Top Three Stocks On Japanese Exchange Estimated To Be Undervalued In June 2024

Amidst a landscape of mixed performances in global markets, Japan's stock market has shown resilience with the Nikkei 225 Index noting a slight gain. This stability, coupled with ongoing monetary policy adjustments by the Bank of Japan, sets an intriguing stage for investors looking at potentially undervalued stocks in this market. In such an environment, identifying stocks that are estimated to be undervalued could offer interesting opportunities for those looking to invest in the Japanese exchange.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

Name | Current Price | Fair Value (Est) | Discount (Est) |

Link and Motivation (TSE:2170) | ¥460.00 | ¥894.53 | 48.6% |

Plus Alpha ConsultingLtd (TSE:4071) | ¥1788.00 | ¥3567.37 | 49.9% |

Hibino (TSE:2469) | ¥2560.00 | ¥4883.24 | 47.6% |

OSAKA Titanium technologiesLtd (TSE:5726) | ¥2804.00 | ¥5537.00 | 49.4% |

Cyber Security Cloud (TSE:4493) | ¥2125.00 | ¥4106.10 | 48.2% |

Gift Holdings (TSE:9279) | ¥2626.00 | ¥5143.31 | 48.9% |

Members (TSE:2130) | ¥873.00 | ¥1720.07 | 49.2% |

NIHON CHOUZAILtd (TSE:3341) | ¥1405.00 | ¥2764.30 | 49.2% |

Macromill (TSE:3978) | ¥876.00 | ¥1686.45 | 48.1% |

freee K.K (TSE:4478) | ¥2330.00 | ¥4462.59 | 47.8% |

Let's explore several standout options from the results in the screener

IbidenLtd

Overview: Ibiden Co., Ltd. operates globally, offering electronic and ceramics products with a market capitalization of approximately ¥926.17 billion.

Operations: The company's revenue is primarily derived from its electronics and ceramics segments, generating ¥190.71 billion and ¥96.52 billion respectively.

Estimated Discount To Fair Value: 45.5%

Ibiden Ltd., with a current trading price of ¥6630, is significantly undervalued based on DCF analysis, suggesting a fair value of ¥12161.6. This represents a 45.5% discount. The company's earnings are expected to grow by 22.18% annually over the next three years, outpacing the Japanese market's average of 8.8%. Despite this growth potential and recent dividend affirmations, challenges include its highly volatile share price and lower profit margins compared to the previous year.

PeptiDream

Overview: PeptiDream Inc. is a biopharmaceutical company focused on the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics, with a market capitalization of approximately ¥292.52 billion.

Operations: The company generates its revenue primarily from the development and commercialization of novel peptide-based therapeutics.

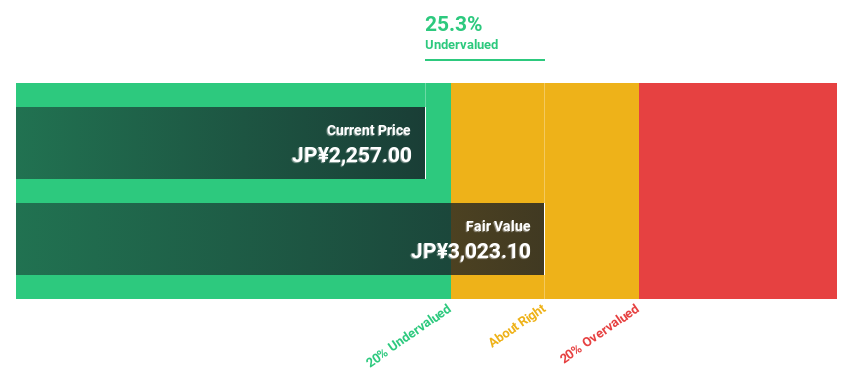

Estimated Discount To Fair Value: 25.3%

PeptiDream Inc., priced at ¥2257, appears undervalued with a DCF-based fair value of ¥3023.1, marking a significant discount. The company's earnings are projected to grow by 22.3% annually over the next three years, surpassing Japan's market average growth rate. Recent strategic expansions with Novartis and promising early-stage clinical studies further underscore its potential. However, concerns persist due to its volatile share price and declining profit margins from the previous year.

Taiyo Yuden

Overview: Taiyo Yuden Co., Ltd. is a global manufacturer and seller of electronic components, operating primarily in Japan, China, and Hong Kong, with a market capitalization of approximately ¥505.61 billion.

Operations: The company's revenue from electronic components totals approximately ¥322.65 billion.

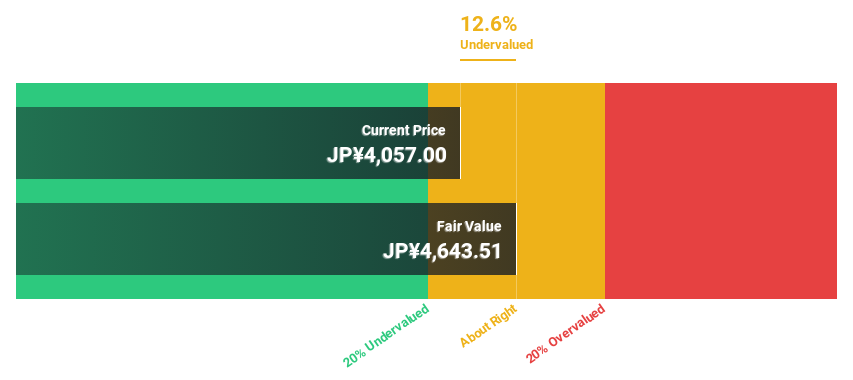

Estimated Discount To Fair Value: 12.6%

Taiyo Yuden, valued at ¥4057, is trading below its estimated fair value of ¥4643.51, suggesting potential undervaluation based on cash flows. The company forecasts robust earnings growth at 28.3% annually, outpacing the Japanese market's 8.8%. However, its dividend sustainability is questionable as it's poorly covered by both earnings and cash flows. Additionally, while expected revenue growth stands at 6.3% per year, this lags behind a more aggressive market rate of 20% per year.

Next Steps

Unlock our comprehensive list of 98 Undervalued Japanese Stocks Based On Cash Flows by clicking here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:4062 TSE:4587 and TSE:6976.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com