Transactions of Sentosa Cove bungalows highest since 2013

CBRE’s Steve Tay was the broker for the sale of a bungalow on Lakeshore View at end-July for $15.5 million ($1,807 psf)

Interest has returned to Sentosa Cove this year, as buyers are starting to see value in the top end of the luxury segment, notes Steve Tay, senior vice-president, resale division, CBRE Realty Associates.

Based on caveats lodged, there have been 11 transactions in Sentosa Cove so far this year. “To my knowledge, there were at least five deals this year, in which caveats were not lodged, which brings the tally to 16,” says CBRE’s Tay. He brokered eight bungalow deals, although not all had caveats lodged.

The deals handled by Tay include the sale of a bungalow on Lakeshore View for $15.5 million ($1,807 psf) at end-July, another on Cove Grove for $16.6 million ($1,707 psf) in June, and a house on Lakeshore View that fetched $21.25 million ($1,886 psf) in March, which was an exclusive listing with CBRE. Based on caveats lodged, it was the first bungalow to be sold this year (see Table 2).

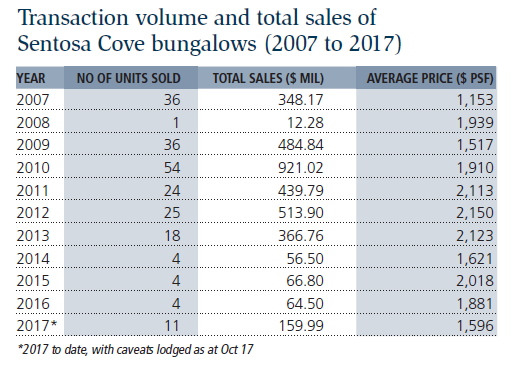

Transactions this year have been the highest since 2013, when 18 bungalows were sold (based on caveats lodged), despite a hefty additional buyer’s stamp duty (ABSD) of 15% that kicked in in January that year. From 2014 to 2016, sales were lacklustre, with only four bungalows changing hands for each of those years (see Table 1).

Many attribute the lacklustre sales to the cumulative effects of the eight rounds of property cooling measures that culminated in the total debt servicing ratio (TDSR) framework, which came into effect at end-June 2013. The Singapore economy had also slowed, owing to the global economic uncertainty, plunging oil prices and volatile stock markets. With the local economy set to recover, the property market has become more buoyant. This is also having a positive impact on Sentosa Cove.

Profile of buyers

What is different this time around is the profile of the buyers. “It’s now a fair mix of local buyers looking at both investment and enjoyment of the lifestyle at the Cove; and new citizens and PRs [permanent residents] — mainly from China, India or the other Southeast Asian countries — who prefer the lifestyle at the Cove to that on the mainland,” says CBRE’s Tay. “Foreigners made up about a quarter of the buyers this year.”

With more homeowners using their Sentosa Cove houses as their primary residence, there are fewer empty houses around. In the past, many of the homes purchased by Singaporeans were used only as weekend homes, while foreign investors used them as second or vacation homes. “Now, many of the homes are lived in, and people are truly enjoying the Sentosa Cove lifestyle and environment,” notes Tay.

Prices 30% to 40% below peak

What is also drawing buyers back is that prices of houses in Sentosa Cove today are 30% to 40% below the record prices achieved in 2010 and 2012, says Tay. In terms of psf price, the highest achieved was for a seafront bungalow on Ocean Drive that fetched $28.2 million ($2,989 psf) in October 2010. In terms of absolute prices, the highest achieved was for a house on Cove Drive that fetched $39 million ($2,448 psf) in February 2012; another property on Paradise Island was sold for $36 million ($2,403 psf) in May 2010.

At the peak of the market, in 2010, average prices of waterway homes were $2,000 psf, while those with premium views of the golf course, lake and sea on Lakeshore View fetched closer to $3,000 psf, says CBRE’s Tay.

Table 1

Source: URA Realis

Table 2

Source: URA Realis, Downloaded as at Oct 17, 2017

Also read: Family home in Sentosa Cove for $17 mil

This article, written by Cecilia Chow, appeared in EdgeProp Pullout, Issue 802 (Oct 23, 2017).

Related Articles From EdgeProp.sg

Two Goodwood Grand strata bungalows sold for $6.95 mil each

Family home in Sentosa Cove for $17 mil

5 Affordable condos for expats to rent in popular neighbourhoods

Bungalow price setters

Yahoo Finance

Yahoo Finance