The new taxes coming to finance all that stimulus spending

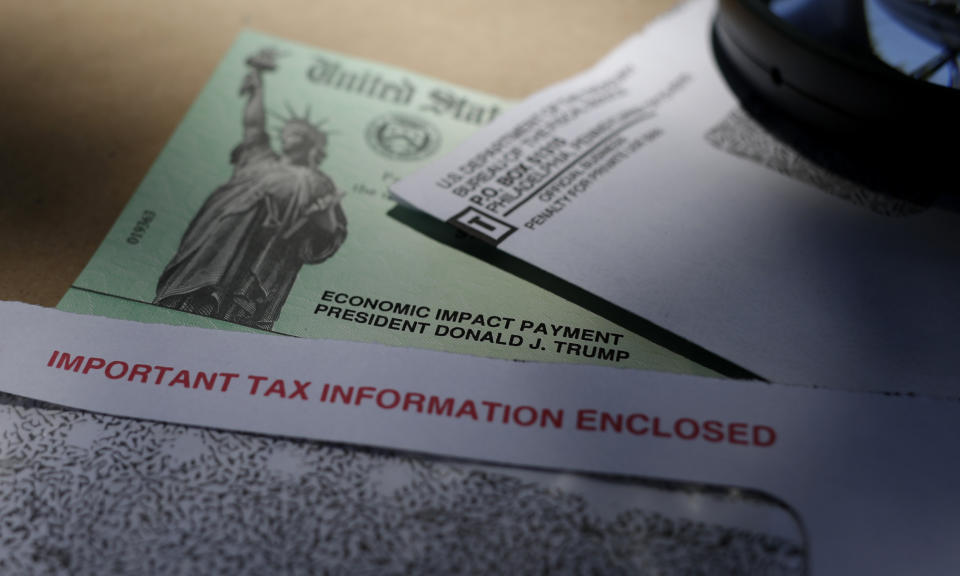

During the last two months, Congress has passed $3.6 trillion in stimulus spending, with more probably on the way. Washington’s annual deficit was likely to be around $1 trillion before the COVID-19 pandemic induced a recession. The deficit will now hit at least $3.7 trillion this year and $2.1 trillion next year, according to the Congressional Budget Office. As a percentage of the economy, federal debt this year will be the highest since World War II, and possibly higher if there’s more stimulus spending.

Budget hawks have typically called for a combination of tax hikes and spending cuts to lower Washington’s mushrooming debt load. But the federal deficit is now getting too big for conventional therapy, which could require a whole new form of taxation in the future. “When we look back at the changes COVID-19 made to society and the economy, we may think about this as the time when the U.S. began to look to sources of tax revenue that once seemed unthinkable,” Howard Gleckman of the Tax Policy Institute wrote recently.

The United States has been able to run up more debt than economists once thought possible without forcing interest rates or inflation higher. But tough choices were always inevitable, and they’re now likely to arrive within the next 5 years. It doesn’t make sense to raise taxes in a severe recession, but it may be necessary when the economy is back on track in a year or two or three.

Medicare, the health insurance program for seniors, could run short of money in 2023 or sooner, as the payroll taxes that finance the program plunge amid record unemployment. The whole program wouldn’t go bust, but it would pay only a portion of the cost for services. Social Security could run short of money by 2028, for the same reason, with the smaller disability insurance program running short by 2024.

Congress could shore up both programs by hiking the payroll taxes that finance them. But bigger changes may be brewing as policymakers contemplate additional stimulus that could be needed in coming years to keep consumers and businesses afloat, and the eventual need to repay at least some of the new debt Uncle Sam is taking on. Here are some options:

Repeal the 2017 Tax Cuts and Jobs Act. This was a landmark tax cut for Republicans who ran Congress at the time, and it would probably take Democratic majorities in both houses, along with a Democratic president, to repeal the whole law or even part of it. If the corporate rate went back to 35% from the current 21%, and tax rates rose for most Americans who got a tax cut under the law, it would only raise about $1.5 trillion, which is $1 trillion less than the increase in U.S. debt in the last two months alone.

A value-added tax. This may be the most efficient way to raise a lot of money quickly. Most advanced nations have a VAT, which is like a national sales tax imposed at various points in the production of goods and services. A 10% VAT would raise around $1 trillion per year, and Congress could design it with protections for lower-income Americans, small businesses and other vulnerable groups. Former Democratic presidential candidate Andrew Yang proposed a 10% VAT as a way to pay for $1,200 monthly “freedom dividends” to every adult American.

A wealth tax. Bernie Sanders and Elizabeth Warren have both proposed annual taxes on the wealth of rich people who earn most of their money from investments taxed at a lower rate than ordinary labor. Both dropped out of the Democratic presidential race as the more moderate Joe Biden became the front-runner, suggesting these tax-the-rich plans didn’t have wide appeal. But that could change. “What was considered a fringe idea of the far political left now may attract more attention from mainstream policymakers,” writes Gleckman.

Higher inheritance taxes. The average federal tax on estates big enough to face taxation is just 2.1%, and loopholes provide many ways to lower that. The Brookings Institution’s Hamilton Project proposes taxing inherited wealth at the same rate as labor income, with an exemption threshold of $1 million or more that would exclude most families. With the top income tax rate at 37%, an inheritance tax at that level would raise around $92 billion per year.

Joe Biden’s tax plan. Biden’s major proposals include higher tax rates on corporate income, wealthy taxpayers, capital gains and other changes that would raise around $400 billion per year. Before the coronavirus recession, Biden wanted to use that money to open Medicare to more people, help some students pay down debt and cover the cost of college, and aggressively address global warming. But suddenly $400 billion a year doesn’t seem like all that much money. So expect some updates and some bigger numbers.

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman. Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available. Click here to get Rick’s stories by email.

Read more:

Why China tolerates animal markets that produce deadly viruses

These Republican states are ignoring Trump’s reopening guidelines

Get the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance