Top High Growth Stocks This Week

Analysts are bullish on these following companies: Health Management International, Geo Energy Resources, Lian Beng Group. These companies are relatively strong financially, and have a great outlook in terms of profits and cash flow. I would suggest taking a look at my list of companies that compare favourably in all criteria, and consider whether they would add value to your current portfolio.

Health Management International Ltd (SGX:588)

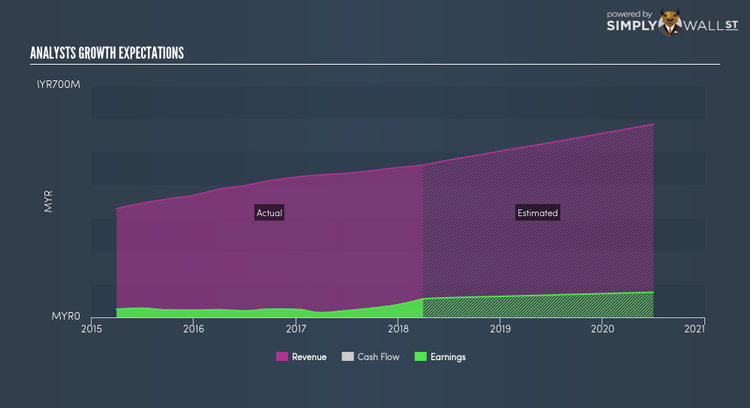

Health Management International Ltd provides private healthcare services in Singapore, Malaysia, and Indonesia. Started in 1991, and currently headed by CEO Wei Chin, the company now has 1,500 employees and with the market cap of SGD SGD527.82M, it falls under the small-cap stocks category.

588’s forecasted bottom line growth is an optimistic double-digit 12.71%, driven by the underlying double-digit sales growth of 23.78% over the next few years. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 24.61%. 588 ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Considering 588 as a potential investment? I recommend researching its fundamentals here.

Geo Energy Resources Limited (SGX:RE4)

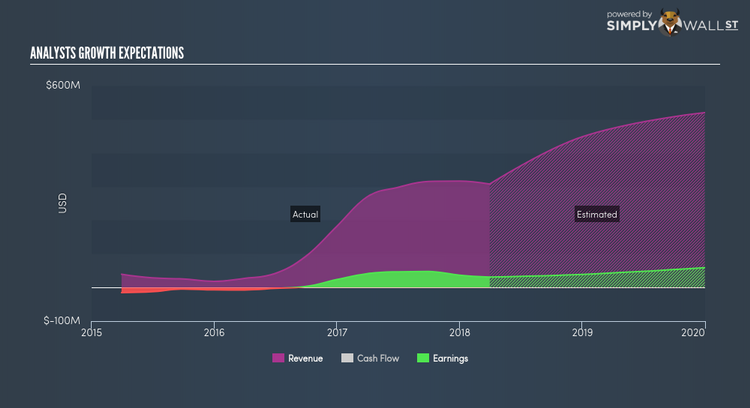

Geo Energy Resources Limited, an investment holding company, engages in mining, producing, and trading coal in Indonesia. Established in 2008, and run by CEO Kum Hon Tung, the company provides employment to 524 people and with the stock’s market cap sitting at SGD SGD299.09M, it comes under the small-cap group.

Thinking of investing in RE4? Check out its fundamental factors here.

Lian Beng Group Ltd (SGX:L03)

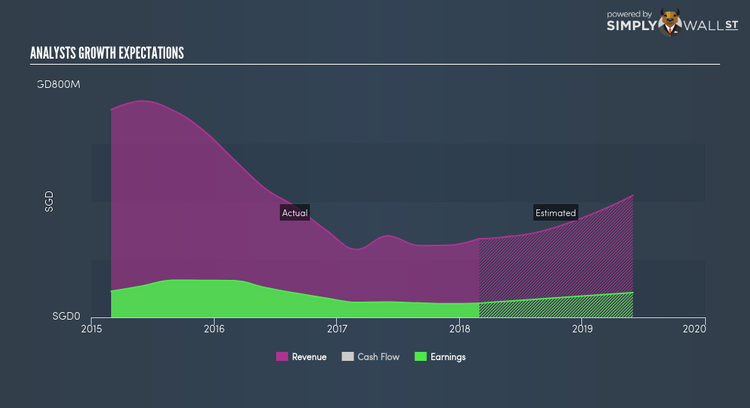

Lian Beng Group Ltd, an investment holding company, engages in the construction business in Singapore and Australia. Lian Beng Group was formed in 1973 and with the stock’s market cap sitting at SGD SGD289.82M, it comes under the small-cap stocks category.

Should you add L03 to your portfolio? Take a look at its other fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance