Total System (TSS) Q1 Earnings Beat Estimates, Revenues Miss

Total System Services, Inc.’s TSS first-quarter 2019 earnings per share of $1.15 surpassed the Zacks Consensus Estimate by 2.9% and also surged nearly 4.5% year over year. Strong performances by all three segments — Issuer Solutions, Merchant Solutions and Consumer Solutions — have contributed to the favorable results.

Total revenues were $1.03 billion, up 5.6% year over year, led by growth across all its three segments. Net revenues (which excludes reimbursable items) of $980.3 million were up 5.6% year over year, but missed the Zacks Consensus Estimate by 1.7%.

Total expenses of $811.3 million were up 1.5% year over year, led by 3.1% increase in cost of services.

The company reported adjusted EBITDA of $357.3 million, up 8% from the year-ago quarter.

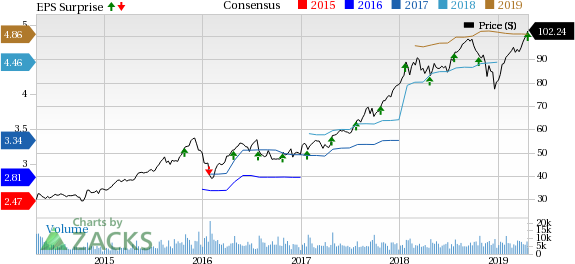

Total System Services, Inc. Price, Consensus and EPS Surprise

Total System Services, Inc. Price, Consensus and EPS Surprise | Total System Services, Inc. Quote

Impressive Segment Results

Issuer Solutions

Net revenues for this segment improved 2.3% year over year to $433.5 million, driven by a 7.2% rise in total transaction year over year and 8.6% growth in traditional accounts on file.

Adjusted EBITDA of $204.9 million was up 4.7% year over year.

Merchant Solutions

Net revenues jumped 8.1% to $343 million, mainly backed by 13.8% higher point-of-sale transactions. Dollar sales volume for the segment expanded 8% year over year to $40.2 billion.

Adjusted EBITDA of $128.8 million increased 8.3% year over year.

Consumer Solutions

Net revenues for this segment amounted to $219.2 million, up 4.1%. This upside is attributable to 3.8% growth in GDV (gross domestic value).

Adjusted EBITDA of $63.7 million increased 18.7% year over year.

Strong Financial Position

Total assets increased 4.1% from the level as of Dec 31, 2018 to $7.8 billion as of Mar 31, 2019.

Total shareholders’ equity declined 9% from Dec 31, 2018 levels to $2.59 billion on Mar 31, 2019.

For the quarter, the company generated free cash flow of $147.2 million, down 11% year over year.

2019 Guidance Affirmed

The company backed its earlier provided guidance for 2019 which calls for total revenues on a GAAP basis in the range of $4.19-$4.29 billion, up 4-6%. On a non-GAAP basis, net revenues are anticipated in the $3.99-$4.09 billion band, reflecting 5-7% year-over-year growth.

GAAP EPS will likely be within $3.48-$3.63, up 11-16% from the comparable quarter last year. Adjusted EPS is forecast between $4.75 and $4.90, translating into an improvement of about 6-10%.

Zacks Rank

Total System Services carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks to Consider

Some stocks worth considering in the same space are Diebold Nixdorf, Inc. DBD, FleetCor Technologies, Inc. FLT and Worldpay Inc. WP. Each of these stocks carries a Zacks Rank #2 (Buy).

Diebold Nixdorf’s and FleetCor Technologies’s Earnings ESP of +5.71% and 0.38% and a Zacks Rank #2 makes us confident of an earnings beat this quarter.

Worldpay has surpassed estimates in each of the four reported quarters with an average positive surprise of 5.1%.

Will you retire a millionaire?

One out of every six people retires a multimillionaire. Get smart tips you can do today to become one of them in a new Special Report, “7 Things You Can Do Now to Retire a Multimillionaire.”

Click to get it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Diebold Nixdorf, Incorporated (DBD) : Free Stock Analysis Report

FleetCor Technologies, Inc. (FLT) : Free Stock Analysis Report

Total System Services, Inc. (TSS) : Free Stock Analysis Report

Vantiv, Inc. (WP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance