TopBuild (BLD) Up 48% Over a Year, Sharpens Competitive Edge

TopBuild Corp. BLD has been reaping benefits from strong demand for residential housing, increased sales volume, and solid contribution from acquisitions and pricing at both businesses (Installation or TruTeam and Distribution or Service Partners). Also, its continuous focus on operational excellence has been driving profitable growth, defying unprecedented supply chain disruptions and labor shortages.

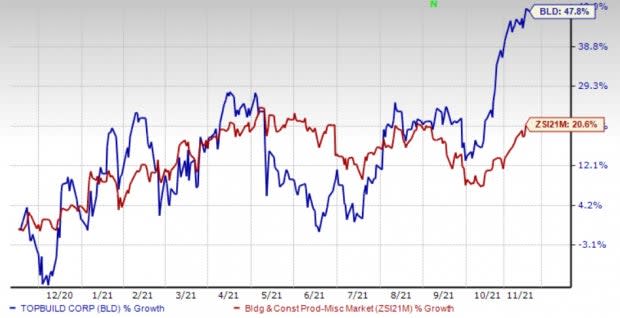

Shares of TopBuild have gained 47.8% over a year compared with the Zacks Building Products – Miscellaneous industry’s 20.6% growth. The price performance was backed by a solid earnings surprise history. TopBuild’s earnings surpassed the Zacks Consensus Estimate in all of the trailing 11 quarters.

Image Source: Zacks Investment Research

Let’s delve deeper into the factors supporting this Zacks Rank #3 (Hold) company’s growth trajectory. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Solid Performance & Upbeat View

TopBuild has been recording solid earnings and revenue growth over the last few quarters. For third-quarter 2021, the company’s sales increased 21.3%, adjusted earnings per share grew 40.5%, gross margin expanded 110 basis points (bps) to 29.2%, adjusted EBITDA was up 32.8% and adjusted EBITDA margin expanded 160 bps from the prior-year period. The impressive margin expansion led to increased profitability, depicting a flexible operating model and its ability to quickly reduce costs.

The uptrend in its performance was backed by increased sales volume and solid contributions from acquisitions and pricing at both businesses defying the labor and material constrained market. Backed by a robust residential housing market and strengthening commercial market, TopBuild raised its expectation for 2021 during the third-quarter earnings call. It now expects sales between $3.425 billion and $3.475 billion versus $3.290-$3.370 billion expected earlier. This indicates an impressive growth from $2.72 billion reported in 2020. Adjusted EBITDA is projected within $585-$605 million versus the earlier projection of $565-$590 million, suggesting growth from $436.7 million reported a year ago.

Inorganic Moves

Acquisitions are an important part of TopBuild’s growth strategy to supplement organic growth, and expand access to additional markets as well as products. This year (as of Nov 9, 2021), TopBuild completed 10 acquisitions, which are expected to generate $1 billion of annual revenues. On Nov 9, 2021, TopBuild acquired St. George, Utah-based Tonks Insulation and Pueblo, Colorado-based Shepherds Insulation. On Oct 18, 2021, the company acquired Distribution International or DI from Advent International in an all-cash transaction valued at $1 billion. This buyout expanded TopBuild's footprint and increased penetration within key markets, including the recurring MRO business. In the same month, the company announced that it had acquired California Building Products, a residential and light commercial insulation company serving Bakersfield, Modesto and Fresno, CA.

Higher ROE

TopBuild’s superior return on equity (ROE) is indicative of growth potential. The company’s ROE stands at 22.7% compared with 9.8% for the industry it belongs to. This indicates efficiency in using its shareholders’ funds.

3 Robust Construction Picks

We have highlighted three better-ranked stocks in the Zacks Construction sector, namely Sterling Construction STRL, EMCOR Group, Inc. EME and Construction Partners, Inc. ROAD, each carrying a Zacks Rank #2 (Buy).

Sterling — a construction company that engages in heavy civil, specialty services and residential construction — has a trailing four-quarter earnings surprise of 34.6%, on average. Shares of the company have jumped 78.7% in the past year.

The Zacks Consensus Estimate for Sterling’s current financial year sales and earnings per share suggests growth of 6.5% and 41.5%, respectively, from the year-ago period.

EMCOR — an electrical and mechanical construction service provider — has a trailing four-quarter earnings surprise of 18.8%, on average. Shares of the company have jumped 51.3% in the past year.

The Zacks Consensus Estimate for EMCOR’s current financial year sales and earnings per share suggests growth of 11.6% and 10.6%, respectively, from the year-ago period.

Construction Partners, a civil infrastructure company, has an expected EPS growth rate of 14.1% for three-five years. Shares of the company have jumped 58.1% in the past year.

The Zacks Consensus Estimate for ROAD’s current financial year sales suggests growth of 20.3% from the year-ago period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Sterling Construction Company Inc (STRL) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

Construction Partners, Inc. (ROAD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance