Three TSX Dividend Stocks With Yields Up To 8.5%

As central banks like the Bank of Canada adjust interest rates in response to shifting economic conditions, investors might look towards stable income streams to navigate these uncertain times. Dividend stocks, particularly those with higher yields, can provide a consistent source of income and may become increasingly attractive in such an environment.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.64% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.10% | ★★★★★★ |

Secure Energy Services (TSX:SES) | 3.42% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.25% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.29% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.78% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 8.79% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 3.11% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.60% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.21% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top TSX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

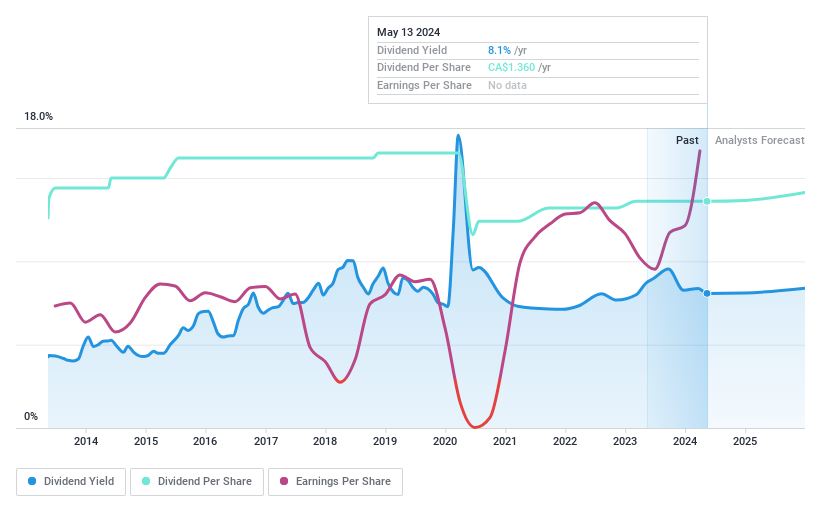

Alaris Equity Partners Income Trust

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Alaris Equity Partners Income Trust is a private equity firm that focuses on various investment types including management buyouts and growth capital, with a market capitalization of approximately CA$717.51 million.

Operations: Alaris Equity Partners Income Trust generates its revenue primarily from unclassified services, totaling CA$234.06 million.

Dividend Yield: 8.6%

Alaris Equity Partners Income Trust offers a high dividend yield, currently at 8.55%, which ranks in the top 25% of Canadian dividend payers. However, the company's dividend history has been volatile and unreliable over the past decade, with payments showing significant fluctuations. Despite recent earnings growth of 89.9% year-over-year as of Q1 2024, analysts predict a substantial average earnings decline of about 45.3% annually over the next three years. The dividends are covered by both earnings and cash flows, with current payout ratios at 29.9% and 77.8%, respectively, suggesting some level of sustainability despite future uncertainties.

North West

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The North West Company Inc. operates as a retailer offering food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean, with a market capitalization of approximately CA$1.99 billion.

Operations: The North West Company Inc. generates CA$2.50 billion from its core operations in retailing food and everyday items across diverse geographical regions.

Dividend Yield: 3.7%

North West Company has shown a steady financial performance with first-quarter sales rising to CA$617.52 million and net income increasing to CA$25.53 million. Despite trading 51.8% below its estimated fair value, the dividend yield of 3.7% is modest compared to leading Canadian stocks but is supported by a payout ratio of 55.2% and cash payout ratio of 59.7%, ensuring dividend sustainability from both earnings and cash flow perspectives over the past decade, including a recent confirmation of a quarterly dividend payment scheduled for July 15, 2024.

Navigate through the intricacies of North West with our comprehensive dividend report here.

Our valuation report unveils the possibility North West's shares may be trading at a discount.

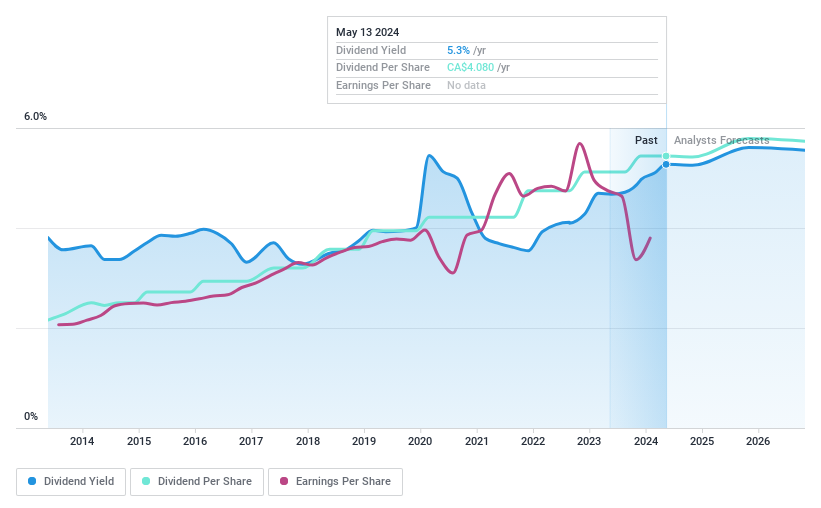

Toronto-Dominion Bank

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toronto-Dominion Bank, along with its subsidiaries, offers a range of financial products and services across Canada, the United States, and other international locations, with a market capitalization of approximately CA$132.80 billion.

Operations: Toronto-Dominion Bank generates revenue through several key segments: Canadian Personal and Commercial Banking (CAD P&C) contributes CA$17.39 billion, U.S. Retail accounts for CA$12.81 billion, Wealth Management and Insurance brings in CA$11.81 billion, and Wholesale Banking adds CA$6.63 billion.

Dividend Yield: 5.3%

Toronto-Dominion Bank's recent fixed income offerings, including a SGD 250 million placement at a 5.700% interest rate and other multi-million dollar issuances, indicate robust financing activities aimed at strengthening its capital structure. Despite a low dividend yield of 5.32% relative to the top Canadian dividend payers, TD has maintained stable dividends over the past decade with a current payout ratio of 66.1%, suggesting sustainability. However, its profit margins have declined from last year's 31.1% to 20.9%. The bank also continues to innovate in customer service and digital banking enhancements as part of its growth strategy.

Seize The Opportunity

Access the full spectrum of 32 Top TSX Dividend Stocks by clicking on this link.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:AD.UNTSX:NWC and TSX:TD

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com