The S&P 500 is closing in on a new record high

After Donald Trump’s election, the Dow Jones Industrial Average rocketed to a new record high.

The broader benchmark S&P 500, however, was still a bit off its record close reached back in the summer. On Thursday, the S&P 500 closed at 2,187.12, just less than 0.1% off its record close of 2,190.15.

And so Friday could be the day we see a new milestone for the index as earnings and economic news slow down while Federal Reserve speakers dominate the day.

Retail

Earnings season is more or less over but Friday will feature a few more reports out of the sector with Foot Locker (FL) and Abercrombie & Fitch (ANF) both set to release quarterly results before the market open. The Buckle Inc. (BKE), will also report earnings before the market open.

On the economic data side, we’ll have a few pieces of second-tier data out Friday with the latest index of leading economic indicators and the Kansas City Fed’s manufacturing survey for November due out in the morning.

We’ll also get speeches from no fewer than four Federal Reserve officials on Friday. Expected speakers include James Bullard, president of the St. Louis Fed, as well as Esther George of the Kansas City Fed, Bill Dudley of the New York Fed, and Robert Kaplan of the Dallas Fed.

On Thursday, markets heard from Fed Chair Janet Yellen, who indicated the anticipated rate hike in December is likely to take place, though Yellen did temper expectations for future rate hikes, saying in prepared remarks that the current stance of monetary policy, “is only moderately accommodative.”

Flipped

It’s not just Donald Trump supporters that are excited about the stock market.

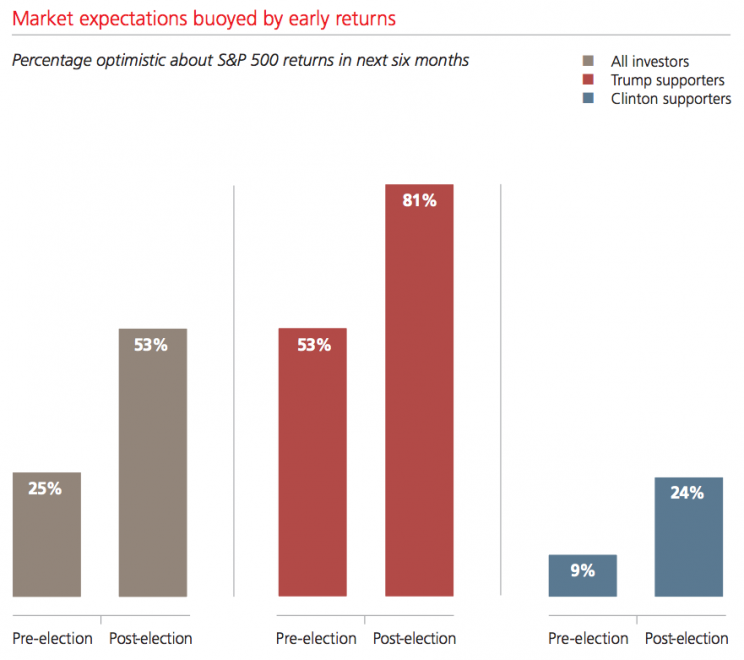

In a report released Thursday, UBS issued a the results from a survey of 1,200 wealth management clients, and the investment bank’s big-money clients — regardless of who they voted for — are now more bullish on stocks after the election.

53% of the firm’s wealth management clients are now optimistic about returns for the S&P 500 over the next six months, a sharp contrast to the 25% who were bullish before the election.

Sure, more Trump voters are in good spirits than Clinton voters (81% vs 24%), but both are marked improvements over expectations ahead of the election.

We’ve written recently that in markets, price moves before the narrative, and we haven’t gotten a clearer example of that then what’s happened around the election. And this survey may prove the point as clearly as anything.

Remember: stocks crashed when Trump looked set to win then rallied after he actually did, with reasons like his conciliatory concession speech cited ex-post by investors.

Sure, a Republican-controlled Washington could give investors tired of gridlock reason to believe policies might change. And many of Trump’s proposal — particularly on taxes — appear mostly positive for US stocks.

But as Thursday morning’s rush of economic data proved, the economy was on stable footing before the election. And still improving.

For the last two years now it seems that we’ve heard constant worries about where the next catalyst to buy stocks would come from.

It shouldn’t be lost on anyone that the event which seems to be providing investors reassurance is a largely unexpected election outcome.

Further Reading

Neel Kashkari on the next crisis and “too big to fail” (Yahoo Finance)

You can make a lot of money publishing fake news (WaPo)

Mitt Romney for Secretary of State? (NBC News)

Matt Bai on what Democrats got wrong in 2016 (Yahoo)

Elon Musk gets his deal: SolarCity and Tesla shareholders approve merger (Bloomberg)

Federal prosecutors file charges against former Valeant executive (WSJ)

—

Myles Udland is a writer at Yahoo Finance.

Read more from Myles here; follow him on Twitter @MylesUdland

Yahoo Finance

Yahoo Finance