Top 3 Swiss Dividend Stocks To Consider In June 2024

The Switzerland market recently displayed resilience, ending firmly as the Swiss National Bank implemented a second consecutive rate cut, signaling easing inflationary pressures and maintaining a supportive environment for economic growth. In light of these developments, investors might consider the stability and potential returns offered by Swiss dividend stocks.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Vontobel Holding (SWX:VONN) | 5.46% | ★★★★★★ |

Cembra Money Bank (SWX:CMBN) | 5.13% | ★★★★★★ |

Compagnie Financière Tradition (SWX:CFT) | 4.24% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.38% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.29% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.39% | ★★★★★☆ |

Roche Holding (SWX:ROG) | 3.84% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 5.04% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.69% | ★★★★★☆ |

Helvetia Holding (SWX:HELN) | 5.08% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Berner Kantonalbank

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Berner Kantonalbank AG provides banking products and services to private individuals and corporate customers in Switzerland, with a market capitalization of approximately CHF 2.16 billion.

Operations: Berner Kantonalbank AG generates CHF 532.28 million in revenue from its banking operations.

Dividend Yield: 4.3%

Berner Kantonalbank has demonstrated a consistent dividend track record, with dividends per share growing stably over the past decade. The bank recently reported a net interest income of CHF 388.2 million and a net income of CHF 174.89 million for FY 2023, indicating financial health that supports its dividend payments. With a payout ratio of 52.8%, its dividends are well-covered by earnings, aligning with a yield of 4.27%—above the Swiss market average—though future coverage data lacks clarity.

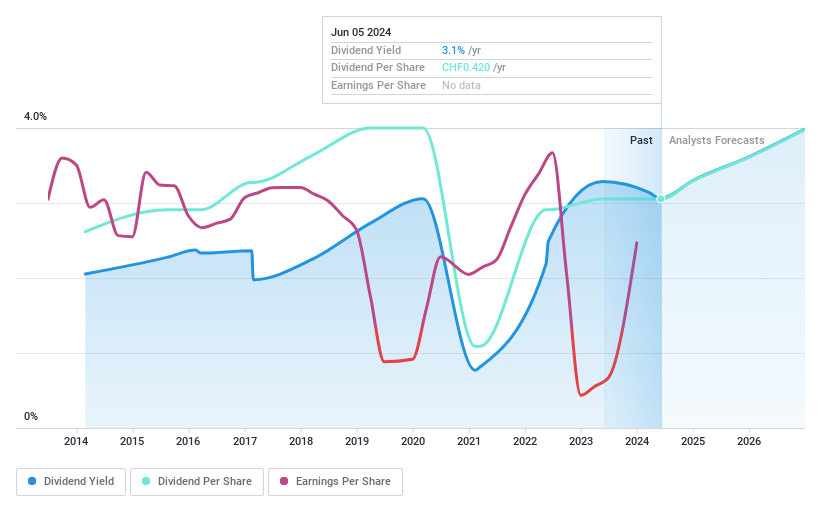

Clariant

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clariant AG is a global company specializing in the development, manufacture, distribution, and sale of specialty chemicals, with a market capitalization of approximately CHF 4.59 billion.

Operations: Clariant AG's revenue is generated through three primary segments: Catalysis (CHF 1 billion), Care Chemicals (CHF 2.32 billion), and Adsorbents & Additives (CHF 1.06 billion).

Dividend Yield: 3%

Clariant AG, with a dividend yield of 3.01%, falls below the top Swiss payers. Despite this, its dividends are supported by earnings and cash flows, with payout ratios at 82.2% and 64.2% respectively. The company became profitable this year and anticipates earnings growth of 22.39% annually. However, its decade-long dividend history shows instability and unreliability in payments despite recent increases, reflecting potential concerns for long-term investors seeking steady income streams from dividends.

Click here and access our complete dividend analysis report to understand the dynamics of Clariant.

Our expertly prepared valuation report Clariant implies its share price may be too high.

Luzerner Kantonalbank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Luzerner Kantonalbank AG, a Swiss bank, offers a range of banking products and services with a market capitalization of approximately CHF 3.31 billion.

Operations: Unfortunately, there are no specific revenue segment details provided for Luzerner Kantonalbank AG in the text you've shared.

Dividend Yield: 3.7%

Luzerner Kantonalbank AG offers a modest dividend yield of 3.73%, slightly below the Swiss market's top quartile. However, its dividends have demonstrated reliability and growth over the past decade, supported by a sustainable payout ratio of 46.5%. Recent earnings growth of 20.2% and trading at a 34.2% discount to fair value further underscore its financial health, although it underperforms some peers in yield attractiveness. First quarter reports show robust gains in net interest income and net income, reinforcing positive financial trends.

Next Steps

Click this link to deep-dive into the 28 companies within our Top Dividend Stocks screener.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:BEKN SWX:CLN and SWX:LUKN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com