Top Ranked Value Stocks to Buy for April 16th

Here are four stocks with buy rank and strong value characteristics for investors to consider today, April 16th:

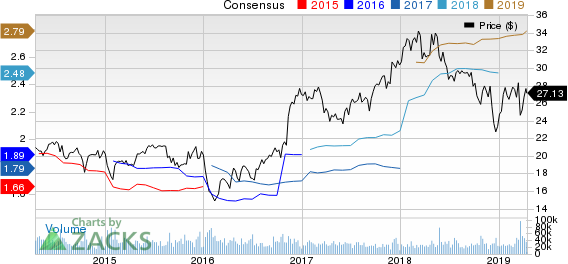

Fifth Third Bancorp (FITB): This diversified financial services company has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 1.5% over the last 60 days.

Fifth Third Bancorp Price and Consensus

Fifth Third Bancorp price-consensus-chart | Fifth Third Bancorp Quote

Fifth Third has a price-to-earnings ratio (P/E) of 9.74, compared with 10.90 for the industry. The company possesses a Value Score of B.

Fifth Third Bancorp PE Ratio (TTM)

Fifth Third Bancorp pe-ratio-ttm | Fifth Third Bancorp Quote

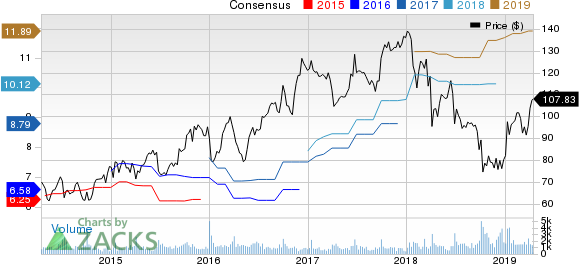

SYNNEX Corporation (SNX): This business process services provider has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 0.7% over the last 60 days.

SYNNEX Corporation Price and Consensus

SYNNEX Corporation price-consensus-chart | SYNNEX Corporation Quote

SYNNEX has a price-to-earnings ratio (P/E) of 9.07, compared with 18.80 for the industry. The company possesses a Value Score of B.

SYNNEX Corporation PE Ratio (TTM)

SYNNEX Corporation pe-ratio-ttm | SYNNEX Corporation Quote

United Rentals, Inc.(URI): This equipment rental company has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 0.2% over the last 60 days.

United Rentals, Inc. Price and Consensus

United Rentals, Inc. price-consensus-chart | United Rentals, Inc. Quote

United Rentals has a price-to-earnings ratio (P/E) of 6.48, compared with 11.30 for the industry. The company possesses a Value Score of A.

United Rentals, Inc. PE Ratio (TTM)

United Rentals, Inc. pe-ratio-ttm | United Rentals, Inc. Quote

QCR Holdings, Inc. (QCRH): This multi-bank holding company has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 0.3% over the last 60 days.

QCR Holdings, Inc. Price and Consensus

QCR Holdings, Inc. price-consensus-chart | QCR Holdings, Inc. Quote

QCR has a price-to-earnings ratio (P/E) of 9.81, compared with 11.70 for the industry. The company possesses a Value Score of B.

QCR Holdings, Inc. PE Ratio (TTM)

QCR Holdings, Inc. pe-ratio-ttm | QCR Holdings, Inc. Quote

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Will you retire a millionaire?

One out of every six people retires a multimillionaire. Get smart tips you can do today to become one of them in a new Special Report, “7 Things You Can Do Now to Retire a Multimillionaire.”

Click to get it free >>

Is your investment advisor fumbling your financial future?

See how you can more effectively safeguard your retirement with a new Special Report, “4 Warning Signs Your Investment Advisor Might Be Sabotaging Your Financial Future.” Click to get your free report.

United Rentals, Inc. (URI) : Free Stock Analysis Report

SYNNEX Corporation (SNX) : Free Stock Analysis Report

QCR Holdings, Inc. (QCRH) : Free Stock Analysis Report

Fifth Third Bancorp (FITB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance