China warns Beijing intervention in Hong Kong will provoke Taiwan

'The ultimate insult': How U.S.-listed Chinese companies are gaming American investors'

Really bad business practice': U.S. security experts sound off on Huawei

U.S.-China showdown: Huawei has 'completely taken over' the Mobile World Congress

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance