US Federal Reserve cuts interest rates by a quarter point: as it happened

US Federal Reserve cuts benchmark interest rate for the second time this year

The committee lowered the policy interest rate by 25 basis points to a target range of 1.75pc to 2pc

Three out of 10 officials vote against rate cut decision

Trump says US will ‘substantially increase’ sanctions on Iran after Saudi oil attack

In UK, inflation cools while house prices shrink across four regions including London

Fed wrap: that's all folks!

Well that was a busy evening - thanks for following along!

The Fed quarter point cut was widely expected - as was Donald Trump's scathing reaction.

Jerome Powell responded to the criticism saying that he was not going to change his practice of not responding to comments from elected officials.

Fed Chair Powell on Trump Criticism:

- I continue to believe that the independence of the Federal Reserve has served the public over time— DailyFX Team Live (@DailyFXTeam) September 18, 2019

US markets extended their losses on the back of the news but later recovered some ground. Let's see what tomorrow has in store...

Join Louis Ashworth bright and early tomorrow morning!

What else Powell has said...

Here are a few interesting lines from Mr Powell this evening...

The Fed would use all tools ‘if it came to it’

We don’t see a recession, we’re not expecting a recession

When we think we've done enough, we will stop lowering rates

We feel we’re doing the best job we can to serve the American people

FED'S POWELL SAYS FED WILL STOP CUTTING INTEREST RATES "WHEN WE THINK WE'VE DONE ENOUGH"

— Redbox Global (@RedboxWire) September 18, 2019

"Fed cut doesn't quite cut it"

The Fed needs to do more, says Tim Foster of Fidelity International.

“After raising rates nine times in the past four years, the Fed kicked off the wave of global central bank easing with their dramatic dovish pivot in January. But simple rate cuts now rather old-fashioned compared to the ECB’s comprehensive and complicated package of easing measures last week.

“This simplicity could change soon, though, as the Fed’s toolkit for monetary policy proves increasingly ineffective against upward pressure on money market rates.

"The balance sheet unwind (‘quantitative tightening’) has finished, but the rapid pace of US government borrowing (in the short term), and growth in cash in circulation means that reserve balances will continue to fall.

"This makes US money market rates harder to control: repo rates rose sharply earlier this week and the effective Fed Funds rate rose above the target band yesterday, while the New York Fed started special open market operations to try to bring rates down.

Powell says "trade policy isn’t our responsibility"

In response to a question on the US-China trade war, Powell says: "Trade policy is weighing on the outlook."

He adds that the Federal Reserve can’t give businesses a settled road map for global trade but that it does have tools to help companies which allows it to support job creation and give consumers the confidence to buy items such as durable goods.

Fed on repo rate...

Someone has asked: What’s caused the sudden jump in the repo rate this week, and are you worried?

Mr Powell that he is no worries and that the jump in the repo rate was caused by tax bills and the cost of settling bond purchases.

#Fed's Powell on Repo blowout: Market response to funding issues was surprising. Fed well aware of potential funding pressures. We will revisit question of when to grow balance sheet. Repo Overnight Rate remains > Fed's upper bound. pic.twitter.com/be2KARmNdc

— Holger Zschaepitz (@Schuldensuehner) September 18, 2019

And as we said in our preview- Fed saying it paid no attention to repo shenanigans re this monetary policy decision

— Neil Wilson (@marketsneil) September 18, 2019

Jerome Powell is opening up the floor for questions...

In his statement Mr Powell brushed off concerns about a cash crunch in US financial markets.

He said the need to pay quarterly tax payments was a factor, which prompted the New York Federal Reserve Bank twice this week to inject liquidity into the short-term funding market.

He said: "While these issues are important for market functioning and market participants, they have no implications for the economy or the stance of monetary policy".

US stocks extend losses after Fed decision

The Dow Jones industrial average is down 0.7pc at 26,919.96 while the S&P 500 is 0.74pc lower to 2,983.55.

The Nasdaq is 1.14pc down to 8,092.84.

Stocks lower as only 7 of 17 Fed officials project another rate cut in 2019. Very different views on what the US economy needs inside the FOMC... pic.twitter.com/tY3jJKKj9r

— Caroline Hyde (@CarolineHydeTV) September 18, 2019

The press conference is now live...

$USDJPY#FOMC | Fed’s Powell: Cut Rates To Keep Economy Strong, Provide Insurance Against Risk

- Trade Tensions Have ‘Waxed And Waned’

- Job Market Remains Strong, Seen Solid Job Gains In Recent Months

- Cites Slower Growth Abroad, Trade Tensions For Weak Investment— LiveSquawk (@LiveSquawk) September 18, 2019

$USDJPY#FOMC | Fed’s Powell: Infl. Pressures Clearly ‘Remain Muted’

- Inflation Still Expected To Rise Towards 2% Target

- Mindful Below Target Infl. Could Pull Infl. Expectations Lower— LiveSquawk (@LiveSquawk) September 18, 2019

Additional cuts has the potential to do more harm than good - do you agree?

"This action has the potential to do more harm than good," says Dr Kerstin Braun of Stenn Group.

"With open global markets, capital moves in and out quickly in massive volumes. These volumes negate the impact of short-term interest rate changes on the real economy.

"Real capital growth and real economic activity are driven by long-term interest rates, which are functions of expected future inflation and investor confidence. That’s why a cut in short-term rates is unlikely to fuel business investment and manufacturing.

"Uncertainty around the global economy and the impact of the trade war has killed any appetite to invest. We’ve had relatively low rates for some time already, and they’ve spurred stock buybacks rather than huge corporate investment."

Donald Trump isn't happy

The President is not at all satisfied. He says the Federal Reserve has "no “guts,” no sense, no vision!"

Jay Powell and the Federal Reserve Fail Again. No “guts,” no sense, no vision! A terrible communicator!

— Donald J. Trump (@realDonaldTrump) September 18, 2019

So what exactly did the Fed say...

Here's a short snippet from the Fed statement...

"Information received since the Federal Open Market Committee met in July indicates that the labor market remains strong and that economic activity has been rising at a moderate rate.

"Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although household spending has been rising at a strong pace, business fixed investment and exports have weakened.

"On a 12-month basis, overall inflation and inflation for items other than food and energy are running below 2 percent.

"Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed."

Economic projections and Dot Plot

$USDJPY | #FOMC Economic Projections & Dot Plot https://t.co/LzqY3A9J6Ppic.twitter.com/8yDm1bb1Uf

— LiveSquawk (@LiveSquawk) September 18, 2019

Reaction on Fed cut

Let's get some reaction on the Fed decision...

Richard Carter of Quilter Cheviot says:

“The decision by the Fed to cut interest rates by 0.25pc was largely as expected. Donald Trump would like them to have done more judging by his regular rants on Twitter but the US economy remains in fairly good shape and there is no sign of an imminent recession so a cautious approach makes sense.

"We are likely to see more gradual interest rate cuts over the course of the year though as the US China trade war continues to hinder the global economy.”

While Neil Wilson of Markets.com tweets:

Hawkish cut ..?

— Neil Wilson (@marketsneil) September 18, 2019

More on the Fed...

The decision lowers the Fed funds rate to 1.75pc-2pc.

It is the second cut in less than two months.

The US Federal Reserve was divided, with three of the 10 officials voting against rate cut decision

One official wanted a deeper cut and the other two wanted to leave rate unchanged

US Fed points to 'weakened' business investment, exports

You can read the full statement here

Fed cuts rates

The US Federal Reserve has cut key interest rates by a quarter point as was widely expected, citing "uncertainties".

$USDJPY | #FOMC Cuts Benchmark Rate By 25Bps; Target Range Stands At 1.75% - 2.00%

- Cuts Interest Rate On Excess Reserves To 1.80% From 2.10%— LiveSquawk (@LiveSquawk) September 18, 2019

Oil prices still falling

Oil prices have continued to tumble today after last weekend's attacks on oil facilities in Saudi Arabia. Oil spiked on Monday in reaction to the news but tumbled yesterday.

Brent Crude is down 0.97pc to $63.52 per barrel.

Tesco boss Dave Lewis says no to chlorinated chicken

The boss of Tesco has ruled out the sale of chlorine-washed chicken if the UK strikes new trade deals with the US after Brexit.

Dave Lewis, who has been striving to turn the grocer's fortunes around since joining in 2014, said: "There's no US sourcing of chicken on my mind. Whatever the trade deals are ... what we won't do is give up our standards as we look at those opportunities. The feedback that comes back from the UK customer is 'I prefer not to have it'. By and large, UK customers reject that idea."

Read Laura Onita's full report here

Airbus informs Germany about potential wrongdoings

Airbus has informed German authorities about potential wrongdoings by several employees with respect to certain customer documents relating to two future German procurement projects in the program line Communications, Intelligence and Security, according to an emailed statement.

The company has also forecast that 39,210 new passenger and freighter aircraft will be needed over the next 20 years, up from the previous prediction of 37,400.

The pan-European aircraft business - which makes the wings for its airliners at Broughton in Wales - says about 25,000 will be needed for growth in the air travel industry, down from the 26,500 it forecast last year, with the remaining 14,210 being replacements for older aircraft.

Just over an hour to go...

We have just over an hour until we hear from Jerome Powell.

Stay with us until then to keep up-to-date with what else is happening in the world of business.

US stocks are trading lower at the moment with the Dow Jones 0.31pc down to 27,023.596 and the S&P 50 0.32pc behind at 2,9963.04.

More on Ineos...

Stuart Apperley of Lloyds Bank Commercial Banking, said Ineos’ move into automotive "is a welcome tonic for the sector".

He added: “While the timing may be seen as bold, Ineos’ presence should provide a major boost for the economy in South Wales. With Aston Martin now operating nearby in St Athan, there is the potential to create a high-value manufacturing cluster in the area, with all the positive knock-on benefits that would bring for the jobs market and development of the supply chain.”

Ineos dismisses Brexit fears by revving up plans to make Land Rover rival in Wales

My colleague Alan Tovey writes:

Sir Jim Ratcliffe’s dream of building a “spiritual successor” to the Land Rover Defender is moving closer to reality with confirmation that the vehicle will be built in Wales.

The billionaire founder of chemicals giant Ineos confirmed £600m of investment, including an entirely new factory in Bridgend to produce a “rugged, utilitarian 4x4” called the Grenadier.

The new plant is expected to employ 200 staff when production starts in 2021, rising to 500 as output ramps up to an annual target of 25,000 vehicles in the medium term.

MPs demand clarity on Mark Carney's successor at Bank of England

Chancellor Sajid Javid has come under pressure from MPs to say when he will appoint a new Bank of England Governor amid fears of a delay in filling the vital role.

The call from the Treasury select committee follows reports that Mark Carney’s successor may not be named until after a general election, and that the Canadian could be asked to stay on if Brexit is delayed.

Read Russell Lynch's full report here

Trump evokes California's stricter emission rules

President Trump has taken to Twitter again...

The Trump Administration is revoking California’s Federal Waiver on emissions in order to produce far less expensive cars for the consumer, while at the same time making the cars substantially SAFER. This will lead to more production because of this pricing and safety......

— Donald J. Trump (@realDonaldTrump) September 18, 2019

....far safer and much less expensive. Many more cars will be produced under the new and uniform standard, meaning significantly more JOBS, JOBS, JOBS! Automakers should seize this opportunity because without this alternative to California, you will be out of business.

— Donald J. Trump (@realDonaldTrump) September 18, 2019

European stocks mixed on close

London's benchmark FTSE 100 closed 0.09pc lower at 7,314.05 while the more domestically-focused FTSE 250 closed 0.07pc higher at 20,054.43.

Frankfurt and Paris stocks closed marginally higher but Wall Street is currently in the red ahead of tonight's guidance from Federal Reserve chief Jerome Powell.

European Closing Prices:#FTSE 7314.05 -0.09%#DAX 12389.62 +0.14%#CAC 5620.65 +0.09%#MIB 21947.7 +0.67%#IBEX 9031.7 +0.31%#STOXX 3528.04 +0.19%

— IGSquawk (@IGSquawk) September 18, 2019

Good afternoon!

Hi everyone. Thanks for staying with us today, I'll be taking you into the evening as we head ever closer to the Fed decision.

Richard Flax, chief investment officer at Moneyfarm, says:

“In the bond market, a steepening yield curve usually means that future growth is expected to be stronger than today. On the equity side, you could argue that when growth is scarce, investors are prepared to pay more for faster growing businesses.

"That leaves value stocks unloved and ignored. But, if growth is stronger and the rising tide lifts all boats, then maybe investors will look for unloved, cheap stocks that will benefit the most from a broad acceleration.

"So maybe, just maybe, all the doom and gloom about the US economy is a bit overplayed. Probably not overplayed enough to prevent the Fed from cutting rates this week, but enough to keep bond yields higher than they have been.”

Handover

With just under three hours to go until the Federal Reserve finishes its meeting and make an announcement on rates, time for me to hand over the blog.

In case you have somehow avoided my attempts to plug this piece, here’s five things to watch out for from the decision.

LaToya Hardingwill be taking over, and bringing you all the news and reaction as it happens this evening.

I’ll be back tomorrow morning, when we will have Bank of England excitement and some potential Brexit news — depending on how things are looking at the Supreme Courts. See you then! — Louis

Analyst: Trump Iran tariff threat ‘unsurprising’

Reacting to Donald Trump’s decision to order further sanctions against Iran, the Economist Intelligence Unit’s Cailin Birch said the President’s decision was “unsurprising”, for three reasons:

She concluded:

For that reason, further sanctions on Iran's economy are actually the most effective, most damaging response that the US could take — and it helps Mr Trump to achieve his goal of keeping the US out of a complex military conflict in the Middle East.

Mr Trump has a proven track record of imposing tough sanctions prior to negotiations (on foreign policy, trade, nuclear disarmament), in order to boost his leverage. The next round of US sanctions, therefore, do not rule out the possibility that Mr Trump will seek to open talks with Iran in the coming months. However, there is a serious risk that Iran will now refuse this invitation, so as not to begin talks in a position of weakness.

Things are still ticking along in the Supreme Court...

...where the lawyers are possibly getting overexcited (Aidan O’Neill is speaking for those challenging the prorogation of Parliament):

"We've got the Mother of Parliaments being shut down by the Father of Lies," Aidan O'Neill tells the Supreme Court

— Matthew Holehouse (@mattholehouse) September 18, 2019

Follow along here: Brexit latest news: Boris Johnson cannot be trusted not to use ‘dirty tricks’, Supreme Court hears

TfL: Elizabeth Line still on track for launch by early 2021

In a filing this afternoon, Transport for London has confirmed the Elizabeth Line (also known as Crossrail) is still on track to be opened on time, and within the same funding window. It said:

Crossrail Limited today confirmed to the TfL Board that it remains on track to open the Elizabeth line within the October 2020 to March 2021 window previously identified, and that no additional funding is needed at this time.

It added that Crossrail’s costs forecasts now contain “additional risk contingency provisions”, adding:

No additional funding has been requested and through appropriate cost control and risk mitigation strategies, delivery can be achieved within the Financing Package.

Quarter of shareholders rebel against Games Workshop chairman

Over a quarter of investors voted against the re-appointment of Games Workshop chairman Nick Donaldson during its annual general meeting this morning.

The Board notes the result of Resolution 4 (the re-appointment of Nick Donaldson). From our ongoing communications with investors and proxy voting agencies, we understand that the concerns are largely in relation to Mr Donaldson being overboarded in terms of the calls on his time.

The Board will consult with those shareholders who did not vote in favour to understand their views with respect to Mr Donaldson’s multiple board commitments. The Board is confident that Mr Donaldson discharges effectively his role as Chairman, notwithstanding his other board commitments.

Mr Donaldson also holds roles at Fulham Shore, which owns Franco Manca and The Real Greek, and Domino’s Pizza Poland.

The hobby company is one of the biggest risers on the FTSe 250 today, up more than 3pc.

Saudi Arabia says it has ‘material evidence’ that Iran was behind oil attack

Over in Saudi Arabia, the Gulf Kingdom’s defense ministry is displays drones and missiles it says were used in the attacks on Saudi Aramco facilities on Saturday. Saudi Arabia says the weaponry, which has been labelled as Iranian, is “material evidence” Iran was behind the attack, responsibility for which has been claimed by Houthi rebels in Yemen.

Reuters: London Metal Exchange to delay ban on tainted metal

An exclusive tale, just over the wires from Reuters. They report:

The London Metal Exchange (LME) will postpone plans to ban metal tainted by human rights abuses until 2025, giving producers three more years to comply with guidelines and the exchange time to rethink its approach, industry sources said.

Under the initial plan announced in April, the exchange had set 2022 as the deadline to bar metal from the LME’s lists of approved brands whose extraction involved abuses such as child labour or which was tainted by corruption.

The initiative to ensure responsible sourcing followed an outcry about cobalt mined by children in Africa.

Two industry sources directly involved with the process said the deadline had been pushed back to 2025 in part because some major producers would not go along with the LME's original plan.

You can read the full report here: London Metal Exchange to delay ban on tainted metal until 2025 — sources

Fedex shares stagger after it cuts profit outlook

Shares in delivery giant FedEx have dropped sharply since US markets opened, after the company slashed its forecasts — blaming a slowdown in the global economy.

In a press conference to discuss earnings late on Tuesday, chief executive Fred Smith said:

The global economy continues to soften and we are taking steps to cut capacity

Shares are down nearly 13pc currently.

Wall Street has opened downbeat more broadly:

Sports Direct writes to business department as auditor appointment deadline passes

With a week passed (has it only been that long?!) since Sports Direct’s annual general meeting, the trouble-prone retailer still hasn’t appointed an auditor to replace Grant Thornton.

Although that strictly means that the government should now appoint an accountancy firm to do the job, it looks like Mike Ashley’s firm is going to play for time. It said in a statement:

Sports Direct is currently in a tender process for a new auditor, as noted at the Annual General Meeting on 11 September 2019. The company will announce the appointment in due course, following the successful conclusion of that process.

Any formal procedures, particularly in relation to the Companies Act, are being adhered to and Sports Direct can confirm it has written to the Department of BEIS under the terms of the Act.

Tweet: British Airways pilots call off strike next week

Pilots’ union BALPA tweets...

“Someone has to take the initiative to sort out this dispute and with no sign of that from BA the pilots have decided to take the responsible course." https://t.co/1bhWunO7H9

— BALPA (@BALPApilots) September 18, 2019

In its statement, general secretary Brian Strutton said:

Someone has to take the initiative to sort out this dispute and with no sign of that from BA the pilots have decided to take the responsible course. In a genuine attempt at establishing a time out for common sense to prevail, we have lifted the threat of the strike on the 27th September.

BA passengers rightly expect BA and its pilots to resolve their issues without disruption and now is the time for cool heads and pragmatism to be brought to bear. I hope BA and its owner IAG show as much responsibility as the pilots.

Full report: Kingfisher’s new boss ‘could split company apart’

My colleague Laura Onita has a full report on Kingfisher following its first-half results (see 8:32am update). She writes:

The new boss of B&Q’s owner could break up the company, its chairman said, as the retailer posted a slump in profits on Wednesday.

“Thierry [Garnier] arrives with absolutely no handcuffs, we’ve asked him to come in and use his knowledge and experience to look at everything. He has complete freedom to decide what he brings to the board. I’m ruling nothing in or out at this point,” said Kingfisher chairman Andy Cosslett when was asked if a break-up of the business might be on the cards.

You can read more here: New Kingfisher boss could break up the business, chairman says

Bloomberg: Repo rate spike ‘doesn’t mean another global funding crisis’

If you’re struggling with the implications of the US overnight repo rate spike, Bloomberg has put up a good analysis piece (which can be read via Yahoo here). Author Liz Capo McCormick writes:

Fed interventions in the repo market, like the one deployed Tuesday and planned for Wednesday, were commonplace for decades before the crisis. Then they stopped when the central bank changed how it enacted policy by expanding its balance sheet and using a target rate band.

The tumult seen Monday and Tuesday doesn’t mean another global funding crisis, even though trouble getting funds through repo a decade ago doomed Lehman Brothers and almost snuffed out the global financial system.

But, many experts say, these wild few days show that there’s not enough reserves -- or excess money that banks park at the Fed — in the banking system.

If the damage done is extreme enough, the US Federal Reserve might have to undertake some unexpected quantitative easing to to grow its balance sheet, or purchase debt in order to create new reserves.

The Fed funds rate, another measure of borrowing costs, also spiked above the target range about forty minutes ago — suggesting the central bank may be losing its grip on some crucial rates.

WSJ: Huawei banned from global cybersecurity forum

The Wall Street Journal is reporting that Chinese tech giant Huawei has been banned from the Forum of Incident Response and Security Teams, a major cybersecurity trade event.

The Journal reports:

The step effectively freezes Huawei out of discussions among members of the group over matters such as software glitches. That could slow the company’s ability to patch or fix holes in its own systems. Huawei will also no longer have access to sensitive discussions within the group’s so-called Special Interest Groups.

The White House has labelled Huawei a threat to national security, saying the phone and telecoms company could be passing sensitive data to the Chinese government.

On the topic on national security, Donald Trump has another announcement:

I am pleased to announce that I will name Robert C. O’Brien, currently serving as the very successful Special Presidential Envoy for Hostage Affairs at the State Department, as our new National Security Advisor. I have worked long & hard with Robert. He will do a great job!

— Donald J. Trump (@realDonaldTrump) September 18, 2019

Cobham sale cleared by US consumer watchdog

The sale of Cobham to Advent, which has sparked a UK probe, has avoiding a second blow from the US consumer regulator. In a short note on its website, the Federal Trade Commission said permission from the deal has been “granted”.

Here’s how things stand in the UK: Ministers probe Cobham’s £4bn takeover by Advent on national security fears

Iran sanctions: a quick primer

As a reminder, the current US sanctions on Iran target the country’s energy, shipping and shipbuilding, and financial sectors.

They were re-introduced in November last year, following the statutory wind-down period following Donald Trump’s announcement that the US would pull out of the Joint Comprehensive Plan of Action — more commonly known as the Iran nuclear deal.

Over 700 individuals, entities, aircraft, and vessels were sanctioned immediately, with further action carried out under the auspices of the sanction regime since. The US Treasury says:

The United States is engaged in a campaign of maximum financial pressure on the Iranian regime and intends to enforce aggressively these sanctions that have come back into effect.

#OOTT slides after Trump tweet on sanctions pic.twitter.com/R5gxKsKdch

— Neil Wilson (@marketsneil) September 18, 2019

Trump: Sanctions on Iran will be raised

Donald Trump has announced (via Twitter, where else?) that economic sanctions on Iran will be increased, without giving further details.

I have just instructed the Secretary of the Treasury to substantially increase Sanctions on the country of Iran!

— Donald J. Trump (@realDonaldTrump) September 18, 2019

The reaction on energy markets seems to be muted so far, but let’s see what happens...

NY Fed injects $75bn into money markets

The New York Federal Reserve has repeated its first-time-in-a-decade intervention in US money markets as it tries to keep the US repo rate under control. AFP reports:

The New York Federal Reserve Bank intervened in US financial markets Wednesday for a second day, injecting $75bn into money markets to keep interest rates in line with the central bank’s target range, the bank said in a statement.

Unlike the so-called repo operation on Tuesday, when only $53bn of the offered amount was used, on Wednesday the New York Fed received $80bn in requests for the $75bn offered.

The repo rate currently stands as around 2.4pc — still higher than targets.

US housing starts and building permits both beat expectations

Some more economic data from across the Atlantic, with just over five hours until Fed time: housing starts and building permits have both beaten expectations, a potentially healthy sign for the country’s construction sector.

Decent housing data from the US.

US building permits (August): 1.41 million vs 1.3 million expected, prior 1.31 million

US housing starts (August): 1.36 million vs 1.25 million expected, prior 1.21 million (revised from 1.19 million)— David Madden (@dmadden_CMC) September 18, 2019

Lloyd’s of London rides investments to get back to black

Storied insurance market Lloyd’s of London bounced back to a profit in the first half of the year, as its investments paid off and it avoided the natural disaster damage that had marked 2017 and 2018. My colleague Harriet Russell reports:

The 330-year old insurance market reported interim pre-tax profits of £2.3bn, after enjoying decent returns from equity investments and from fixed interest assets in the wake of falling US and UK bond yields.

Last year Lloyd’s told its members to cut back the worst performing 10pc of their businesses in a drive to improve overall performance.

Lloyds chairman Bruce Carnegie-Brown said the market still had “a job to do” to improve underwriting returns after contribution to profits from this segment fell from £500m to £100m.

You can read her full report here: Lloyd’s of London market bounces back into the black

Gold hovers near $1,500 ahead of Fed decision

The price of gold is just barely above $1,500 an ounce — the psychologically-significant figure it beat last month amid trade-war worries. The precious metal tends to strengthen amid uncertainty, as it is seen as a safe-haven asset for investors to hold. That means it could move either way later today, based on how the Federal Reserve acts.

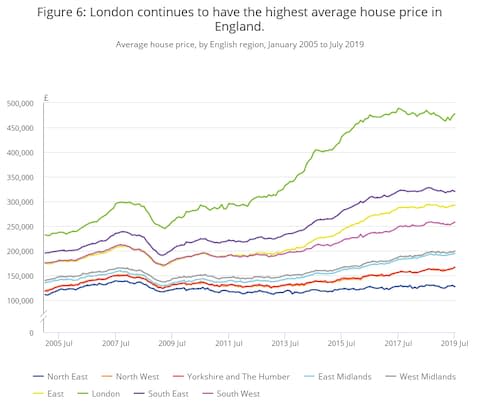

Full report: South East drags house price growth to seven-year low

Here’s Economics Editor Russell Lynch with the full details on this morning’s house price figures:

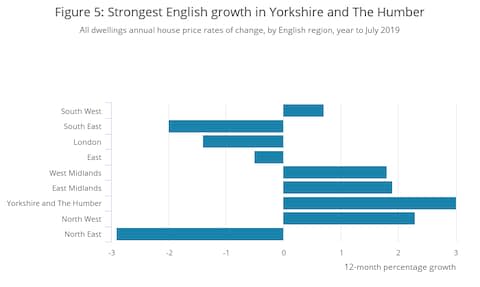

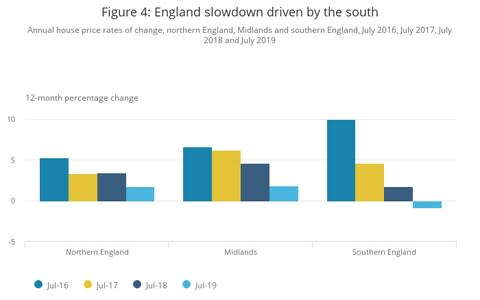

Average UK house prices rose just 0.7pc in the year to July – the weakest performance since September 2012 – driven largely by flagging markets in the more expensive South East and London, according to Land Registry data. The Registry said the southern market had witnessed a “sustained slowdown”.

The average UK home now costs £233,000 – £2,000 more than in July 2018 – but the modest overall gain disguises huge variances within regional markets.

The figures showed four areas – the North East, South East, London and eastern England – where prices are falling outright. Over July alone, prices fell 0.3pc across the country.

You can read his full report here: Struggling South East drags house price growth to lowest since 2012

Ben Marlow: Sirius Minerals’ Yorkshire mine plans are finished

With miner Sirius Minerals in the pits once more (see 11:38am update), investors and analysts are struggling to see any chance to the company finding the light again. Chief city commentator Ben Marlow writes:

It is a great shame to see an ambitious project like this derailed. Sirius planned to dig two 5,000-foot mine shafts and build a 23-mile tunnel to transport the potash to Teesside, where it would be shipped to countries all over the world.

It would have been one of the biggest engineering projects being undertaken anywhere in Britain, creating 4,000 jobs, in a region where unemployment is among the worst in the country...

...Surely this is the sort of project that Brexit Britain is crying out for?

His conclusion, however, is that Sirius can’t go forward from here, saying the company “may have vanished down the black hole for good

You can read his full thoughts here: Sirius Minerals’ dreams to turn North Yorkshire into a global mining hub are dead and buried

Eddie Stobart confirms it has received takeover offer

In a filing this morning, beleaguered haulage firm Eddie Stobart told the City it has recieved a “highly preliminary expression of interest” from a group controlled by Andrew Tinkler.

The offer, made through the vehicle TVFC (3) Limited, follows news that investor DBAY is also considering making a bid for the company, shares in which are suspended following an accounting issue.

Eddie Stobart said:

The company emphasis that there can be no certainty either that an offer will be made nor as to the terms of any offer, if made. A further announcement will be made when appropriate.

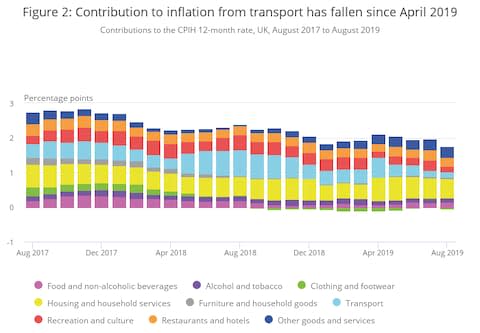

Full report: Families given a hand by lowest inflation since 2016

Deputy economics editor Tim Wallace has a full report on this morning’s inflation figures. He writes:

Cheaper clothes, toys and petrol helped pull inflation down to 1.7pc in August, its weakest annual pace since December 2016.

“Sharply lower inflation is great news for the UK economy. Along with soaring earnings, low inflation boosts consumer spending power just when the economy needs it,” said Ian Stewart, chief economist at Deloitte.

Clothes prices are down 0.9pc year on year as retailers keep on discounting despite the launch of new autumn collections in the shops, in an effort to keep customers coming through the doors...

...Wages rose by 4pc in the 12 months to July, so households’ spending power is rising at a rate not seen since July 2016, before the fall in the pound pushed up prices.

You can read more here: Cheaper clothes, toys and petrol give families a hand with lowest inflation since 2016

European shares at the bright side of flat

The gains aren’t going to set the world on fire, but European stocks are in the green across the board, with the FTSE getting some help from a weak pound as some domestically-focused stocks suffer — particularly housebuilders.

Sirius shares stagger again amid funding crisis

Sirius Minerals is back as the FTSE 250’s biggest faller as it continues to battle a funding crisis that may see the miner go under.

Shares are off 14pc, having lost over half their value during Tuesday’s session.

As Jon Yeomans reported yesterday:

The FTSE 250 company warned that it had been unable to sell a $500m (£400m) junk bond it needed to unlock $2.5bn in debt financing from JPMorgan, throwing the future of its ambitious scheme to mine under the North York Moors into doubt. Up to 1,200 jobs are at risk as Sirius has only enough cash to last six months.

It will wind down construction work at its site near Whitby as it desperately seeks alternative financing or a partner to save the mine.

NIESR: Companies may be waiting for Brexit outcome to adjust prices

The National Institute Of Economic and Social Research have offered their assessment of this morning’s inflation figures. Senior economist Jason Lennard said:

Consumer price inflation was lower than expected at 1.7 per cent in the year to August 2019. Our analysis of 130,000 goods and services included in the basket suggests that fewer firms raised prices than is typical for this time of year. Firms are probably waiting to see beyond 31 October before adjusting prices. The slowing of inflation was widespread, falling in 10 of the 12 regions of the United Kingdom with the biggest drops in Northern Ireland and Wales.

Jeremy Warner: National Grid needs ‘bold policy action’ — but not to be nationalised

In his column today, the Telegraph’s Jeremy Warner has taken a look at National Grid, as it treads the tough path to reach net zero carbon emissions. Jeremy writes:

Uncertainty over Brexit hangs like a cloud over previously supportive international sentiment. But in Grid’s case, it is more specific than that. Unpredictable politics has fuelled suspicion of the regulatory regime, with trust in its governance collapsing alongside trust in politics.

Labour plans to renationalise the electricity industry, including National Grid, act as a further deterrent. The curiosity here is that like the pound sterling, the more the present Government disintegrates, the more the share price rebounds.

You can read his full thoughts here: National Grid has a unique bet on net zero by 2050. But first it must avoid renationalisation

Sterling wobbles against dollar after inflation figures

The pound dropped nearly to nearly 0.5pc down against the dollar following the release of those inflation figures, but has pared back slightly to 0.3pc down now.

It took an early hit this morning, after European Commission President Jean-Claude Juncker said there was a “palpable” chance of a no-deal Brexit.

On the Brexit front, the government is continuing to make its arguments in defence of the prorogation of Parliament. Follow along live via video stream or our live blog:

Look ahead: What to expect from the Fed’s rate decision this evening

Ahead of the Federal Reserve’s rate announcement, set for 7pm this evening, economics correspondent Tom Rees has written a breakdown of the five things to look out for:

Here’s the super-reduced version of the key signs:

How rate-setters think interest rates will move in the future

How Powell describes the decision

How markets react

How Trump reacts

What prognosis for the US economy the Fed provides

Analyst polling by Bloomberg, which has a strong track record of predicting interest rates moves, suggests we will see a 0.25pc cut from the Fed.

That is obviously to make Donald Trump happy: the President has been a constant critic of Jerome Powell, and has called for a 1pc cut.

...The United States, because of the Federal Reserve, is paying a MUCH higher Interest Rate than other competing countries. They can’t believe how lucky they are that Jay Powell & the Fed don’t have a clue. And now, on top of it all, the Oil hit. Big Interest Rate Drop, Stimulus!

— Donald J. Trump (@realDonaldTrump) September 16, 2019

Mr Trump has even expressed eagerness for an eventual move to negative rates.

Reaction: Inflation outlook ‘still does not warrant lower interest rates’

More reaction to the inflation figures, from Pantheon Macroeconomics’ Samuel Tombs, who says “The inflation outlook still does not warrant lower interest rates”. he writes:

The chance that the MPC follows other central banks and cuts Bank Rate this year remains slim, despite the sharp fall in CPI inflation in August. The 1.7pc print actually exceeded the Committee’s August Inflation Report forecast of 1.6pc. In addition, half of the sharp fall in the headline rate was driven by further volatility in the price of computer games.

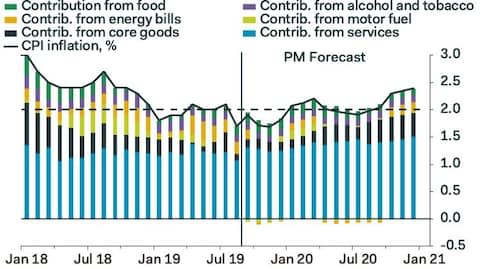

Here’s Pantheon’s prediction for the coming years:

Economist: Inflation rate could let Bank turn dovish

Reacting to those inflation figures, Capital Economics’ Andrew Wishart said:

Our forecast is for overall inflation to stay around 2pc until the end of this year as a fall in utilities prices is offset by increases to inflation-linked duty on tobacco and a pick-up in core inflation.

The risk to our view, which was borne out in today’s release, is that core services inflation fails to pick up pace, as strong wage growth suggests it should. At the margin, this might allow the [Bank of England Monetary Policy Committee] to strike a more dovish tone at tomorrow’s meeting.

