Top Ranked Value Stocks to Buy for April 28th

Here are four stocks with buy rank and strong value characteristics for investors to consider today, April 28th:

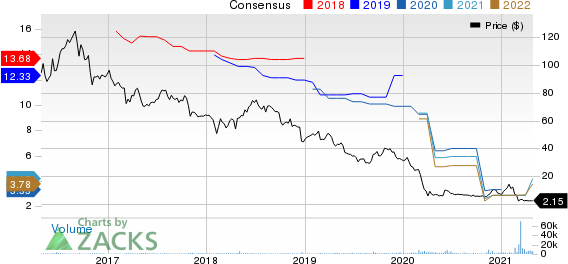

Washington Prime Group Inc. (WPG): This retail REIT has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 45.5% over the last 60 days.

Washington Prime Group Inc. Price and Consensus

Washington Prime Group Inc. price-consensus-chart | Washington Prime Group Inc. Quote

Washington Prime has a price-to-earnings ratio (P/E) of 0.51, compared with 9.90 for the industry. The company possesses a Value Score of A.

Washington Prime Group Inc. PE Ratio (TTM)

Washington Prime Group Inc. pe-ratio-ttm | Washington Prime Group Inc. Quote

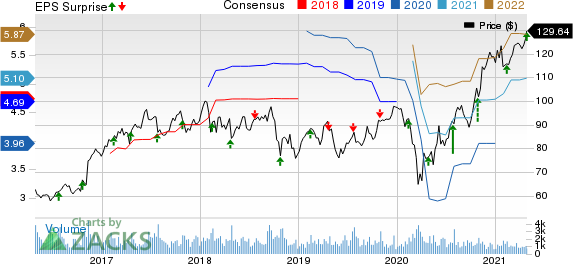

Discover Financial Services (DFS): This direct banking and payment services company has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 43.6% over the last 60 days.

Discover Financial Services Price and Consensus

Discover Financial Services price-consensus-chart | Discover Financial Services Quote

Discover Financial has a price-to-earnings ratio (P/E) of 8.37, compared with 9.40 for the industry. The company possesses a Value Score of A.

Discover Financial Services PE Ratio (TTM)

Discover Financial Services pe-ratio-ttm | Discover Financial Services Quote

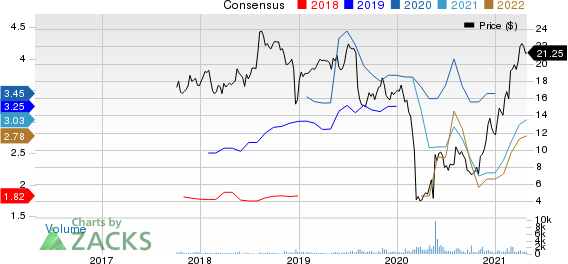

Orrstown Financial Services, Inc. (ORRF): This holding company for Orrstown Bank has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 23.4% over the last 60 days.

Orrstown Financial Services Inc Price and Consensus

Orrstown Financial Services Inc price-consensus-chart | Orrstown Financial Services Inc Quote

Orrstown Financial Services has a price-to-earnings ratio (P/E) of 8.97, compared with 13.10 for the industry. The company possesses a Value Score of B.

Orrstown Financial Services Inc PE Ratio (TTM)

Orrstown Financial Services Inc pe-ratio-ttm | Orrstown Financial Services Inc Quote

Oasis Midstream Partners LP (OMP): This company that provides crude oil, natural gas, and water-related midstream services has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 13.1% over the last 60 days.

Oasis Midstream Partners LP Price and Consensus

Oasis Midstream Partners LP price-consensus-chart | Oasis Midstream Partners LP Quote

Oasis Midstream Partners has a price-to-earnings ratio (P/E) of 7.01, compared with 9.40 for the industry. The company possesses a Value Score of A.

Oasis Midstream Partners LP PE Ratio (TTM)

Oasis Midstream Partners LP pe-ratio-ttm | Oasis Midstream Partners LP Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Washington Prime Group Inc. (WPG) : Free Stock Analysis Report

Orrstown Financial Services Inc (ORRF) : Free Stock Analysis Report

Oasis Midstream Partners LP (OMP) : Free Stock Analysis Report

Discover Financial Services (DFS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance