Top Ranked Value Stocks to Buy for February 3rd

Here are four stocks with buy rank and strong value characteristics for investors to consider today, February 3rd:

Banco Macro S.A. (BMA): This company that provides various banking products and services to individuals and corporate customers has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 21.4% over the last 60 days.

Banco Macro S.A. Price and Consensus

Banco Macro S.A. price-consensus-chart | Banco Macro S.A. Quote

Banco Macro has a price-to-earnings ratio (P/E) of 3.08, compared with 6.20 for the industry. The company possesses a Value Score of A.

Banco Macro S.A. PE Ratio (TTM)

Banco Macro S.A. pe-ratio-ttm | Banco Macro S.A. Quote

Navient Corporation (NAVI): This company that provides education loan management and business processing solutions for education, healthcare, and government clients at the federal, state, and local levels has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 0.8% over the last 60 days.

Navient Corporation Price and Consensus

Navient Corporation price-consensus-chart | Navient Corporation Quote

Navient has a price-to-earnings ratio (P/E) of 4.82, compared with 7.80 for the industry. The company possesses a Value Score of A.

Navient Corporation PE Ratio (TTM)

Navient Corporation pe-ratio-ttm | Navient Corporation Quote

CBL & Associates Properties, Inc. (CBL): This company that owns and manages a national portfolio of market-dominant properties located in dynamic and growing communities has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 1.9% over the last 60 days.

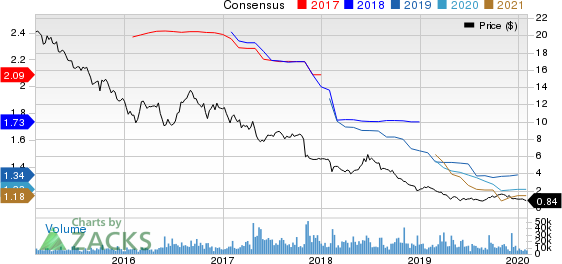

CBL & Associates Properties, Inc. Price and Consensus

CBL & Associates Properties, Inc. price-consensus-chart | CBL & Associates Properties, Inc. Quote

CBL & Associates Properties has a price-to-earnings ratio (P/E) of 0.68, compared with 13.40 for the industry. The company possesses a Value Score of A.

CBL & Associates Properties, Inc. PE Ratio (TTM)

CBL & Associates Properties, Inc. pe-ratio-ttm | CBL & Associates Properties, Inc. Quote

Brighthouse Financial, Inc. (BHF): This annuity and life insurance products provider has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 0.8% over the last 60 days.

Brighthouse Financial, Inc. Price and Consensus

Brighthouse Financial, Inc. price-consensus-chart | Brighthouse Financial, Inc. Quote

Brighthouse Financial has a price-to-earnings ratio (P/E) of 3.85, compared with 12.40 for the industry. The company possesses a Value Score of A.

Brighthouse Financial, Inc. PE Ratio (TTM)

Brighthouse Financial, Inc. pe-ratio-ttm | Brighthouse Financial, Inc. Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Navient Corporation (NAVI) : Free Stock Analysis Report

CBL & Associates Properties, Inc. (CBL) : Free Stock Analysis Report

Macro Bank Inc. (BMA) : Free Stock Analysis Report

Brighthouse Financial, Inc. (BHF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance