Top Ranked Value Stocks to Buy for April 23rd

Here are four stocks with buy rank and strong value characteristics for investors to consider today, April 23rd:

QCR Holdings, Inc. (QCRH): This provider of commercial and consumer banking services has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 0.3% over the last 60 days.

QCR Holdings, Inc. Price and Consensus

QCR Holdings, Inc. price-consensus-chart | QCR Holdings, Inc. Quote

QCR has a price-to-earnings ratio (P/E) of 0.96 compared with 1.35 for the industry. The company possesses a Value Score of A.

QCR Holdings, Inc. PE Ratio (TTM)

QCR Holdings, Inc. pe-ratio-ttm | QCR Holdings, Inc. Quote

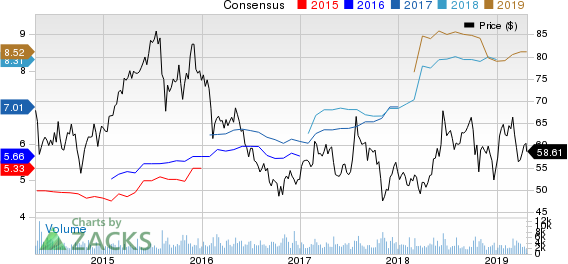

SYNNEX Corporation (SNX): This business process services provider has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 0.7% over the last 60 days.

SYNNEX Corporation Price and Consensus

SYNNEX Corporation price-consensus-chart | SYNNEX Corporation Quote

SYNNEX has a price-to-earnings ratio (P/E) of 8.86 compared with 17.70 for the industry. The company possesses a Value Score of B.

SYNNEX Corporation PE Ratio (TTM)

SYNNEX Corporation pe-ratio-ttm | SYNNEX Corporation Quote

AMC Networks Inc. (AMCX): This owner of theatrical exhibition business has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 2.3% over the last 60 days.

AMC Networks Inc. Price and Consensus

AMC Networks Inc. price-consensus-chart | AMC Networks Inc. Quote

AMC has a price-to-earnings ratio (P/E) of 6.88 compared with 14.40 for the industry. The company possesses a Value Score of B.

AMC Networks Inc. PE Ratio (TTM)

AMC Networks Inc. pe-ratio-ttm | AMC Networks Inc. Quote

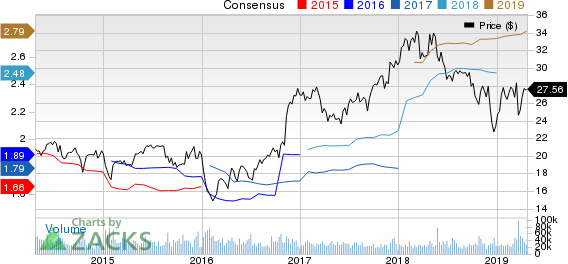

Fifth Third Bancorp (FITB): This diversified financial services company has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 1.1% over the last 60 days.

Fifth Third Bancorp Price and Consensus

Fifth Third Bancorp price-consensus-chart | Fifth Third Bancorp Quote

Fifth Third has a price-to-earnings ratio (P/E) of 9.89 compared with 11.00 for the industry. The company possesses a Value Score of B.

Fifth Third Bancorp PE Ratio (TTM)

Fifth Third Bancorp pe-ratio-ttm | Fifth Third Bancorp Quote

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SYNNEX Corporation (SNX) : Free Stock Analysis Report

QCR Holdings, Inc. (QCRH) : Free Stock Analysis Report

Fifth Third Bancorp (FITB) : Free Stock Analysis Report

AMC Networks Inc. (AMCX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance