Three Japanese Exchange Growth Companies With Up To 23% Insider Ownership

Japan's stock markets recently demonstrated robust performance, with both the Nikkei 225 and TOPIX indexes reaching all-time highs, buoyed by a weakening yen which benefits export-driven sectors. This backdrop of economic strength makes it an opportune time to explore growth companies in Japan, particularly those with high insider ownership, as these firms often exhibit aligned interests between shareholders and management, potentially leading to enhanced governance and performance.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 26.9% |

Hottolink (TSE:3680) | 27% | 59.7% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 42.9% |

Medley (TSE:4480) | 34% | 28.7% |

Micronics Japan (TSE:6871) | 15.3% | 39.8% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

ExaWizards (TSE:4259) | 21.9% | 91.1% |

Astroscale Holdings (TSE:186A) | 20.9% | 90% |

AeroEdge (TSE:7409) | 10.7% | 28.5% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

Let's dive into some prime choices out of from the screener.

Lifedrink Company

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lifedrink Company, Inc., a beverage manufacturer and seller based in Japan, has a market capitalization of ¥83.18 billion.

Operations: The company generates its revenue through the manufacture and sale of beverages.

Insider Ownership: 14.6%

Lifedrink Company, a growth entity with high insider ownership in Japan, demonstrates promising financial trends despite some challenges. Its earnings are expected to grow by 9.45% annually, slightly outpacing the broader Japanese market. Last year, earnings surged by 52%, and revenue growth projections stand at 6.3% per year, again ahead of market averages. However, the company trades at an 11% discount to its estimated fair value and faces issues like high volatility in share price and significant debt levels.

freee K.K

Simply Wall St Growth Rating: ★★★★★☆

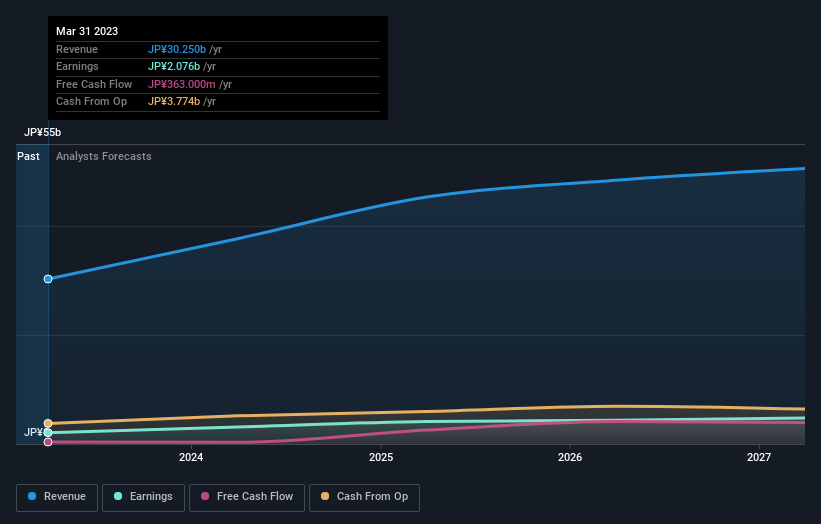

Overview: Freee K.K., headquartered in Japan, specializes in providing cloud-based accounting and HR software solutions, with a market capitalization of approximately ¥147.47 billion.

Operations: The firm specializes in cloud-based solutions for accounting and HR, generating revenue from these core services.

Insider Ownership: 23.9%

freee K.K. in Japan, recognized for its robust revenue growth forecast at 20.2% annually, is expected to outpace the general market significantly. Despite a highly volatile share price recently, the company's earnings could see an uptick, with projections suggesting a 72.92% annual increase. Challenges include a lower forecasted Return on Equity at 17.7% in three years and no substantial insider trading reported over the past three months. Recent board decisions to issue new restricted shares and consider significant structural changes like share exchanges highlight active management involvement and potential strategic shifts.

Get an in-depth perspective on freee K.K's performance by reading our analyst estimates report here.

Japan Electronic Materials

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Japan Electronic Materials Corporation specializes in producing probe cards and electron tube parts, operating both domestically and internationally, with a market capitalization of approximately ¥50.01 billion.

Operations: The firm generates its revenue primarily through the production and sales of probe cards and electron tube parts, with operations spanning across both domestic and international markets.

Insider Ownership: 13%

Japan Electronic Materials, poised for substantial growth, forecasts revenue and earnings to outpace the Japanese market significantly with annual increases of 15% and 44.3%, respectively. Despite trading at a 26.2% discount to its estimated fair value, the company faces challenges such as high share price volatility and declining profit margins from 12.6% to 3.6%. Notably, there's no recent insider trading activity reported, which could impact investor sentiment towards its insider ownership stability.

Seize The Opportunity

Click through to start exploring the rest of the 95 Fast Growing Japanese Companies With High Insider Ownership now.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:2585 TSE:4478 and TSE:6855.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com