Three US Stocks Estimated To Be Trading Below Their Intrinsic Values In July 2024

Amidst a turbulent period for major indices like the Nasdaq and S&P 500, marked by tech sell-offs and a pivot towards smaller cap stocks, investors are keenly watching for opportunities that might be undervalued in this shifting landscape. In such times, identifying stocks trading below their intrinsic values could offer potential avenues for those looking to invest in assets that may be poised for recovery or growth as market conditions evolve.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

Victory Capital Holdings (NasdaqGS:VCTR) | $50.22 | $100.02 | 49.8% |

Marriott Vacations Worldwide (NYSE:VAC) | $88.19 | $169.56 | 48% |

Sachem Capital (NYSEAM:SACH) | $2.74 | $5.36 | 48.9% |

Atlanticus Holdings (NasdaqGS:ATLC) | $33.22 | $64.30 | 48.3% |

Kiniksa Pharmaceuticals International (NasdaqGS:KNSA) | $21.60 | $41.90 | 48.4% |

Rush Street Interactive (NYSE:RSI) | $8.83 | $17.02 | 48.1% |

EVERTEC (NYSE:EVTC) | $32.28 | $61.85 | 47.8% |

Viant Technology (NasdaqGS:DSP) | $10.29 | $19.98 | 48.5% |

Harvard Bioscience (NasdaqGM:HBIO) | $3.28 | $6.55 | 49.9% |

Vasta Platform (NasdaqGS:VSTA) | $3.10 | $6.13 | 49.5% |

Let's take a closer look at a couple of our picks from the screened companies.

BioMarin Pharmaceutical

Overview: BioMarin Pharmaceutical Inc. specializes in developing and commercializing therapies for individuals with serious and life-threatening rare diseases, boasting a market cap of approximately $15.63 billion.

Operations: The company generates revenue primarily through the development and commercialization of innovative therapies, totaling approximately $2.47 billion.

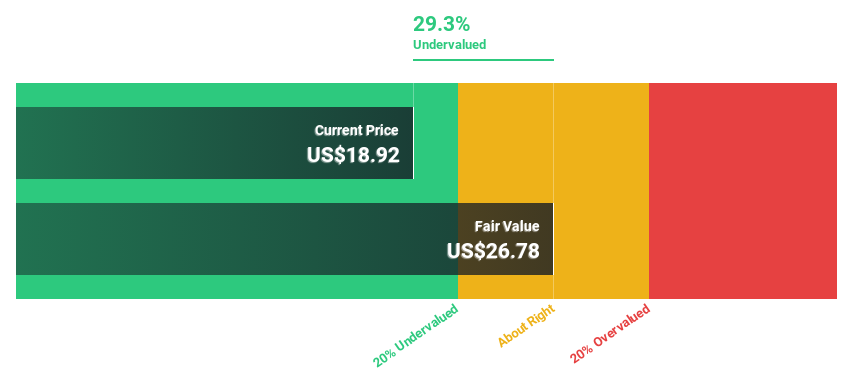

Estimated Discount To Fair Value: 43.7%

BioMarin Pharmaceutical is significantly undervalued based on its cash flows, trading at US$83.91 against a fair value estimate of US$148.97, marking a substantial discount. The company's earnings are expected to grow by 30.6% annually, outpacing the US market forecast of 14.8%. Despite recent drops from several Russell indexes and additions to defensive indexes reflecting a shift in market perception, BioMarin's strong past earnings growth of 186.9% and robust revenue growth forecasts align with its potential undervaluation signals based on discounted cash flow analysis.

Li Auto

Overview: Li Auto Inc. is a company based in the People’s Republic of China, specializing in the electric vehicle market, with a market capitalization of approximately $21.99 billion.

Operations: The company generates its revenue primarily from the auto manufacturing segment, totaling CN¥130.70 billion.

Estimated Discount To Fair Value: 13%

Li Auto, priced at US$21.44, is currently trading below the estimated fair value of US$24.63, suggesting a modest undervaluation based on discounted cash flow analysis. Although its return on equity is expected to remain low at 18.4%, the company's earnings are projected to grow by 21% annually, outstripping the US market's growth rate of 14.8%. Additionally, revenue growth forecasts are robust at 20.2% per year, significantly higher than the market average of 8.8%. Despite recent legal challenges and operational missteps impacting stock prices and investor confidence, Li Auto's strong delivery numbers and expanding operational footprint in China underscore its growth potential amidst competitive pressures.

3M

Overview: 3M Company operates globally, offering diversified technology services and has a market capitalization of approximately $56.26 billion.

Operations: The company's revenue is generated through four primary segments: Consumer ($4.97 billion), Health Care ($8.20 billion), Safety and Industrial ($10.91 billion), and Transportation and Electronics ($8.56 billion).

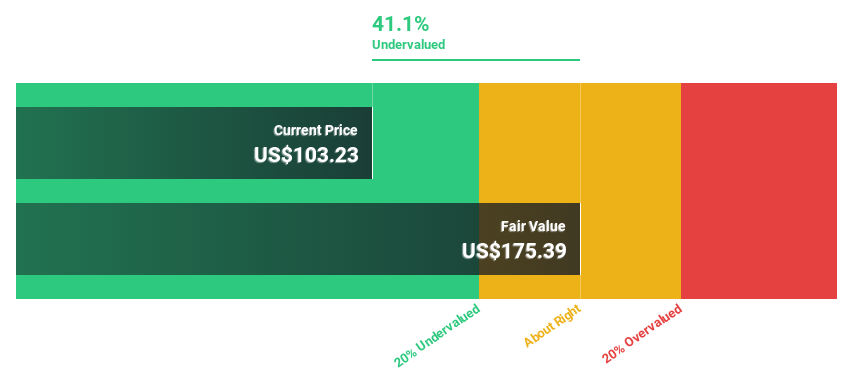

Estimated Discount To Fair Value: 41.1%

3M, priced at US$103.23, is trading 41.1% below its estimated fair value of US$175.39, indicating significant undervaluation based on discounted cash flow metrics. Despite a forecasted annual earnings growth of 59.95%, the company faces challenges with a projected revenue decline of -6.7% annually over the next three years and a dividend coverage issue, as current dividends are not well supported by earnings. Additionally, high debt levels and recent executive departures add to its risk profile, although it is expected to achieve very high return on equity in the coming years.

Where To Now?

Click here to access our complete index of 177 Undervalued US Stocks Based On Cash Flows.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:BMRN NasdaqGS:LI and NYSE:MMM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com