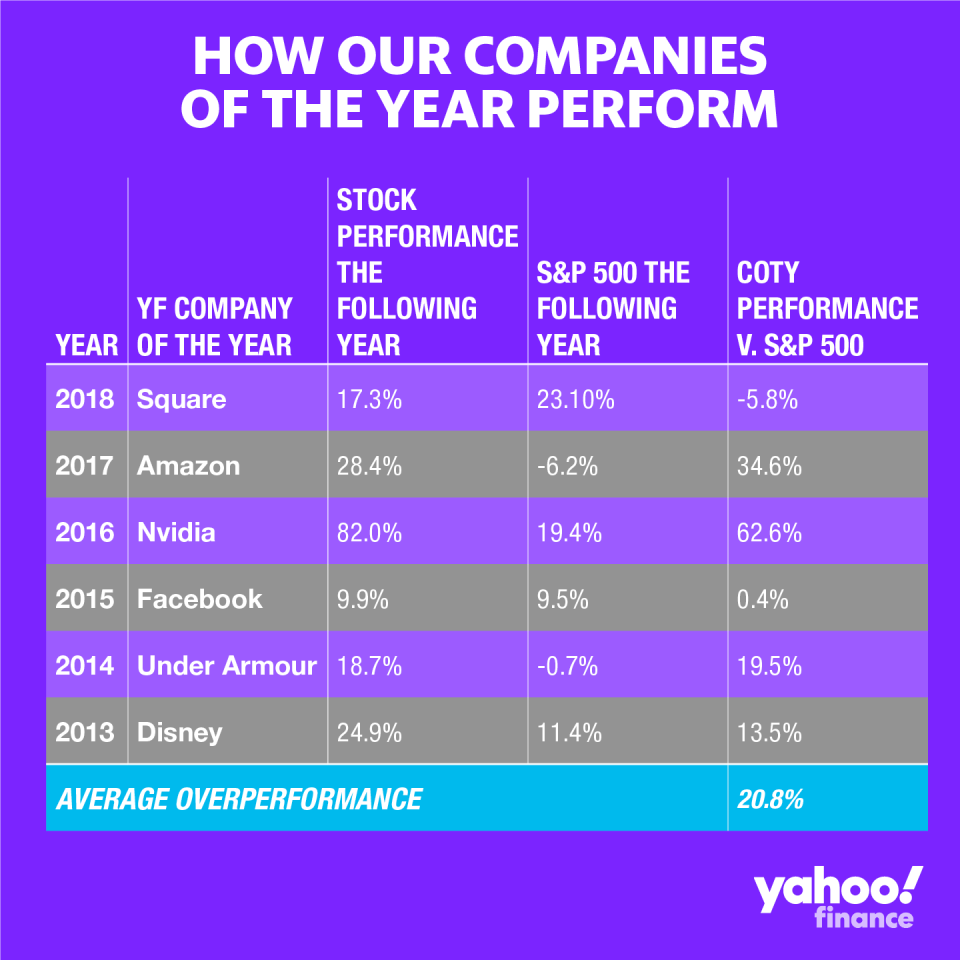

The Yahoo Finance Company of the Year is usually a good stock bet

Payments company Square was killing it earlier this year, with the stock up 44% by mid-summer—more than twice the gain of the S&P 500 index. Then in August, the company downgraded its earnings guidance. The stock fell, and it’s now up just 19% for the year, trailing the S&P by 5 points.

Square (SQ), the 2018 Yahoo Finance Company of the Year, is our only pick to underperform the broader market the year following our selection. All of the five prior winners—Disney, Under Armour, Facebook, Nvidia and Amazon—beat the market after we honored the company. Among all six, the average performance in the following year is a 20.8% gain. That’s 11 points better than the S&P, on average.

Our Company of the Year choice is not a stock recommendation; we’re not predicting future gains. But our selection process focuses on companies that have performed well and still have considerable upside left. The list of past winners confirms that. Disney (DIS), our first Company of the Year, in 2013, has now taken a leadership position in streaming, with the launch of Disney+. Nvidia (NVDA), our 2016 pick, suffered from the cryptocurrency pullback, since miners rely on its processors. But it’s still going strong thanks to strong demand elsewhere. And Amazon (AMZN), our 2017 pick, is so successful that some critics now consider it a monopolistic threat.

[Read why Target is the Yahoo Finance 2019 Company of the Year]

Under Armour (UA), our 2014 winner, began to struggle a couple years later as it missed the athleisure trend. And Facebook (FB), the 2015 champ, has been mired in controversy since it unwittingly allowed numerous abuses during the 2016 presidential election. (Even so, the stock has risen 75% during the last three years.)

Target (TGT), the 2019 Company of the Year, has defied brick-and-mortar skeptics with impressive sales and an improbable 90% gain in the value of the stock. It outperformed the S&P 500 by an astonishing 60 points this year. Can Target keep it up? We’ll let you know around this time next year.

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman. Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available. Click here to get Rick’s stories by email.

Read more:

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance