Top 5 Nasdaq Composite Stocks to Buy Ahead of Q4 Earnings

The fourth-quarter 2022 earnings season is in full swing as big techs are slated to report this week. This earnings season will be important as market participants will closely monitor any sign of earnings, revenues or margin decline.

In addition to tech companies, several non-tech components of the tech-heavy Nasdaq Composite are also slated to report financial numbers. We have selected five such companies with a favorable Zacks Rank that are set to beat earnings estimates. The combination of a favorable Zacks Rank and a possible earnings beat should drive their stock prices in the near-term.

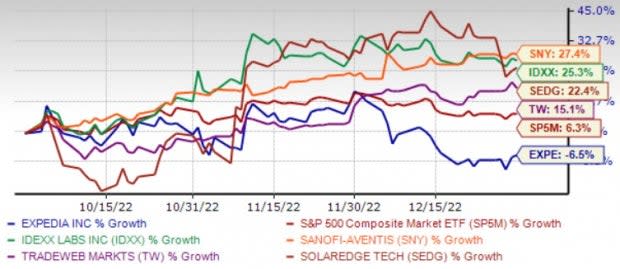

These companies are Expedia Group Inc. EXPE, IDEXX Laboratories Inc. IDXX, Tradeweb Markets Inc. TW, SolarEdge Technologies Inc. SEDG and Sanofi SNY.

Nasdaq Composite in Q4 2022

Wall Street wrapped up 2022 as the worst year since 2008, terminating a three-year winning streak. Major stock indexes suffered a bloody blow last year. The Nasdaq Composite Index tumbled 33.1% year over year and 32.9% from its all-time high.

The technology sector, which enabled Wall Street to get rid of the coronavirus-induced short bear market and formed the new bull market, suffered the most in 2022 due to overvaluation, a high-interest rate regime and tighter monetary control adopted by the Fed to combat 40-year high inflation.

However, in fourth-quarter 2022, the Nasdaq Composite Index declined just a little over 1%. Peak inflation seems behind us. Less-than-expected inflation rates in October, November and December with respect to several measures and an unexpected drop in wage rate in December and November have clearly indicated this.

Q4 2022 Earnings Results So Far

As of Jan 27, 143 S&P 500 companies reported their earnings results. Total earnings of these companies are down 3.3% year over year on 6.1% higher revenues with 71.3% beating EPS estimates and 67.1% beating revenue estimates. Our current projection shows that for fourth-quarter 2022, total earnings of the S&P 500 Index as a whole are expected to decline 6.9% year over year on 4.3% higher revenues.

Our Top Picks

Five Nasdaq Composite companies are set to beat earnings estimates. Each of these stocks carries a Zacks Rank #2 (Buy) and has a positive Earnings ESP. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our research shows that for stocks with the combination of a Zacks Rank #3 (Hold) or better and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. These stocks are anticipated to appreciate after their earnings releases. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The chart below shows the price performance of our five picks in the last quarter.

Image Source: Zacks Investment Research

Sanofi’s Specialty Care unit is on a strong footing, particularly with the regular label expansion of Dupixent. Notably, Dupixent has become the key top-line driver for SNY. With multiple approvals for new indications, its sales are expected to be higher.

SNY possesses a leading vaccine portfolio, which has become the primary top-line driver. Sanofi’s R&D pipeline is strong. Sanofi’s Consumer unit is delivering above-market sales growth. SNY has also launched several new drugs in the past couple of years and is expanding its pipeline through M&A deals.

Sanofi has an Earnings ESP of +2.49%. It has an expected earnings growth rate of 2.1% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the last seven days.

SNY recorded earnings surprises in the last four reported quarters, with an average beat of 9.5%. The company is set to release earnings results on Feb 3, before the opening bell.

Expedia Group is benefiting from strong improvement across all its lines of business, owing to the increasing travel resiliency of people. Moreover, EXPE is experiencing growth in gross bookings. Strong momentum in lodging and air bookings is contributing well to the top-line. We expect growth in lodging and air revenues in the days ahead.

Our estimates suggest lodging and air revenues to grow 37.1% and 36.2% in 2022 from the year-ago figures. Further, we expect gross bookings to witness a year-over-year rise of 32.5% in 2022. These apart, continuous efforts toward strengthening products and technology offerings are helping Expedia Group to gain momentum among customers.

EXPE has an Earnings ESP of +7.34%. It has an expected earnings growth rate of 23.8% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the last seven days. Expedia Group is set to release earnings results on Feb 9, after the closing bell.

IDEXX Laboratories develops, manufactures, and distributes products and services primarily for the companion animal veterinary, livestock and poultry, dairy, and water testing markets worldwide.

IDXX has benefitted from strong CAG Diagnostics recurring revenue growth. The upside was supported by record instrument placements, resulting in a year-over-year expansion of IDXX's global premium instrument installed base, which is encouraging. The company continues to demonstrate solid growth globally.

IDEXX Laboratories has an Earnings ESP of +0.39%. It has an expected earnings growth rate of 19.1% for the current year. IDXX recorded earnings surprises in the last four reported quarters, with an average beat of 5.2%. The company is set to release earnings results on Feb 6, before the opening bell.

SolarEdge Technologies designs, develops, and sells direct current optimized inverter systems for solar photovoltaic installations worldwide. SEDG’s optimized inverter solutions address a broad range of solar markets.

SEDG registered record revenues in 14 European countries and may continue to witness strong growth momentum. While SolarEdge Technologies’ core expertise has been in inverter solutions, of late, SEDG expanded its product portfolio and currently offers a variety of energy solutions, including lithium-ion cells.

SolarEdge Technologies has an Earnings ESP of +11.47%. It has an expected earnings growth rate of 82.3% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 15.1% over the last seven days. SEDG is set to release earnings results on Feb 13, after the closing bell.

Tradeweb Markets is an operator of electronic marketplaces for the trading of products across the rates, credit, money markets and equities asset classes. TW provides access to markets, data and analytics, electronic trading, straight-through-processing and reporting to clients in the institutional, wholesale and retail markets.

TW has an Earnings ESP of +0.16%. It has an expected earnings growth rate of 14.1% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.5% over the last 30 days.

TW recorded earnings surprises in the last four reported quarters, with an average beat of 1.1%. The company is set to release earnings results on Feb 2, before the opening bell.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

Expedia Group, Inc. (EXPE) : Free Stock Analysis Report

Tradeweb Markets Inc. (TW) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance