Top 3 Stocks That May Be Below Estimated Value On KRX In July 2024

The South Korean market has shown robust growth recently, with a 2.8% increase over the last week and an impressive 9.4% climb over the past year, alongside expectations of earnings growing by 30% annually. In this context, identifying stocks that may be undervalued can offer potential opportunities for investors looking to capitalize on these favorable market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

Name | Current Price | Fair Value (Est) | Discount (Est) |

Iljin ElectricLtd (KOSE:A103590) | ₩28850.00 | ₩56020.08 | 48.5% |

Caregen (KOSDAQ:A214370) | ₩23100.00 | ₩44549.16 | 48.1% |

Revu (KOSDAQ:A443250) | ₩10790.00 | ₩20649.99 | 47.7% |

Anapass (KOSDAQ:A123860) | ₩28200.00 | ₩48677.60 | 42.1% |

NEXTIN (KOSDAQ:A348210) | ₩65100.00 | ₩109381.94 | 40.5% |

KidariStudio (KOSE:A020120) | ₩4180.00 | ₩7300.73 | 42.7% |

Genomictree (KOSDAQ:A228760) | ₩22150.00 | ₩39222.64 | 43.5% |

Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

SK Biopharmaceuticals (KOSE:A326030) | ₩80300.00 | ₩149728.31 | 46.4% |

Ray (KOSDAQ:A228670) | ₩12620.00 | ₩21018.39 | 40% |

We'll examine a selection from our screener results.

Neosem

Overview: Neosem Inc. is a company that manufactures and sells semiconductor inspection equipment, with a market capitalization of approximately ₩572.32 billion.

Operations: The company generates revenue primarily from its semiconductor equipment and services segment, totaling approximately ₩107.79 billion.

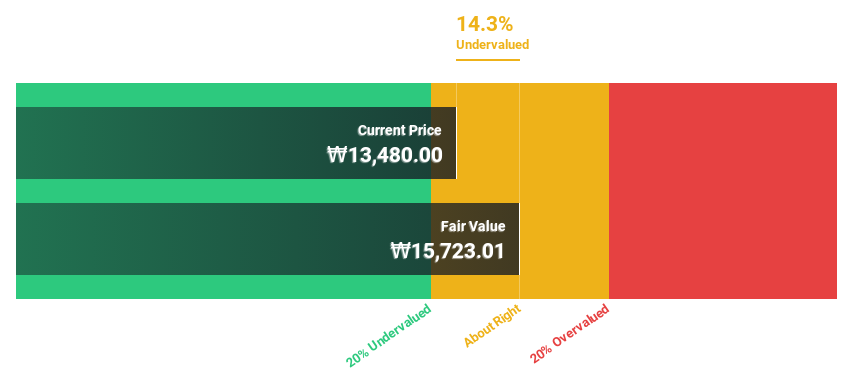

Estimated Discount To Fair Value: 14.3%

Neosem, currently priced at ₩13,480, stands below the estimated fair value of ₩15,723.01, indicating potential undervaluation based on discounted cash flows. The company's earnings are expected to increase by a very large margin annually over the next three years, outpacing the South Korean market's growth. Despite this robust profit outlook and a high forecast return on equity of 24.8%, investors should note Neosem's highly volatile share price and recent shareholder dilution.

The growth report we've compiled suggests that Neosem's future prospects could be on the up.

Delve into the full analysis health report here for a deeper understanding of Neosem.

Amorepacific

Overview: Amorepacific Corporation is a global company engaged in the research, development, manufacturing, marketing, and sales of cosmetics and beauty products, with a market capitalization of approximately ₩9.41 trillion.

Operations: The company operates primarily in the cosmetics and beauty products sector, achieving a market capitalization of approximately ₩9.41 trillion.

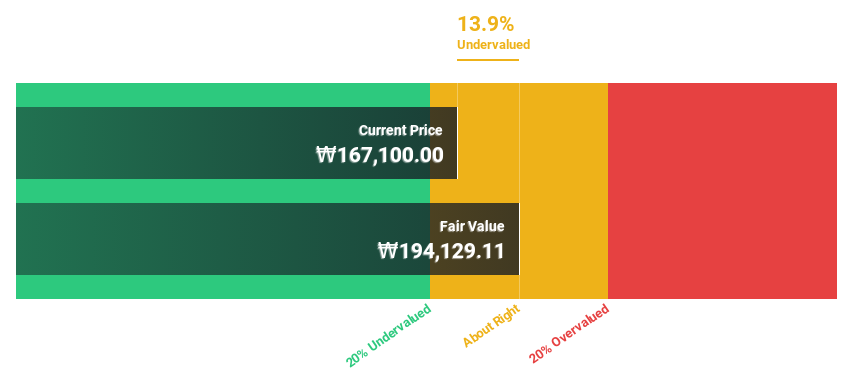

Estimated Discount To Fair Value: 20.1%

Amorepacific, trading at ₩153,000, is perceived as undervalued with its price being 20.1% below the estimated fair value of ₩191,446.74. Forecasted to grow earnings by 38.7% annually over the next three years—surpassing the South Korean market's growth—its financial outlook appears robust despite revenue growth projections slightly trailing behind some market averages at 14% per year. Recent leadership changes with Giovanni Valentini's appointment could further influence North American business strategies and expansion efforts for key brands like Laneige and Sulwhasoo.

Iljin ElectricLtd

Overview: Iljin Electric Co., Ltd is a heavy electric machinery company based in South Korea, with operations extending internationally, and has a market cap of approximately ₩1.38 billion.

Operations: Iljin Electric's revenue is primarily generated from its Wire and Power System segments, which respectively brought in ₩1.03 billion and ₩0.32 billion.

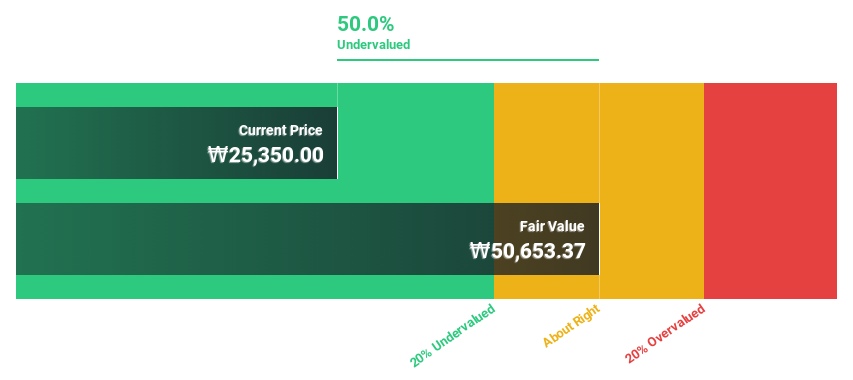

Estimated Discount To Fair Value: 48.5%

Iljin Electric Ltd, priced at ₩28,850, is significantly undervalued with its market price 48.5% below the calculated fair value of ₩56,020.08. Despite a forecasted low return on equity of 18.1% in three years, the company's earnings are expected to grow by 37.48% annually over the same period—outpacing the South Korean market's average growth rate of 29.7%. Revenue growth projections also exceed the market average at 11% per year compared to 10.8%, indicating potential underestimation by investors based on cash flow analysis.

Seize The Opportunity

Navigate through the entire inventory of 38 Undervalued KRX Stocks Based On Cash Flows here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSDAQ:A253590 KOSE:A103590 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com