Top Swedish Dividend Stocks Yielding Up To 4.8%

As global markets react to the recent Federal Reserve rate cut, European indices have shown mixed performance, with investors cautiously optimistic about future monetary policies. Amid this backdrop, Sweden's stock market offers intriguing opportunities for dividend-focused investors. In considering dividend stocks, it's crucial to look for companies with stable earnings and a history of consistent payouts—qualities that can provide a measure of reliability in today's fluctuating economic environment.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Betsson (OM:BETS B) | 5.87% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.85% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.56% | ★★★★★☆ |

Zinzino (OM:ZZ B) | 3.50% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.07% | ★★★★★☆ |

Bredband2 i Skandinavien (OM:BRE2) | 4.39% | ★★★★★☆ |

Duni (OM:DUNI) | 4.85% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.41% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.68% | ★★★★★☆ |

Afry (OM:AFRY) | 3.05% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top Swedish Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Bahnhof

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector across Sweden and Europe, with a market cap of SEK 5.88 billion.

Operations: Bahnhof AB (publ) generates revenue from its Internet and telecommunications operations across Sweden and Europe.

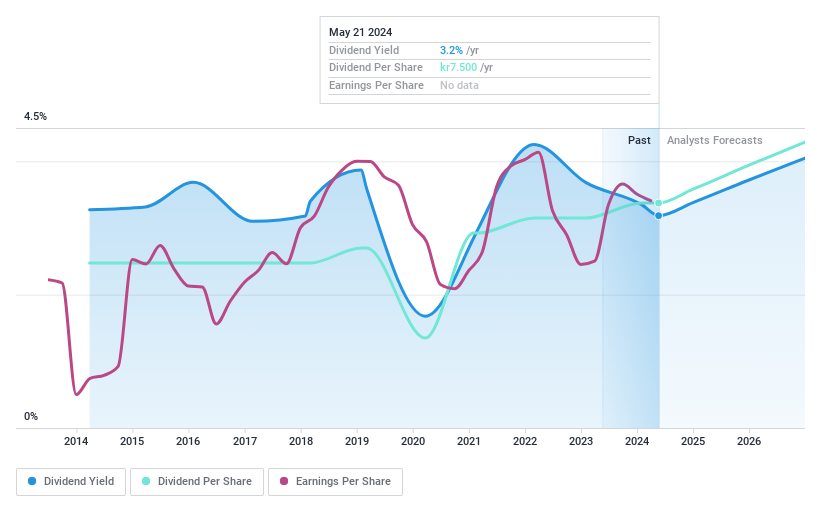

Dividend Yield: 3.7%

Bahnhof AB's recent earnings report shows strong revenue growth, with Q2 sales at SEK 500.88 million and a net income of SEK 53.71 million. Despite reliable and stable dividend payments over the past decade, the current payout ratio (94.4%) indicates dividends are not well covered by earnings, raising sustainability concerns. The dividend yield of 3.66% is lower than the top quartile in Sweden but remains consistent due to steady profit growth and minimal volatility in payouts.

Duni

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Duni AB (publ) develops, manufactures, and sells concepts and products for meal serving, take-away, and packaging in Sweden and internationally with a market cap of SEK 4.84 billion.

Operations: Duni AB (publ) generates revenue from dining solutions amounting to SEK 4.52 billion and food packaging solutions totaling SEK 3.05 billion.

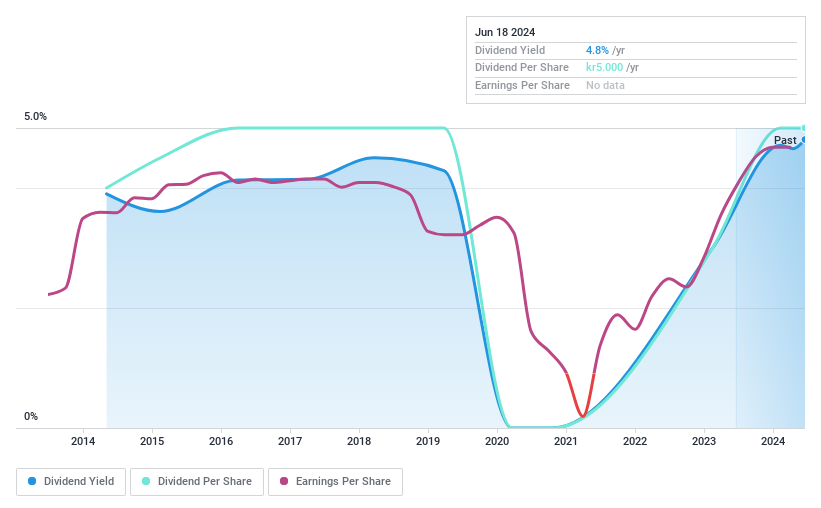

Dividend Yield: 4.9%

Duni's dividend payments are well covered by both earnings (63.9% payout ratio) and cash flows (42.9% cash payout ratio), positioning it among the top 25% of Swedish dividend payers with a yield of 4.85%. However, its dividends have been volatile over the past decade despite recent increases. Recent plans to establish a new warehouse hub in Germany aim to enhance logistics efficiency but may impact short-term financials due to restructuring costs.

AB SKF

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB SKF (publ) designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring, and services worldwide with a market cap of SEK88.21 billion.

Operations: AB SKF (publ) generates revenue from two main segments: Automotive, contributing SEK29.44 billion, and Industrial, accounting for SEK71.08 billion.

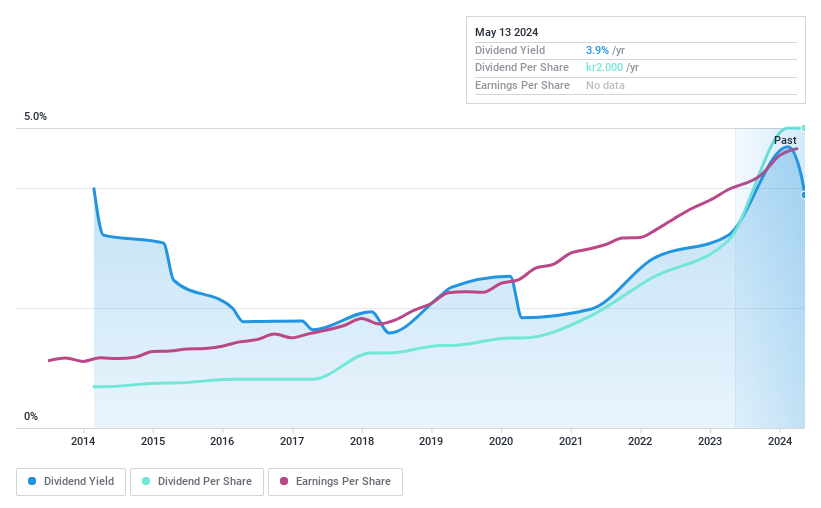

Dividend Yield: 3.9%

SKF's dividend payments are covered by earnings and cash flows, with payout ratios of 59.9% and 53.6%, respectively, but have been volatile over the past decade. Recently, SKF announced plans to separate its Automotive business to focus on its higher-margin Industrial unit, potentially enhancing growth and efficiency. The company's dividend yield is lower than the top 25% of Swedish dividend payers at 3.87%.

Delve into the full analysis dividend report here for a deeper understanding of AB SKF.

Our expertly prepared valuation report AB SKF implies its share price may be lower than expected.

Key Takeaways

Discover the full array of 20 Top Swedish Dividend Stocks right here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BAHN B OM:DUNI and OM:SKF B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com