House price growth slows

Alongside the CPI figures, the ONS released its latest house price index, which slows the year-on-year rate of house price growth slowed in July.

Four regions saw prices drop (South East, London, East and North East), with the overall slowdown driven by the south:

The ONS said:

At a regional level, Yorkshire and The Humber was the English region with the highest annual house price growth, with prices increasing by 3.2pc in the year to July 2019. This was followed by the North West, with prices increasing by 2.3pc in the same period.

London continues to have far and away the highest house prices, however:

Drop puts inflation below Bank of England target

The fall in inflation offers some extra wiggle room to the Bank of England, which has taken a firm wait-and-see attitude to the consequences of Brexit.

The central bank’s target interest rate is 2pc, which today’s figure undershot slightly: however, with inflation expected to increase in the event of a no-deal Brexit, this means there is some extra cushioning for the Bank, which is holding its next rates meeting tomorrow.

UK inflation fell in August. CPI down to 1.7%y/y from 2.1%y/y in July, with core inflation dropping from 1.9%y/y to 1.5%y/y. Main drivers were recreational goods, clothing & sea fares. Air fares the largest upward push. CPIH at 1.7%y/y from 2.0%y/y & RPI at 2.6%y/y vs 2.8%y/y. pic.twitter.com/jVHzVF9YHH

— Rupert Seggins (@Rupert_Seggins) September 18, 2019

UK inflation falls to lowest since December 2016, down from 2.1% to 1.7%, with PMI suggesting consumer price index has further to fall in coming months #GBP#BOEpic.twitter.com/KZ45LD5HGk

— Chris Williamson (@WilliamsonChris) September 18, 2019

Reacting to the figures, the IoD’s chief economist Tej Parikh said:

The drop in inflation will buoy consumers, but upward price pressures are in the pipeline.

Allied with falling inflation, the sturdy growth in pay packets will temporarily boost households’ spending power and offer some uplift to retailers. However, domestic and international factors are conspiring to push UK prices up in the near future.

Higher wages will eventually translate into inflationary pressure, while the recent decline in the value of the pound and concerns over oil supply will lead to increased input costs for British firms, raising prices across the supply chain.

The Bank of England will no doubt be wary of the upside risks to inflation down the line. Despite this, with subdued economic growth, a disorderly no-deal Brexit still possible, and a global slowdown thrown into the mix, the MPC is likely to keep interest rates on hold to support the economy.

Inflation drops to lowest since 2016

The UK’s inflation rate has hit its lowest level since December 2016, driven by rising prices for video games and clothes.

The year-on-year consumer prices index rose by 1.7pc in August, down from 2.1pc in July, according to the Office for National Statistics.

The ONS’s Mike Hardie said:

The inflation rate has fallen noticeably into August, to its lowest since late 2016.

This was mainly driven by a decrease in computer game prices, plus clothing prices rising by less than last year after the end of the summer sales.

Strike one, strike two, strike three: Asda, Wilko and Ryanair workers walk out

Notable industrial action today: some Asda, Wilko and Ryanair workers are walking out.

Asda employees are complaining about a new contract that would force them to accept flexible hours or face redundancy.

Wilko distribution centre staff have said they will walk out over their weekend working rota, described to the BBC as “brutal”.

Ryanair pilots are going on strike over concerns about new contracts and pay.

A brief note on repo rates...

Yesterday, the US Federal Reserve stepped into financial markets to squash rising short-term interest rates, following an unexpected rise in the overnight repurchasing rate for dollars.

The central bank used the New York Fed to channel $75bn into markets after the rate hit over 8pc, well above the target level of 2pc to 2.25pc. It was the first intervention of its type since the financial crisis.

If that is already making your head hurt or prompting you to nod off, here’s the short version: repurchasing agreements are a crucial part of the financial system’s ‘plumbing’, through which companies temporarily borrow dollars. When it goes wrong, it creates big disruptions.

Following the intervention, the rate seems to have returned to normal levels. Early assessments suggest a combination of a tax deadline and a bond issuance created a temporary shortage of tradeable dollars.

Car dealer Pendragon blames Brexit uncertainty and stock reductions as it swings to loss

Pendragon, the UK’s biggest car dealership, swung to a £32m pre-tax loss over the first half of the year, which it blamed on “heightened political and Brexit uncertainty” hitting consumer confidence, and efforts to reduce its used car stock.

The loss — a sharp swing for a £28m profit during the same period in 2018 — came despite revenues ticking up 2.9pc on a like-for-like basis. The company said:

The principal driver of the group’s performance was the reduction in the level of used car stock to more appropriate levels, which was actively managed during the second quarter through a combination of both lower retail pricing and clearance through trade auction channels.

These necessary actions resulted in significant losses in the period, exacerbated by market-driven reduction in used car values.

The small-cap company is currently searching for a new chief executive, after former boss Mark Herbert quit at the start of the summer after just three months in the position.

Accesso announces progress with sale; results in line despite revenue fall

Accesso Technology, the AIM-listed firm that provides tech solutions for point-on-sale systems, virtual ticketing and queuing, announced its performance during the first half of the year was “broadly in-line” with expectations, as a 6.8pc decline in revenue was offset by lower-than=anticipated costs.

It said the formal sales process that it launched in July following high bid interest is ongoing, adding:

The company recently held management presentations with a number of interested parties and is expected to receive feedback by the end of September 2019.

Games Workshop announces 35p-a-share dividend as trading meets expectations

Games Workshop, the company behind the Warhammer tabletop games, has announced it will pay a dividend of 35p per share after saying trading is on track to hit expectations.

In an update ahead of its annual general meeting at 10am today, chairman Nick Donaldson said:

Games Workshop Group PLC announces today that trading is in line with the Board's expectations. Cash generation also remains strong

The FTSE 250 retailer’s share price has risen around 55pc this year. Here’s Questor’s tip on the stock from last November:

Peel Hunt analysts said:

There is a lot of positive momentum in the business, with increases in the number of trade accounts and hobby stores, new product launches and developments in live action and animation. The company is increasing the level of engagement with hobbyists and adding to both production and distribution capacity. It also has considerable IP to drive royalty revenue.

Kingfisher profits slip as French operation underperforms

B&Q-owned Kingfisher’s underlying profit flipped by 6.4pc in the first half, as a poor performance from its French division dragged down the home improvement retail group.

The results arrive just ahead of the exit of chief executive Véronique Laury, who will be replaced by Thierry Garnier, a veteran of continental supermarket Carrefour.

The FTSE 100 company’s share price has slipped by almost a quarter over the past year, prompting some analysts to speculate it may become a takeover target. It operates a range of home improvement stores across Europe.

Chairman Andy Cosslett said:

In the near term our focus will be on improving execution and delivering on our key priorities for the year. Thierry will bring a fresh perspective to the Group as we focus on delivering growth in shareholder value and creating a compelling experience for our customers and colleagues.

Royal Bank of Canada analysts said:

We maintain our cautious view as we feel the outlook remains subdued and there is still a need for extensive range change, which increases execution risk.

We feel Kingfisher has had continued challenges, given that it is still trying to exit its loss-making peripheral businesses of Castorama Russia and Brico Dépôt Spain, and given its poor performance in France. In addition, we believe Kingfisher has been losing share to Wickes and the discounters in the UK and to Leroy Merlin in France.

Mixed picture, mostly flat, for European stocks

European stocks have opened fairly flat, with the FTSE 100 slightly outperforming peers in France and Germany ahead of inflation data.

Saudi oil capacity will be ‘fully restored’ by end of month

The price of oil is trending slightly upwards, after Saudi Aramco’s chief put out a bullish statement on the impact of Saturday’s drone attacks.

Speaking to media in Jeddah on Tuesday, Amin Nasser said:

These synchronized attacks were timed to create maximum damage to our facilities and operations. The rapid response and resilience demonstrated in the face of such adversity shows the Company's preparedness to deal with threats aimed at sabotaging Aramco's supply of energy to the world.

He said production capacity would be fully restored by the end of September, and said the company remained prepared to proceed with its planned mega-float.

Here’s how things stood yesterday:

Cobham takeover deal faces probe

A big story in British business this morning: the £4bn takeover of UK-listed defence and aerospace company Cobham by US private equity group Advent International is to be investigated to see if it harms Britain’s national security. Industry editor Alan Tovey reports:

Business Secretary Andrea Leadsom has ordered the the Competition and Markets Authority (CMA) to examine the deal on public interest grounds.

The Government has the power to block the deal if it is found to put UK national security at risk or harm the country’s industrial footprint.

Cobham, a specialist in air-to-air refuelling, has a swathe of contracts with the British military, including helping train RAF pilots, and the CMA probe is on security grounds.

You can read his full report here: £4bn Cobham takeover faces national security probe

And here’s more from our Chief City Commentator, Ben Marlow:

Agenda: It’s Fed day!

Are you hanging up your stock picks on the wall? Are you hoping that the interest rate rate will fall?

The US Federal Reserve is widely expected to make another rate cut this evening, a jolt of stimulus they hope will stop the American economy succumbing to a global slowdown. Today promises to be one of this year's most closely-watched decisions on financial markets — and the latest showdown between Fed chair Jerome Powell and President Donald Trump.

5 things to start your day

1) The biggest decision on financial markets: Five things to watch out for at the US Fed. All eyes will turn to Washington this evening but for once the US president will not be hogging the limelight. The Federal Reserve - the US central bank - will release its latest decision on interest rates, a vote that will reverberate in financial hubs across the globe.

2) Britain's workers urgently need a wave of investment in robots because a more modern and productive economy will result in more jobs and better pay, according to MPs. Contrary to fears that automation will push people out of work, the new technology will in fact secure jobs and create new roles by making the country more competitive on the global market, the Business, Energy and Industrial Strategy Committee found.

3) Banking technology start-up GoCardless expands to America: The financial technology start-up said the decision to expand its service, which allows businesses to receive direct debit payments online, to America has taken several years of planning and negotiations with regulators.

4) Thousands of retail investors risk losing their money in Sirius Minerals afterit admitted its plan to build a fertiliser mine in Yorkshire was on the brink of collapse and the Government appeared to rule out a rescue. The FTSE 250 company warned that it had been unable to sell a $500m (£400m) junk bond it needed to unlock $2.5bn in debt financing from JPMorgan, throwing the future of its ambitious scheme to mine under the North York Moors into doubt.

5) Oil price lurches lower as Saudis claim quick recovery from attacks: Global oil markets made an abrupt U-turn yesterday as crude prices fell on hopes that Saudi Arabia could bounce back far more quickly than feared from the drone attacks which crippled production.

What happened overnight

Oil prices cooled on Wednesday as Saudi Arabia said full oil production would be restored by month’s end while caution ahead of an expected US interest rate cut kept wider financial markets in tight ranges.

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.13pc while Japan's Nikkei was flat. In Hong Kong, the Hang Seng Index inched up 7.29 points to 26,797.53 by the break.

Wall Street shares ticked up a tad on Tuesday with the S&P 500 gaining 0.26pc.

Brent crude futures dipped 0.1pc to $64.50 a barrel, having conceded more than 60pc of their gains made after the weekend attack on Saudi oil facilities.

US West Texas Intermediate (WTI) crude lost 0.5pc to $59.06 per barrel, compared to four-month peak of $68.38 marked on Monday.

Coming up today

Kingfisher, which owns a plethora of home-improvement brands and is perhaps best known as owner of B&Q, will report first-half results on Wednesday. Jefferies analysts say they hope for “greater clarity” from the company on its troubled French operations. They say the company could become a target for takeover.

Interim results: Accesso, Kingfisher, Pendragon

Economics: Inflation, PPI, house price index (UK), inflation (eurozone), mortgage application and Federal Reserve interest rates (US)

Yahoo Finance

Yahoo Finance