Transocean (RIG) Stock Hardly Shifts Since Posting Wider Q3 Loss

Share price of Transocean Ltd. RIG has shown no substantial change since third-quarter 2021 earnings announcement on Nov 1.

Despite the company’s ability to minimize its debt-to-capitalization, its shares failed to display an uptrend, primarily due to unpleasant bottom-line and top-line performances.

Behind the Earnings Headlines

Transocean reported an adjusted net loss of 19 cents per share for third-quarter 2021, wider than the Zacks Consensus Estimate of a loss of 16 cents and the year-ago period’s loss of 11 cents. This underperformance reflects lower utilization.

The offshore drilling powerhouse’s total revenues of $626 million fell short of the Zacks Consensus Estimate of $655 million. Also, the top line fell 19% from the year-earlier figure of $773 million.

Segmental Revenue Break-Up

Transocean’s Ultra-deepwater floaters contributed to 68.4% of the total contract drilling revenues while Harsh Environment floaters accounted for the remainder. In third-quarter 2021, revenues from Ultra-deepwater and Harsh Environment floaters totaled $428 million and $198 million, respectively, compared with the corresponding year-ago quarter’s reported figures of $490 million and $283 million.

Revenue efficiency was 98.1%, higher than 98% reported sequentially and higher than the year-ago value of 97%.

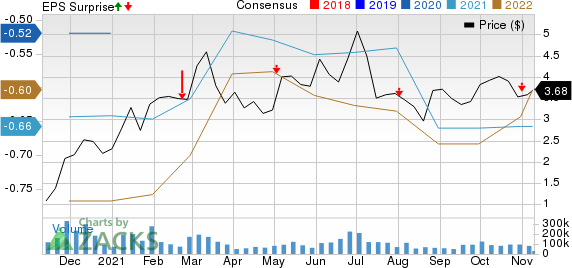

Transocean Ltd. Price, Consensus and EPS Surprise

Transocean Ltd. price-consensus-eps-surprise-chart | Transocean Ltd. Quote

Dayrates and Utilization

Average dayrates in the quarter rose to $367,100 from the year-ago level of $343,500. The company witnessed strong year-over-year average revenues per day from Harsh Environment floaters and Ultra-deepwater floaters. Overall, fleet utilization was 53% in the quarter, down from the prior-year period’s utilization rate of 65%.

Backlog

Transocean’s backlog record of $7.1 billion for October reflects a decline of $1.1 billion from the year-ago figure.

Costs, Capex & Balance Sheet

Operating and maintenance costs decreased to $398 million from $470 million a year ago. The company spent $37 million on capital investment in the third quarter. Cash provided by operating activities totaled $141 million. The company had cash and cash equivalents worth $900 million as of Sep 30, 2021. Long-term debt was $6.77 billion with debt-to-capitalization of 37.6% as of the same date, declining from the sequential quarter’s 38.2%.

Guidance

For the fourth quarter of 2021, this offshore drilling contractor expects adjusted contract drilling revenues of $670 million, indicating a decline from the sequentially reported figure of $683 million. It expects fourth-quarter operations and maintenance expenses of $403 million. Its G&A expenses are expected to be $46 million while capital expenditure including capitalized interest is estimated to be $96 million.

Zacks Rank & Stocks to Consider

Transocean currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the energy space are Denbury Inc. DEN, Diamondback Energy, Inc. FANG and APA Corporation APA, each presently flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Transocean Ltd. (RIG) : Free Stock Analysis Report

APA Corporation (APA) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

Denbury Inc. (DEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance