Top 5 Momentum Stocks for April After a Solid March

Wall Street ended last month on a positive note despite severe volatility. The three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — were up 1.9%, 3.5% and 6.7%, respectively. U.S. stock markets moved northward, defying the banking sector turmoil across the globe and the threat of a recession.

Timely intervention by the U.S. government and the Fed to resolve the banking sector crisis strengthened market participants’ confidence. Moreover, a moderate reading of the Fed’s most favorite inflation gauge – the core PCE (personal consumption expenditure) price index – also boosted investors’ sentiment.

Meanwhile, in its March FOMC meeting, the Fed raised the benchmark interest rate by 25 basis points to the range of 4.75% to 5%. This is the highest level of the Fed fund rate since late 2007. However, Fed Chairman Jerome Powell signaled that the rate hike cycle is approaching its end.

Fed’s latest projection shows that the terminal interest rate at the end of 2023 will be 5.125%. This implies that just one more 25 basis-point hike in the benchmark lending rate will complete this cycle. Although no rate cut is anticipated in 2023, Powell signaled that the Fed fund rate will be reduced by 0.8% in 2024 and most likely by another 1.2% in 2025.

April generally remains favorable to equity investors. Recently, released several key economic data have shown that demand is declining in line with the central bank’s expectation. At this stage, it will be prudent to invest in momentum stocks with a favorable Zacks Rank to strengthen one’s portfolio.

Our Top Picks

We have narrowed our search to five momentum stocks. These stocks have strong potential for 2023 and have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries a Zacks Rank #1 (Strong Buy) and has a Momentum Score of A. You can see the complete list of today’s Zacks #1 Rank stocks here.

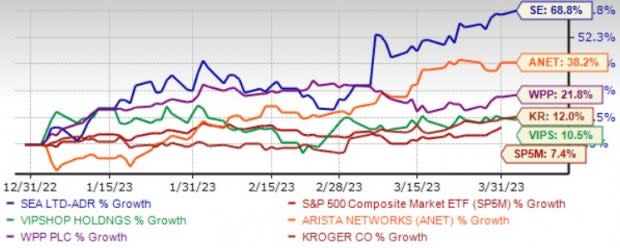

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Arista Networks Inc. ANET develops markets and sells cloud networking solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. ANET benefits from the expanding cloud networking market, driven by strong demand for scalable infrastructure. The company recently joined the Microsoft Intelligent Security Association.

Arista Networks continues to gain from solid momentum and diversification across its top verticals and product lines. It is well-poised for growth in the data-driven cloud networking business, with proactive platforms and predictive operations. ANET introduced an enterprise-grade Software-as-a-Service offering for its flagship CloudVision platform.

Arista Networks has an expected revenue and earnings growth rate of 24.8% and 26.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 10.7% over the last 60 days. The stock price of ANET has jumped 38.2% year to date.

The Kroger Co. KR has been undertaking efforts to strengthen its position not only with respect to products but also in the way consumers shop. KR has been making investments to enhance product freshness and quality as well as expand digital capabilities. Further, The Kroger has been augmenting “Our Brands” portfolio by launching new products.

Management provided an upbeat outlook for fiscal 2023. KR’s Leading with Fresh and Accelerating with Digital initiatives should help generate sustainable returns. Recently, Kroger entered into a deal to acquire Albertsons Companies. The tie-up would strengthen its position in the competitive grocery space. The combined entity would benefit from a loyal customer base and a broader portfolio.

Kroger has an expected revenue and earnings growth rate of 2.5% and 6.2%, respectively, for the current year (ending January 2024). The Zacks Consensus Estimate for current-year earnings has improved 6.4% over the last 30 days. The stock price of KR has surged 12% year to date.

WPP plc WPP is a creative transformation company that provides communications, experience, commerce, and technology services globally. WPP operates through three segments: Global Integrated Agencies, Public Relations, and Specialist Agencies.

WPP offers plans and creates marketing and branding campaigns, designs, and produces advertisements across various media, and provides media buying services. WPP also offers public relations advisory services to clients seeking to communicate with a range of stakeholders from consumers to governments and business and financial communities, as well as specialist agency services.

WPP has an expected earnings growth rate of 3.9% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last seven days. The stock price of WPP has climbed 21.3% year to date.

Vipshop Holdings Ltd. VIPS is an online discount retailer for brands. VIPS offers branded products to consumers in China through flash sales on its vipshop.com website. VIPS offers a wide selection of various famous branded discount products including apparel for women, men and children, fashion goods, cosmetics, home goods and other lifestyle products, through its website.

Vipshop has an expected revenue and earnings growth rate of 1.8% and 6.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.9% over the last seven days. The stock price of VIPS has advanced 10.5% year to date.

Sea Ltd. SE is an internet service provider company. It offers Digital Entertainment, E-Commerce and Digital Financial Services known as Garena, Shopee and AirPay. SE operates primarily in Indonesia, Taiwan, Vietnam, Thailand, Philippines, Malaysia and Singapore.

Sea has an expected revenue and earnings growth rate of 11.4% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.9% over the last seven days. The stock price of SE has soared 68.3% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Kroger Co. (KR) : Free Stock Analysis Report

Sea Limited Sponsored ADR (SE) : Free Stock Analysis Report

Vipshop Holdings Limited (VIPS) : Free Stock Analysis Report

WPP PLC (WPP) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance