Trading Currencies: Into the Final Straight

With the first US presidential debate on the 29th, we have officially entered the final phase of the 2020 presidential race, a race that is getting tighter than we realise.

Although most polls suggest a Biden win, how the final results will fall is still a mystery, and FX trading is reflecting this risk.

DXY’s Recent Uptrend – Could It Be A Telling of USD’s Future Path?

Since entering the final 60 days of the campaign, the US dollar basket has begun to pop and is trading in a strong upward channel. It has added as much as 300 points since the 60-day mark as seen in this chart. Check USD price today.

Keep an Eye on the Following Issues If You’re Trading DXY and USD

There are five main issues of the campaign that are beginning to take shape, and these issues, when discussed by the candidates, are moving DXY.

These include:

The Supreme Court – the reactions to which can been seen from the 21st of September after the passing of Ruth Baber Grinberg.

COVID-19 handling – this is a big issue for Trump’s re-election, over 60% of American are worried about the handling of the disease.

Race and violence in the cities – Handling of this issue varies greatly between the two candidates and will spark fierce debate.

The Economy and its recovery – polls suggest Americans see Trump as a better candidate here. If Biden wins, the initial reactions in FX and equities may be a slight negative from an economic reasoning.

Validity of the Vote – this is building as one of the biggest risks in the market. The President continues to seed this idea to his supporter base – a contested election would put volatility front and centre and would ramp up risk-off trading.

How Is the Market Forecasting the USD Trend?

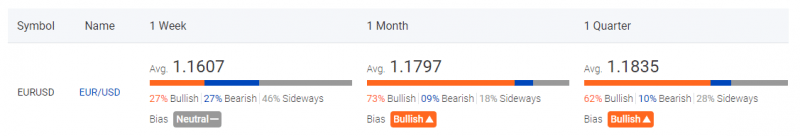

If we try to take a look at the market forecast of EUR/USD, we will notice that experts are mostly predicting a bullish trend for the pair in the long run. Given the high uncertainty surrounding the US politics as well as its economy, it’s obvious that the market is unsure how the USD trend may go. Nonetheless, as the election draws closer, the debates would offer fresh clues and ideas for USD traders.

If USD’s Broad Weakness Continues, How Can Traders Make the Most of It?

With the election happening in just a month and with two more debates to go, it’s very likely that USD trend will go on a roller-coaster ride with unpredictable turns and loops. Yet, the good thing about trading forex or even index derivatives is that traders have the freedom to decide to go long or short based on the market’s trend. With derivative market’s characteristic that allows traders to buy/sell with leverage and relatively low deposit, traders can grasp more opportunities during this volatile period.

Mark Your Calendar! Most Important Events to Trade on for USD Traders:

Oct 7 (Wed) 7:00-8:30 pm MDT – Vice presidential debate

Oct 15 (Thurs) 9:00-10:30pm EDT – Second presidential debate

Oct 22 (Thurs) 8:00-9:30pm CDT – Third presidential debate

In the upcoming debates, the 5 issues mentioned in the above will be discussed and dissected by the candidates and it will surely drive FX direction and momentum. Traders should stay alert on the headlines of the debates as well as the overall US politics.

This article is prepared by Lucia from Mitrade and is for reference only. We do not represent that the material provided here is accurate, current or complete. The article content neither takes into account your personal investment objects nor your financial situation, and therefore it should not be relied upon as such. You should seek for your own advice.

This article was originally posted on FX Empire

More From FXEMPIRE:

EUR/USD Daily Forecast – Test Of Resistance Area Between 20 EMA and 50 EMA

Crude Oil Price Update – Weakens Under $38.99, Strengthens Over $39.57

Ugly Presidential Debate Creates More Uncertainty while Generating ‘Risk-Off’ Response

Pfizer to Invest $200 Million in China-based CStone Pharmaceuticals; Target Price $42

Yahoo Finance

Yahoo Finance