Three Japanese Exchange Stocks Estimated To Be Below Intrinsic Value In July 2024

Amidst a backdrop of global economic fluctuations, Japan's stock markets have shown remarkable resilience, achieving all-time highs recently. This robust performance sets an intriguing stage for investors to consider the potential of undervalued stocks within this market.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

Name | Current Price | Fair Value (Est) | Discount (Est) |

Mimaki Engineering (TSE:6638) | ¥2123.00 | ¥3963.23 | 46.4% |

Fujibo Holdings (TSE:3104) | ¥4795.00 | ¥9423.24 | 49.1% |

S-Pool (TSE:2471) | ¥323.00 | ¥622.94 | 48.1% |

Macromill (TSE:3978) | ¥869.00 | ¥1677.69 | 48.2% |

Cyber Security Cloud (TSE:4493) | ¥2259.00 | ¥4329.62 | 47.8% |

Yokowo (TSE:6800) | ¥2078.00 | ¥3910.23 | 46.9% |

DKS (TSE:4461) | ¥3720.00 | ¥7190.49 | 48.3% |

Bushiroad (TSE:7803) | ¥382.00 | ¥720.23 | 47% |

Atrae (TSE:6194) | ¥861.00 | ¥1712.43 | 49.7% |

Money Forward (TSE:3994) | ¥5276.00 | ¥10377.48 | 49.2% |

Let's dive into some prime choices out of from the screener.

Treasure FactoryLTD

Overview: Treasure Factory Co., LTD operates a chain of reuse stores across Japan, focusing on the resale of second-hand goods, with a market capitalization of approximately ¥49.40 billion.

Operations: The company generates ¥33.66 billion in revenue primarily from its reuse business segment.

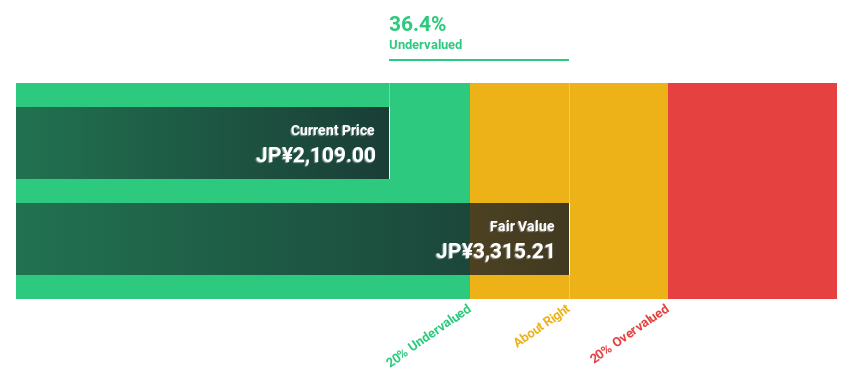

Estimated Discount To Fair Value: 36.4%

Treasure Factory Co., LTD. is trading at JPY 2109, significantly below the estimated fair value of JPY 3315.21, indicating potential undervaluation based on discounted cash flows. The company recently raised its earnings guidance for FY2025, reflecting robust sales growth and operational efficiency with net sales expected to reach JPY 41.86 billion and operating income projected at JPY 4.04 billion. Despite a forecasted annual earnings growth rate of 11.1%, which outpaces the Japanese market's average, the company's share price remains highly volatile.

Click here to discover the nuances of Treasure FactoryLTD with our detailed financial health report.

TORIDOLL Holdings

Overview: TORIDOLL Holdings Corporation operates and manages a chain of restaurants both in Japan and internationally, with a market capitalization of approximately ¥336.16 billion.

Operations: The firm oversees a global restaurant chain, generating revenues from its operations across both domestic and international markets.

Estimated Discount To Fair Value: 39%

TORIDOLL Holdings, priced at ¥3850, is perceived as undervalued against a fair value of ¥6306.38, reflecting a potential discount of over 20%. The company's earnings are projected to expand by 26% annually, outpacing the Japanese market's average. Despite slower revenue growth forecasts at 13% yearly compared to more aggressive market averages, recent adjustments in dividend policies underscore a commitment to enhancing shareholder returns. This strategic financial management could signal underlying strengths not fully recognized by the current market price.

TOWA

Overview: TOWA Corporation specializes in designing, developing, manufacturing, and selling semiconductor manufacturing equipment and high-precision molds both domestically and internationally, with a market capitalization of approximately ¥279.24 billion.

Operations: The company operates primarily in the design, development, manufacture, and sale of semiconductor manufacturing equipment and high-precision molds globally.

Estimated Discount To Fair Value: 28.5%

TOWA Corporation, trading at ¥11170 against a fair value of ¥15632.22, appears undervalued by over 20%. Its earnings are expected to grow by 24.78% annually, outstripping the Japanese market's forecast of 9%. Despite this robust profit outlook and a recent dividend increase to JPY 60 per share for FY2025 from JPY 40 in FY2024, its revenue growth projection of 15.6% lags behind more aggressive benchmarks. Additionally, its return on equity is anticipated to be low at 17.9% in three years, coupled with a highly volatile share price recently.

The growth report we've compiled suggests that TOWA's future prospects could be on the up.

Unlock comprehensive insights into our analysis of TOWA stock in this financial health report.

Key Takeaways

Unlock more gems! Our Undervalued Japanese Stocks Based On Cash Flows screener has unearthed 87 more companies for you to explore.Click here to unveil our expertly curated list of 90 Undervalued Japanese Stocks Based On Cash Flows.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:3093 TSE:3397 and TSE:6315.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com